A new 'bug' may be spreading...

A new 'bug' may be spreading...

The coronavirus pandemic has dominated the news cycle. As we've said many times here at Altimetry Daily Authority, it has led to big changes in folks' spending habits.

And while it hasn't gotten as much attention, part of that trend is so-called "gear acquisition syndrome" ("GAS"). It's a "condition" affecting musicians... And it's the all-consuming desire to expand their collection of gear and equipment.

The vicious cycle of spending to buy the next great instrument or piece of equipment can batter bank accounts.

News or a personal event can drive consumers to replace or purchase a new piece of equipment.

After the purchase, they go through a series of emotions... and finally end up repeating the cycle anew.

With an inability to spend on experiences during the pandemic, many musicians have seen GAS flair up in 2020 and 2021. Purchases of products over experiences even as the pandemic recedes could be "stickier" than most folks recognize... and musicians are no exception.

One company would seem to be riding the coattails of these out-of-control consumer spending habits...

One company would seem to be riding the coattails of these out-of-control consumer spending habits...

Most music companies are private – they're either small, family-owned businesses or under the control of private equity firms.

As one of the only publicly listed musical instrument companies, Japan-based Yamaha (YAMCY) looks like it would benefit from a spending surge.

The company offers a wide range of musical products from pianos, keyboards, and string instruments all the way to professional audio equipment and soundproof rooms.

With the shift in spending from experiences to goods, Yamaha seems poised to ride strong tailwinds.

But without understanding the market's position on a stock, it's impossible for investors to know if they're ahead of a trend... or if the market has already priced in that trend.

Here at Altimetry, we can understand this by looking at the market's ‘embedded expectations' for future performance at a company's current valuations.

Here at Altimetry, we can understand this by looking at the market's ‘embedded expectations' for future performance at a company's current valuations.

By cutting out the "noise" of as-reported accounting, we can build an accurate historical performance for a particular company. Then we can see what the market expects at that company's current stock price.

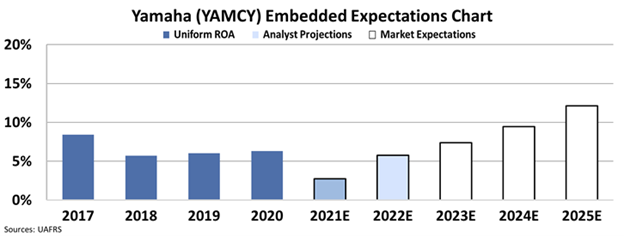

The embedded expectations chart below shows Yamaha's historical corporate performance levels in terms of Uniform returns on assets ("ROAs") and asset growth (dark blue bars) versus what sell-side analysts think the company is going to do for its next fiscal year and fiscal year 2022 (light blue bars). It also shows what the market is pricing in at current valuations (white bars).

Analysts expect a decline rather than an expansion in Yamaha's 2021 returns. For context, the company's fiscal year ends on March 31... so the 2020 fiscal year was almost entirely before the pandemic hit most of the world. Yamaha's 2021 fiscal year was when results were affected.

While investors might expect GAS and changing spending habits to create tailwinds for Yamaha, the coronavirus crisis and general economic headwinds have actually hurt the company's profitability.

And yet, as you can see below, the market is pricing Yamaha with the expectation for booming returns. The company hasn't seen a Uniform ROA greater than 9% over the past five years, and yet the market is pricing returns to reach 12% by 2025.

Even if GAS and a spending shift are here to stay within the music industry, the market is already pricing them in as a massive tailwind for Yamaha – enough for ROAs to hit double-digit levels. If the normal cycles of GAS and consumer spending mean demand doesn't stay this strong forever, Yamaha investors are set up for disappointment.

Regards,

Joel Litman

April 7, 2021

A new 'bug' may be spreading...

A new 'bug' may be spreading...