Brooklyn's first and only 'supertall tower' is going to auction on June 10...

Brooklyn's first and only 'supertall tower' is going to auction on June 10...

Known as the Brooklyn Tower, the residential building stretches 1,066 feet high and boasts a grand total of 93 stories.

It's New York City's first skyscraper outside of Manhattan. And given its performance... it might be the last for quite some time.

The project has fallen behind schedule. The building, which has been under construction since 2018, was supposed to be completed two years ago.

Like many other real estate projects, inflation and high interest rates have made things difficult. Construction costs have soared. And debts have piled up.

The tower's property developer, Michael Stern, defaulted on a $235 million mezzanine loan earlier this month.

Stern couldn't refinance. So the issuer of the loan, Silverstein Capital Partners, put the building up for sale in a foreclosure auction.

We've seen similar stories about other big buildings that have gone to auction recently... and all of them have sold for pennies on the dollar.

One Charles Center in Baltimore was valued at $10 million in 2022. It sold for just $4.4 million at auction earlier this month. And the former AT&T building in St. Louis, once valued at $205 million, recently sold for $3.6 million... a 98% drop in value.

When the Brooklyn Tower goes to auction in June, it could command a similar discount.

Regular readers know commercial real estate has fallen on tough times. And it appears things are only getting worse.

Today, we'll look at just how bad one company in particular is doing...

Veris Residential (VRE) has an exceptionally risky business in a tough real estate market...

Veris Residential (VRE) has an exceptionally risky business in a tough real estate market...

It develops, owns, and manages properties in up-and-coming markets in urban areas.

For example, instead of focusing on real estate in Manhattan or Brooklyn, it has developments nearby in Jersey City. And in the Boston area, it has properties in the relatively inaccessible East Boston neighborhood.

When the economy is humming along, these kinds of neighborhoods are good investments. They're cheaper to develop, and property values have a lot of room to grow.

Plus, given their proximity to major urban centers, these areas tend to develop fast when people are flocking to cities.

However, when the real estate market weakens, these areas are among the first to come undone...

Folks will either move to more established urban centers or they'll move where it's even cheaper.

It's hard for Veris to succeed in today's conditions...

It's hard for Veris to succeed in today's conditions...

The company has barely been able to turn a profit over the past five years.

And yet, investors seem to think Veris' business will ramp up... as soon as this year.

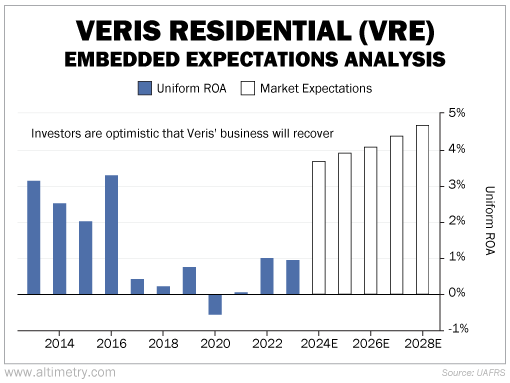

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Veris' Uniform return on assets ("ROA") has hovered around 1% since 2017. However, the market is pricing Uniform ROA to surge to nearly 5% by 2028... something the company hasn't achieved in more than a decade.

Take a look...

With so many real estate projects failing, it's hard to imagine that Veris will manage to buck the trend.

Things in the real estate market aren't getting better anytime soon. And considering most of Veris' projects are located in economically sensitive areas, the company will likely continue to struggle...

Be wary of real estate investments right now... Things can keep getting worse.

Regards,

Joel Litman

April 30, 2024

Brooklyn's first and only 'supertall tower' is going to auction on June 10...

Brooklyn's first and only 'supertall tower' is going to auction on June 10...