Hedge fund managers keep getting burned by meme stocks...

Hedge fund managers keep getting burned by meme stocks...

Meme stock madness is back in full swing. Retail investors, who support online forums like Reddit's WallStreetBets, sent more shorted stocks to all-time highs.

In some way, bad news has become good news. Social-media-fueled investors seem to be targeting struggling stocks with high short interest.

These meme traders sent stocks like Clover Health Investments (CLOV) to all-time highs this month.

Among all the meme stocks, AMC Entertainment (AMC) stands out, with shares jumping more than 100% in the last month. At these levels, the stock price is nearly double its 2015 all-time high.

Despite AMC's stock strength, the company is struggling.

The coronavirus pandemic forced AMC to close for months. And the company lost hundreds of millions of dollars. To sustain its losses and avoid bankruptcy, AMC borrowed money.

To add to its troubles, one of its competitive advantages of theatergoing is slipping. The movie "release window," the time frame when a film can only be played in theaters, has declined steadily over time. And it took a sharp decline during the pandemic.

Now, some new releases are available to stream the same day they are released in theaters.

Same-day streaming of new releases is a major concern for AMC. If consumers can watch the movie at home, there's less incentive to see a film in theaters.

Even before the pandemic, AMC and the movie theater industry were struggling. Increased competition from streaming giants such as Netflix (NFLX) meant more movies and shows for consumers to watch from the comfort of their sofas.

And Wall Street hedge funds have bet repeatedly that AMC's stock would eventually fall.

Despite being right about the fundamentals, these hedge funds keep ending up on the wrong side of AMC stock, losing tons of capital.

Take Mudrick Capital as an example.

The distressed investment firm lent AMC money at a favorable 15% interest rate. And then, the firm offset the risk of the loan by selling call options on AMC stock.

When AMC stock took off in early June, Mudrick Capital lost 10% of its fund's value in just a few days, wiping out all its gains from its lending.

Mudrick Capital's trade made sense based on fundamental metrics...

Mudrick Capital's trade made sense based on fundamental metrics...

Mudrick Capital sold AMC call options with a strike at $40. This means that Mudrick was selling the right to buy AMC stock for $40 a share before the expiration date.

Essentially, Mudrick was betting that AMC stock would not go up by more than $40 a share by the time the call options expired.

At Altimetry, we can determine what return AMC would need to justify its stock price.

At Altimetry, we can determine what return AMC would need to justify its stock price.

Most investors determine stock valuations using a discounted cash flow ("DCF") model, which makes assumptions about the future and produces the "intrinsic value" of the stock.

Here at Altimetry, we know models with garbage-in assumptions only come out as garbage.

Therefore, we've turned the DCF model on its head with our Embedded Expectations Framework. Here, we use the current stock price to determine what returns the market expects...

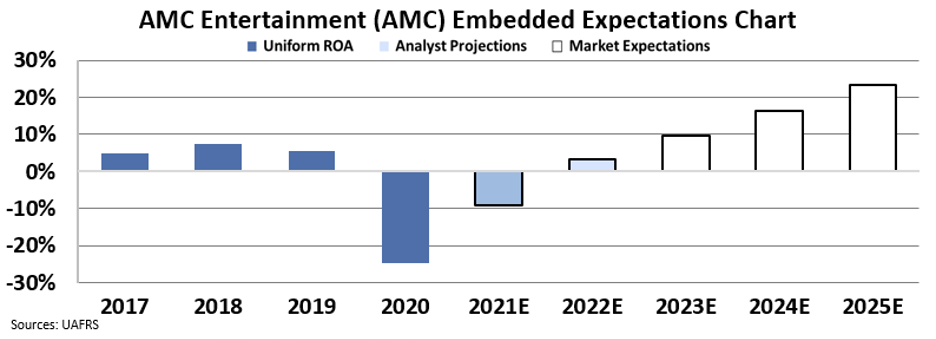

Looking at the Embedded Expectations Chart, we can determine that for AMC to be worth $40 a share, the Uniform return on assets ("ROA") would need to improve to 16% over the next few years.

You can see this in the chart below. The dark blue bars represent AMC's historical corporate performance levels regarding ROA. The light blue bars are Wall Street analysts' expectations for the next two years. Finally, the white bars are the market's expectations for how the company's ROA will shift in the next five years.

AMC's Uniform ROA was less than 10% in the three years leading up to the pandemic.

Therefore, Mudrick Capital bet that AMC stock would not go above $40 per share. That makes sense from a fundamental standpoint. The likelihood that Uniform ROA would rise to 16%, with all the headwinds facing AMC, seemed unlikely.

However, AMC's stock shot past $40 per share up to an intraday high of $72 per share on June 2. By the end of the week, Mudrick's trade had gone bust.

At this price, from a fundamental standpoint, retail investors are expecting AMC's Uniform ROA to expand to 23% levels – nearly double AMC's peak Uniform ROA.

Before buying a stock, know that there's more to the story...

Before buying a stock, know that there's more to the story...

Overall, Mudrick Capital's trade made sense from a fundamental perspective.

AMC should never have been trading above $40, much less at $72 per share. The stock is overpriced, no matter how you look at it.

Anyone left holding AMC at current prices is holding onto the momentum generated by social media traders, which does not represent the economic reality for the company.

Altimeter subscribers can click here to see how AMC and other meme stocks are valued based on Uniform Accounting. The Altimeter is a "stock truth detector," allowing you to see the full gradings for more than 4,000 U.S.-listed companies.

If you aren't already an Altimeter subscriber, click here to learn how to gain instant access.

Best regards,

Rob Spivey

June 29, 2021

Hedge fund managers keep getting burned by meme stocks...

Hedge fund managers keep getting burned by meme stocks...