A year ago, I declared 2023 to be 'the year of AI'...

A year ago, I declared 2023 to be 'the year of AI'...

And to be frank... I was wrong.

AI was mentioned in earnings calls almost 10 times as much in 2023 as it was in 2022. With the rise of chatbot ChatGPT, folks expected AI to supercharge nearly every industry.

I was no exception. I predicted businesses would devote their time and energy to embracing this technology. Free from the burden of menial tasks, they'd spend more time on creative enterprises and improving productivity.

Yet last year, businesses spent more time talking about AI than actually implementing it... Most of these companies didn't make any real progress.

Today, I'll share why this year looks much more promising for actual AI implementation... and where to invest to make the most of it.

Stocks lived and died by their responses to AI last year...

Stocks lived and died by their responses to AI last year...

Take Chegg (CHGG) and Duolingo (DUOL)... two education technology businesses with vastly different approaches to the AI surge.

Chegg was forced to admit that free AI products like ChatGPT threatened its tutoring business model. It did little to embrace AI after this announcement. As a result, its stock fell more than 50% in 2023.

On the other hand, language app Duolingo explored ways to improve its platform using AI... reducing the cost of translation and building new personalized lessons for users. Shares rose more than 200% in the same time frame.

Even those moves were based on speculation, not on actual spending. I believe that's about to change...

We're starting to see an uptick in AI investment. And that's great for consulting companies, which help clients build and use new tools.

Accenture (ACN) – one of the biggest consultants in the world – reported only $300 million worth of AI consulting projects for the first six months of 2023.

That sounds like a lot... until you realize Accenture earns about $65 billion in revenue per year.

AI-related bookings for the company rose to $450 million from September to November. That said, there's still a lot of room for spending to increase.

Consultants like Accenture will own the AI movement over the next two years...

Consultants like Accenture will own the AI movement over the next two years...

If you're looking for a way to profit as AI sweeps the business world, this is where your money should be. Consulting firms will help companies implement all the AI projects they discussed last year.

Said another way, Accenture in 2024 and beyond could look a lot like tech darlings Nvidia (NVDA) and Alphabet (GOOGL) in 2023.

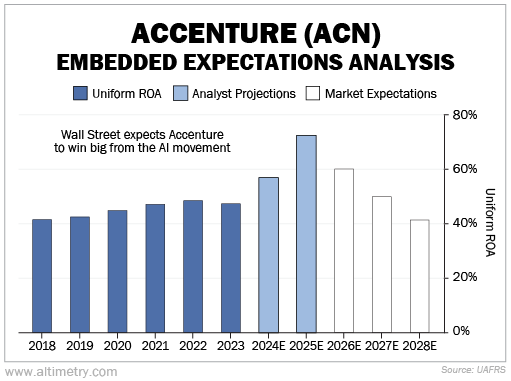

We can see this through our Embedded Expectations Analysis ("EEA")...

The EEA works a lot like a betting line in a sports bet. We use Accenture's current share price to calculate what investors expect from future performance... and compare those forecasts with our own.

It tells us how well our "team" (the company) has to perform to justify the market's "bet" (the current price).

Just take a look at profitability over the next two years. Uniform return on assets ("ROA") already jumped from 42% in 2018 to a high of 49% in 2022.

And that's only the start... Wall Street analysts expect it to reach 57% in 2024 and 72% the following year.

Take a look...

While Wall Street is confident in Accenture's prospects, the market thinks Uniform ROA will fall back to 42%. Shares will soar when this consultant proves them wrong.

The big difference is AI.

This year could be tough for a lot of companies, thanks to persistent high interest rates. More businesses will realize they can cut costs by implementing AI, similar to Duolingo.

And they'll rely on consultants like Accenture for help... keeping it stable through the coming recession.

Subscribers to our Altimetry's Hidden Alpha monthly advisory know that we recommended Accenture back in April 2023. It's up 25% since then. And while it's trading above our recommended buy-up-to price today, we're confident this is only the beginning of what it can do.

There's still plenty of room for Accenture to run.

Regards,

Joel Litman

January 18, 2024

Editor's note: Accenture is up double digits since Joel first featured it in Altimetry's Hidden Alpha. And while it's now trading above his recommended buy-up-to price, he recently published a list including four other AI "juggernauts" you can buy today...

According to Joel, these businesses have plenty of industry experience to back them up – and each could unlock a ton of value for your portfolio from here. Plus, he shared five ticking AI "time bombs" you should avoid at all costs. (One of them was a market favorite for all of last year.) Click here to learn more.

A year ago, I declared 2023 to be 'the year of AI'...

A year ago, I declared 2023 to be 'the year of AI'...