Railway workers hit their breaking point last week...

Railway workers hit their breaking point last week...

On Friday, one of the most important cogs in the U.S. economic machine almost came to a grinding halt. More than 50,000 railway workers threatened to strike for better working conditions and higher wages.

Railways are an essential part of the American economy. They provide transportation for millions of people – and vital economic goods – every year. In fact, the U.S. ships 61 tons of goods per person annually by railway.

So it's safe to say a strike would be catastrophic. That's especially true considering the U.S. economy is already riddled with supply-chain issues.

Rail lines across the country, including Amtrak, canceled trips and adjusted their schedules in anticipation of the walkouts. But last Thursday, the White House reached a deal with railway unions and some of the largest freight railroad carriers to halt the strike.

The contract includes a double-digit pay increase and allows workers to take time off for certain medical conditions without punishment.

Unions still have to vote on the deal. If they accept it, the economy will be able to breathe a huge sigh of relief. But that might not be the case for investors...

Rail companies have enjoyed large profits and impressive growth in recent years. That's partially because they've been able to keep wage costs low.

But this juncture reminded everyone that unions still have power in today's world. And cost-cutting efforts by companies will eventually backfire.

With costs all but guaranteed to go up, it could put pressure on shares of railroad companies...

With costs all but guaranteed to go up, it could put pressure on shares of railroad companies...

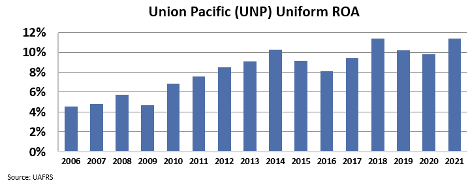

That includes Union Pacific (UNP), one of the largest rail companies in the U.S. For the past 15 years, Union Pacific has been steadily improving its business and driving up returns.

Uniform Accounting shows us that the company turned its business around in the mid-2000s. Its Uniform return on assets ("ROA") improved from less than 5% in 2006 to 11% in 2021. Take a look...

But investors haven't been the only ones to notice this impressive trend. Workers are also seeing these profits... and wondering why they aren't getting their fair share.

After negotiations with the White House and railway unions, the new settlement could require Union Pacific to raise wages 24%. This would significantly hurt the company's bottom line.

But the market isn't taking a potential wage hike into account...

But the market isn't taking a potential wage hike into account...

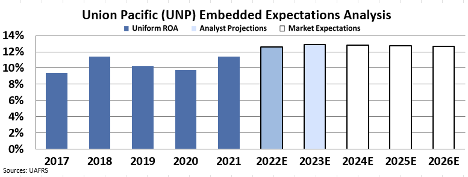

To understand how investors are valuing Union Pacific, we can look at embedded expectations.

Stock prices are indicators of future performance. Our Embedded Expectations Analysis framework uses Uniform Accounting to show us exactly what the market expects a company to do at the current stock price.

Here's how it looks for Union Pacific...

The market thinks Union Pacific's ROA will expand to all-time highs in perpetuity. And it might actually have achieved those levels... if it was able to keep costs as low as possible.

But that won't be the case anymore, thanks to the new railway-worker agreement.

Investors are expecting too much from this company. Declining profits will force them to lower their expectations. And Union Pacific's stock will likely fall as a result.

Regards,

Rob Spivey

September 20, 2022

Editor's note: We came within spitting distance of a catastrophic railway strike. And it's only the latest in a string of events creating economic uncertainty this year.

If you're growing uneasy watching all this unfold, Altimetry founder Joel Litman says your suspicions are correct...

In short, Joel believes a new financial crisis has taken hold of America – but it's not the one you'd likely expect. This crisis isn't arriving next week or even next month. According to Joel, it's already here.

On Thursday, September 22, at 8 p.m. Eastern time, he's joining Marc Chaikin – founder of our corporate affiliate Chaikin Analytics – to reveal the dramatic financial shift that could devastate millions of Americans by the end of the year... and the "financial lifeline" that could trigger a wave of potential wealth so powerful, it could save your retirement. RSVP for free right here.

Railway workers hit their breaking point last week...

Railway workers hit their breaking point last week...