Wall Street loves to tout 'discipline' when the market gets tough...

Wall Street loves to tout 'discipline' when the market gets tough...

And the C-suite might love it even more.

The moment there's even a hint of an impending downturn, you'll find post after post about the importance of a disciplined investment strategy. And when companies start to struggle, management trips over itself to assure investors that it's staying disciplined.

This is nothing new. Discipline has been a favorite corporate buzzword for decades.

In the mid-1990s, business strategists Michael Treacy and Fred Wiersema published their bestselling book, The Discipline of Market Leaders. It heralded the "next big thing" in management consulting. What most people don't know is that the title of the book was created by focus groups.

The authors flashed ideas for the title of the book in front of various executives and consultants. As one of the authors told me personally, "Every time the word 'discipline' flashed in front of audiences, people literally sat up in their seats."

The title of the book seemed to appeal greatly to company executives... and they might be on to something. As I'll share today, discipline shouldn't be limited to those at the top of the corporate ladder. Particularly in environments like today's, a steadfast investment strategy is critical.

Someone, somewhere, has told you to buy low and sell high...

Someone, somewhere, has told you to buy low and sell high...

This adage is well known... and in theory, well understood. And yet, it's amazing how many investors lack the discipline to put this idea into action.

Too often, investors get caught up in the sensationalism of Wall Street and the mainstream financial media on both ends of the market. They tend to buy when the market is hot and stay in cash when stocks are at their lows.

Take what happened in late-March 2020, for instance. The headlines were all about how March was one of the worst months ever in the market. We had just finished the worst first quarter in the history of the Dow Jones Industrial Average.

Far too many folks heard that news and ran for the hills. Even those who had been fed a steady diet of "buy low, sell high" froze when it came time to act. It's a lot harder than it sounds to load up on shares when the world is panicking.

Those who were disciplined enough to ignore the market "noise" booked outsized gains. In our Altimetry's Hidden Alpha monthly advisory, we recommended online-education business Chegg (CHGG) and fintech giant PayPal (PYPL) in May 2020.

Subscribers who followed our advice booked a combined 94% gain in Chegg in only seven months... and a combined gain of 112% in PayPal in a little more than a year.

Now, look at what's going on today...

Now, look at what's going on today...

Last year was a volatile one for the markets. Inflation and interest rates were both rising... Russia was starting a war in Ukraine... and the risk of a recession was growing.

The economy has only gotten more bumpy. We grappled with big bank failures in March. And we're still facing elevated inflation and interest rates.

And yet, the stock market is doing quite well. The S&P 500 is up 8% year to date, and the Nasdaq is up more than 19%.

We view the recent price action as a "FOMO" rally. Investors are scared of missing out on all the fun of a potential recovery. They're tempted to buy on the hope of a resurging bull market.

Too bad we're still not out of the woods yet. Disciplined students of the stock market could tell you why...

As we explained back in March, investors are buying into improving momentum – not improving fundamentals. We can see this by comparing exposure and correlation levels.

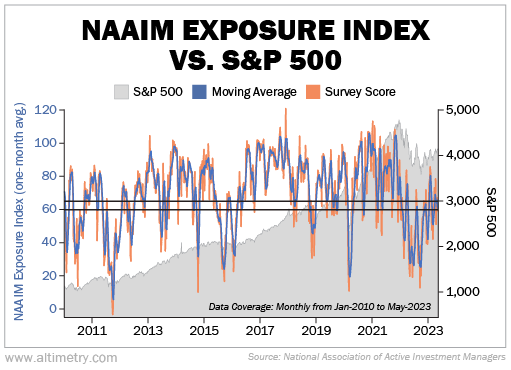

U.S. equity exposure levels are rising, which means investors are buying more stocks. We can see this through the National Association of Active Investment Managers ("NAAIM") Exposure Index.

We discussed the NAAIM Exposure Index in that March essay...

The index gets its data from a weekly survey that tracks how much members are investing in equities. Results tend to fall between 0% and 100%. But they can be lower or higher than that if investors are shorting stocks or using leverage.

The long-term average allocation is between 60% and 65%. That means in an average market, active investors have 60% to 65% of their assets in stocks.

When allocations rise, investors are bullish. They're pouring a lot of money into the stock market.

During a normal, healthy bull market, rising exposure leads to lower stock correlations... meaning how different stocks perform against one another and the overall market. If all stocks move in the same direction every day, that's a perfect 100% correlation.

When the market is in good shape, good stocks perform well and bad stocks perform worse. When the market falls, like it did in March 2020, correlation gets really high because it's being driven by fear.

This year, exposure is rising... meaning investors are buying more stocks. Correlation is also high, meaning investors are acting emotionally. Take a look...

We aren't seeing much of a difference between the stock-price movements of good and bad companies.

That's not a recipe for success.

Don't get me wrong... I still love the long-term prospects of the U.S. stock market.

Don't get me wrong... I still love the long-term prospects of the U.S. stock market.

Nowhere else in the world do so many companies have the potential to generate so much long-term profit.

The issue is how fast investors should be buying into the current market. Global and domestic issues are hard on companies' shorter-term earnings and growth rates. Meanwhile, the highly correlated nature of the big run-up in stocks this year brings many risks with it.

Long-term U.S. equity fundamentals are incredibly strong. Any money invested today is still "buying low" relative to the opportunity of the next 10 years or more.

We expect the market to stay choppy and volatile for the next several quarters. That's why we like to encourage "dollar-cost averaging"... meaning buying a portion of your total planned investment on a regular schedule, no matter what the stock does.

Of course, things can change fast. We may see a true buying opportunity, as we have in the past. Our recommendation will change with that. In the current environment, prudent investors would dollar-cost average their money over a 24-month period.

That's the discipline required today.

Wishing you love, joy, and peace,

Joel

May 19, 2023

Wall Street loves to tout 'discipline' when the market gets tough...

Wall Street loves to tout 'discipline' when the market gets tough...