Abercrombie & Fitch (ANF) was the place to go for clothing in the early 2000s...

Abercrombie & Fitch (ANF) was the place to go for clothing in the early 2000s...

From the late 1990s until the mid-2000s, the company was a staple at American malls.

With shirtless male models standing outside stores along with dim lighting and thumping music inside creating a club-like atmosphere, shopping at Abercrombie was an experience.

As someone who caught the early part of that era as a teenager, I can confirm that if you didn't have Abercrombie clothing, you were viewed as behind the curve at school or parties. Most teens wanted to be decked out head to toe in the latest Abercrombie apparel.

The brand's marketing strategy revolved around the "cool kid" figure, someone who played football and had an "all-American look."

The strategy was further bolstered by several celebrities appearing in ads, including Taylor Swift, Jennifer Lawrence, and Channing Tatum. Everyone wanted to be like them.

However, as anyone who tracked the company at the tail end of the era remembers, all was far from perfect at Abercrombie. There were significant issues with the way the company dealt with diversity, both internally and for its customers.

Lawsuits started popping up around 2003 alleging the company had discriminatory hiring practices.

A recent Netflix (NFLX) documentary called White Hot: The Rise & Fall of Abercrombie & Fitch highlights the story, including details about the company's former CEO Michael Jeffries. Comments like one that Jeffries gave in a 2006 interview, calling the clothing brand "exclusionary," contributed to the company's fall from grace.

As fashion trends changed, Abercrombie struggled to keep up with popular styles and failed to adapt to the world of e-commerce, leading to the rapid demise of its popularity.

Since the late 2000s, the Abercrombie fad broke down...

Since the late 2000s, the Abercrombie fad broke down...

Even though the brand is on more solid footing since bringing in CEO Fran Horowitz in 2017, Abercrombie is still far weaker than it was in its heyday. Investors, as well as customers, moved away from the brand as the business lost its profitability.

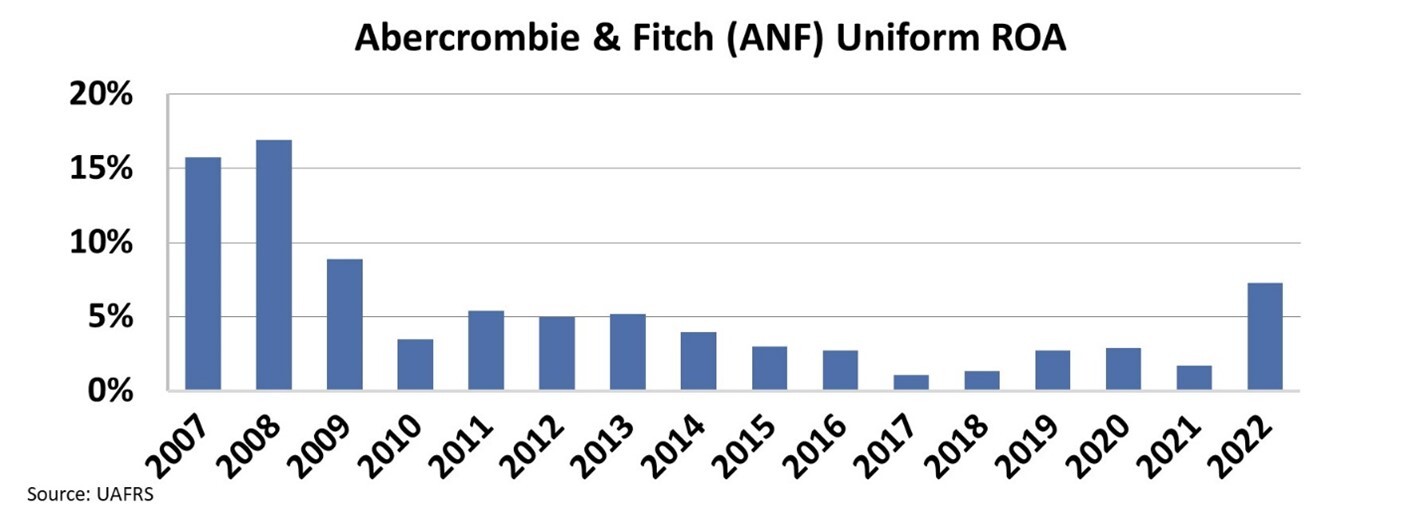

We can look at the figures using Uniform Accounting to understand how the company performed after its days in the spotlight.

