Editor's note: Every Friday, we showcase a featured topic from our YouTube show, Altimetry Authority.

This week, we tackle themes from today's episode, which airs at 8 a.m. Eastern time.

Read on below to learn about a new Ozempic announcement... and why investors are overreacting...

Ozempic could soon cost just $150 per month...

Ozempic could soon cost just $150 per month...

At least, that's what President Donald Trump announced from the Oval Office in mid-October.

His one statement was enough to send shares of Novo Nordisk (NVO) down 10% in the past month. Wall Street panicked, assuming profit margins for GLP-1 giants were about to get slashed.

But behind the headlines, Novo has already laid the groundwork for a new pricing model... and a far bigger market.

Back in August, the company slashed the out-of-pocket price for Ozempic to $499 for cash-paying patients. It launched that offer with partners like GoodRx to widen access.

Far from being blindsided, Novo is driving the price cuts itself. And as you'll see, the market is overreacting to Trump's announcement...

Novo is betting on a much bigger opportunity than list prices suggest...

Novo is betting on a much bigger opportunity than list prices suggest...

The GLP-1 market has exploded. Analysts expect it to grow to $95 billion by 2030, fueled by weight-loss drugs like Ozempic, Wegovy, and Mounjaro.

These medications are quickly shifting from niche weight-loss aids to cornerstone therapies. Over the past few years, researchers have theorized they could reduce the risk of cardiovascular disease, kidney disease, and even dementia.

All those uses have created an addressable market the likes of which we've never seen from another drug. Big GLP-1 producers now need to focus on volume, rather than price, to maximize their returns.

And this transformation is central to Novo's strategy...

Today's $499 monthly price already undercuts Ozempic's $1,000 list rate. And the $150 figure Trump touted isn't far from what many insured patients actually pay.

In a sense, Trump didn't announce anything new about Novo's sales model...

In a sense, Trump didn't announce anything new about Novo's sales model...

If GLP-1s become the default treatment for a host of chronic diseases, volume will soar.

That's the playbook Novo is following... And it's one that doesn't require a $1,000 sticker price to be profitable.

But with Ozempic's price in question, investors keep getting more pessimistic.

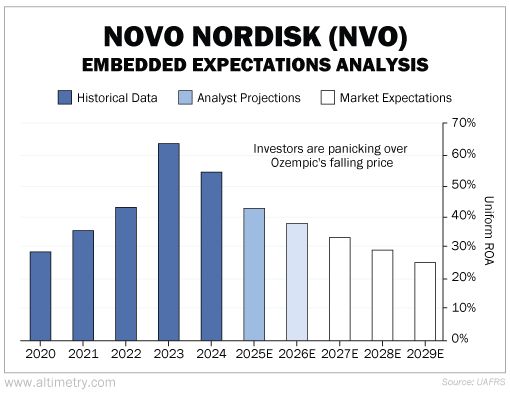

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Novo Nordisk's Uniform return on assets ("ROA") has boomed since it introduced GLP-1s... from 29% in 2020 to a peak of 64% in 2023. It was 55% last year, more than quadruple the market average.

But investors think returns will fall to just 25% by 2029... lower than any time since 2013.

Investors no longer think GLP-1s help Novo's business. They think Ozempic will hurt profitability.

That just doesn't make sense... considering this pricing strategy is nothing new.

Investors are acting like Novo Nordisk is making a concession...

Investors are acting like Novo Nordisk is making a concession...

In reality, it's following its own plan to sell Ozempic to as many folks as possible. Novo has a chance to dominate a drug category that's rapidly becoming essential to public health.

It might look like Novo's margins should be slipping away at first glance. But customers aren't actually paying much less than they used to. And in the meantime, more and more folks will be buying Ozempic.

That's a net positive for the company... and for investors.

Regards,

Joel Litman

November 14, 2025

P.S. We'll dive deeper into Novo Nordisk and Ozempic in today's episode of Altimetry Authority. New episodes air every Tuesday and Friday at 8 a.m. Eastern time.

Check out our YouTube channel right here... and be sure to click the "Subscribe" button.

Ozempic could soon cost just $150 per month...

Ozempic could soon cost just $150 per month...