The 'American Dream' isn't what it used to be...

The 'American Dream' isn't what it used to be...

For a long time, owning a home was considered a core tenet of successful adulthood. Then, in an all-too-familiar refrain, along came the pandemic.

A lot of people rushed to make homeownership a reality. They moved from cities to suburbs, scooping up everything on the market. Unprecedented housing demand sent median home prices from $329,000 in January 2020 to $440,000 by April 2022 – near an all-time high.

Investors and developers saw an opportunity from soaring prices. They knew that as homes became less affordable, more people would have to rent again. So they started to build... fast.

These rental investors and developers took on a lot of debt. They assumed there would always be enough renters to pay the costs. Little did they know that the record-breaking supply of new homes they helped build was going to flood the housing market.

The influx of rental units is great for renters. At the same time, as we'll discuss today, it's a scary proposition for real estate owners... and that doesn't seem to be changing anytime soon.

With more rental homes on the market, renters don't have to accept high rates...

With more rental homes on the market, renters don't have to accept high rates...

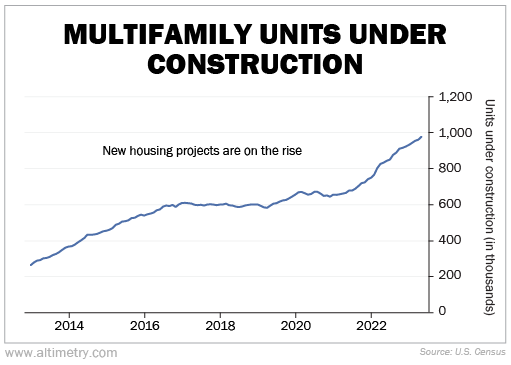

A massive amount of housing stock is becoming available. Take a look at the following chart. It shows the number of multifamily developments currently under construction.

As you can see, nearly 1 million units are set to hit the market soon...

So much stock coming on the market is depressing the prices of apartments in big cities. And after real estate prices soared, interest rates started rising, too. So the price to buy a home got a lot steeper for most people.

All of a sudden, it's becoming more economical for folks to keep renting. That's going to crush demand for single-family homes... which will hurt home prices.

And as we said, many investors took on debt to build new housing projects. It seems like some of them forgot that prices don't always go up...

When you combine all these factors, the residential real estate sector is in for some trouble...

When you combine all these factors, the residential real estate sector is in for some trouble...

And yet, the market still pretends like it isn't an issue.

A great example is a real estate investment trust ("REIT") called Equity Residential (EQR) – the fifth-largest property owner and 14th-largest property manager in the U.S.

Equity Residential's real estate portfolio mostly consists of properties in big cities like New York, San Francisco, and Washington, D.C. These are expensive markets. As more units become available, they could struggle to keep rent prices stable.

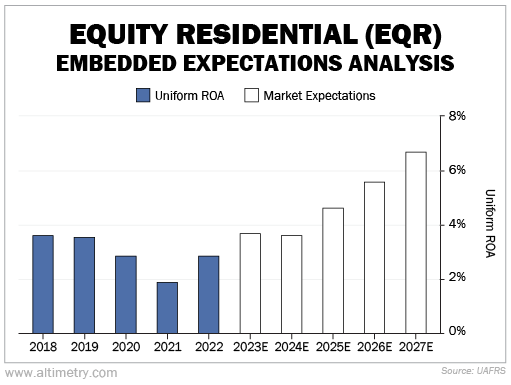

Investors don't care about these headwinds. We can see what they anticipate from the company by taking a look at our Embedded Expectations Analysis ("EEA")...

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Equity Residential's Uniform return on assets ("ROA") has been around 2% to 3% for the past three years. The REIT average is 6%... So it was already a weak business.

At current valuations, the market expects a significant rise in Equity Residential's profitability. Investors think Uniform ROA will more than double by 2027, even as rent prices come under pressure.

Take a look...

This is an incredibly optimistic view. Just look at Equity Residential's performance since 2018. It has never cracked a 4% Uniform ROA.

Considering the company's recent profitability trends and the current state of the residential real estate sector, the market's expectations don't make any sense.

This type of company will have trouble in the coming quarters. It's going to have to navigate falling rent prices, high interest rates, and a possible recession.

Other residential real estate stocks are in the same boat. It's only a matter of time before investors start seeing the bigger picture.

Regards,

Joel Litman

July 12, 2023

The 'American Dream' isn't what it used to be...

The 'American Dream' isn't what it used to be...