The company's Uniform return on assets ("ROA") crumbled, falling from best-in-class levels of 16% in 2007 to 2% in 2021. Uniform ROA jumped to 7% in fiscal year 2022, increasing hopes that the firm, with new management and a new vision, might finally be on the road to recovery...

Abercrombie faces a steep road to its previous highs...

Abercrombie faces a steep road to its previous highs...

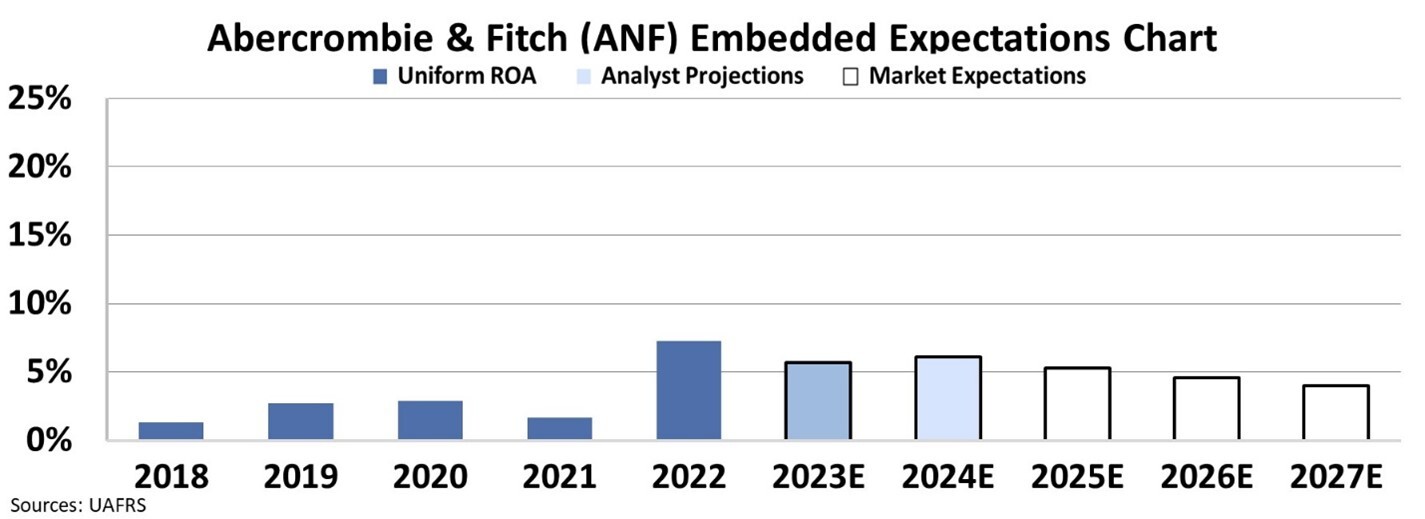

Even with ROA bouncing back in 2022, the company has a long way to go before it can reach performance levels last seen in the early 2000s. It's important to understand what the market thinks the company will do before getting too excited about the latest rise in profitability.

Stock valuations are typically determined using a discounted cash flow ("DCF") model, which makes assumptions about the future and produces the "intrinsic value" of the stock.

Here at Altimetry, we know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, with our Embedded Expectations Analysis ("EEA") framework, we use the current stock price to determine what returns the market expects.

ANF shares currently trade around $33... and at these levels, the market expects the company to have a weak Uniform ROA of 4%, dropping from the current 7% level. Analysts expect a slightly smaller fall in profitability, with ROA staying at 6%.

Even as fashion trends appear to be circling back to the '90s, it doesn't mean Abercrombie's profitability is. The company may have a hard time keeping its profitability at current levels, and neither the market nor Wall Street analysts expect it to be a winner in today's throwback style culture.

Regards,

Rob Spivey

May 17, 2022

Abercrombie & Fitch (ANF) was the place to go for clothing in the early 2000s...

Abercrombie & Fitch (ANF) was the place to go for clothing in the early 2000s...