America's upper-income earners are struggling to pay their debts...

America's upper-income earners are struggling to pay their debts...

Consumer-driven spending has powered the American economy for years.

Five years ago, pandemic-era stimulus checks and low interest rates meant folks could spend and borrow without worry. High-income households in particular spent on luxuries like cars, vacations, and home upgrades.

Fast-forward to now, and the U.S. economy is sitting on a massive pile of debt. As of the second quarter of 2025, consumer debt has soared to $18.4 trillion.

And while you might assume the bulk of this debt is from lower-income households... that's not the case.

Defaults are rising where pockets are deepest. We're seeing signs of a major pullback in spending as high-income earners struggle to finance their debt.

This isn't a warning sign... yet.

But there's no denying it – financial stress is building where it usually doesn't...

Delinquencies are surging in places they shouldn't be...

Delinquencies are surging in places they shouldn't be...

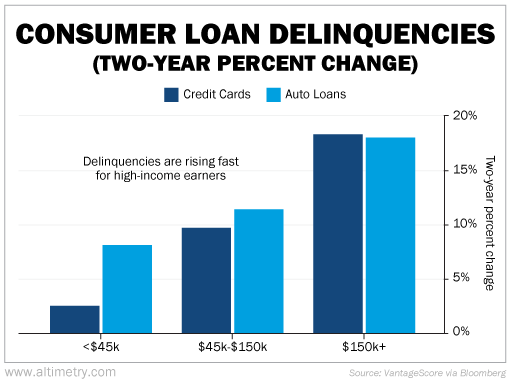

Credit-scoring firm VantageScore reports that Americans who make over $150,000 per year are falling behind on their credit-card and auto-loan payments faster than anyone else.

Their delinquency rate has surged nearly 20% over the past two years.

Take a look...

As you can see, high-income earners are having a hard time keeping up. Their delinquency rate has soared nearly twice as much as the next-highest bracket.

The economy as a whole has been feeling the squeeze from soaring interest rates. Student-loan payments resumed in May, adding another burden for consumers.

But for high-income earners, the problems don't end there...

The labor market seems to be cooling off as hiring freezes sweep the jobs market. Planned job cuts were just above 54,000 through September. And total hiring plans for the year are just above 200,000.

Three-month average wage growth was just 4.1% in August, lower than 2022's high of 6.7%.

AI is hitting white-collar positions in the tech sector and elsewhere. Just last week, Amazon (AMZN) made headlines for plans to slash as many as 30,000 jobs.

In other words, debt is rising... and the money used to pay off those debts is getting harder to come by.

That's concerning for an economy that traditionally relies on spending from high-income earners. These mounting pressures are taking a toll on all sides of the consumer-driven economy.

All that said, it's not time to panic about an economic crisis...

All that said, it's not time to panic about an economic crisis...

The household-debt-to-GDP ratio is around 68% – a sharp drop from 98% in 2008. It's closer to late-1990s levels today.

Said another way, total debt levels are low versus one of the worst consumer environments of the past few decades.

It's not time to panic just yet. Most consumers aren't overleveraged. The broader debt situation remains stable despite rising delinquencies.

The stress on high-income earners is unusual... and worth watching. If debt levels start rising from here, it could signal deeper cracks in the economy.

But for now, we're not jumping to any conclusions. The data will tell the story in due time.

Regards,

Joel Litman

November 3, 2025

America's upper-income earners are struggling to pay their debts...

America's upper-income earners are struggling to pay their debts...