Editor's note: Every Friday, we showcase a featured topic from our YouTube show, Altimetry Authority.

This week, we tackle themes from our upcoming episode, including the return of student-loan payments... rising consumer debt... and what it means for the corporate landscape.

Read on below...

Millions of borrowers just missed their first payments... and it's getting worse...

Millions of borrowers just missed their first payments... and it's getting worse...

After more than three years of pandemic-era grace, federal student-loan payments resumed in early May.

Tens of millions of borrowers can no longer avoid their debt. It was a long-anticipated milestone... and a looming test of the consumer's financial health.

Now, we're starting to see the results. And we won't sugarcoat it – they're ugly.

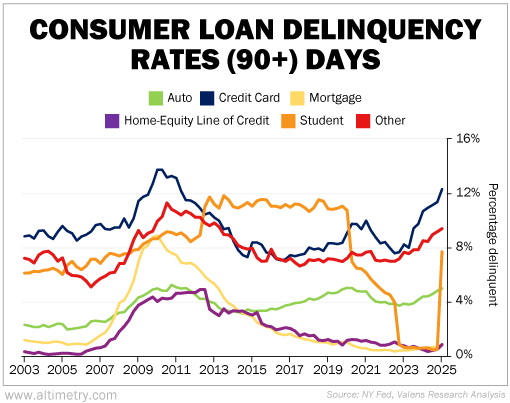

According to fresh data from the Federal Reserve Bank of New York, nearly 8% of student loan balances are now delinquent by 90 days or more. That number was below 1% just one quarter ago.

It's the sharpest single-quarter jump on the chart. Millions of Americans simply aren't keeping up.

Consumer stress is accelerating across the board. This spike in student-loan delinquencies is a flashing warning sign for the consumer.

And it could drag down broader economic momentum in the coming quarters.

While student loans were frozen, the rest of the consumer had already cracked...

While student loans were frozen, the rest of the consumer had already cracked...

Over the past year, we've seen plenty of signs of rising financial pressure on U.S. households.

Credit-card delinquencies have surged past pre-pandemic levels. Auto loans are deteriorating fast. And total household debt just hit a new record high of $18.2 trillion.

All the while, one big category remained frozen in time... student loans. But that changed on May 5.

Roughly 42 million borrowers were told to restart monthly payments on loans that had been paused since March 2020. They came back to a very different world. And the data shows how unprepared they were...

Student-loan delinquencies exploded.

In the first quarter of 2025, the share of seriously delinquent student loan balances (90-plus days past due) jumped from 0.8% to 7.7%. That's an enormous increase in just three months.

Take a look...

Student-loan debt now has the fastest-rising delinquency rate of all the major consumer credit types. It even outpaced credit cards and auto loans.

This shockwave goes far beyond student debt. It signals that American consumers, already strained, are hitting a breaking point.

Consumers are juggling more debt than ever... and failing to keep it all afloat...

Consumers are juggling more debt than ever... and failing to keep it all afloat...

The consumer has been walking a financial tightrope for more than a year. The job market is getting tough... tariffs have prices of all kinds of goods rising... and as we mentioned, debt loads keep rising.

Student-loan repayments may be what finally knocks folks off balance.

And the impact will stretch further than many people realize. Consumer spending makes up nearly 70% of U.S. GDP. If more Americans are forced to pull back, companies will feel it in the form of weaker demand.

Corporate balance sheets remain healthy... so far. They won't stay insulated forever, though. The strain we're now seeing in consumer debt markets could eventually ripple into corporate earnings.

Smart investors should start preparing now. It's time to get exposed to stable, low-volatility stocks that can hold up in a consumption-driven slowdown.

There's a chance the worst is behind us. But it's better to be safe than sorry. Prepare for more volatility in the coming months.

Regards,

Joel Litman

May 16, 2025

P.S. We dive deeper into the "student-loan apocalypse" in the upcoming episode of Altimetry Authority, which airs at 11 a.m. Eastern time today. Check it out on our YouTube channel right here... and be sure to click the "Subscribe" button.

Millions of borrowers just missed their first payments... and it's getting worse...

Millions of borrowers just missed their first payments... and it's getting worse...