The responses have been coming in all week...

The responses have been coming in all week...

I wasn't sure how the note about intermittent fasting ("IF") would go over last Wednesday, particularly before the biggest day of eating of the year... But I hope you had a wonderful Thanksgiving and were able to spend it with family and friends.

I was happy to see all the positive feedback about my comments on IF.

I even received a nice note from and had a wonderful phone call with Dr. Jason Fung. Dr. Fung is one of the true pioneers of research around IF. And totally unbeknownst to me, he's a regular reader of Altimetry Daily Authority.

We had a great discussion about the power of IF on overall health, for helping with various ailments like diabetes, and for maintaining desired weight levels.

I highly recommend reading Dr. Fung's work if you're interested in IF – his YouTube channel is a great start.

Many of our readers wrote in confirming that they had also discovered the power of IF and found the technique effective.

Several asked me questions to the effect of:

How do you structure your day around fasting for 12 to 18 hours?

Well, I don't have an absolutely fixed regimen. I can't... My travel and speaking schedule often define what days I choose to do what level of fasting.

That said, my target regimen is to fast five days a week for 16 to 18 hours. Then one day a week I'll do a full 24 hours of fasting, and on another day I'll fast for 12 hours or even less.

I didn't begin with this routine. I started fasting for just 12 hours a day for a month. Then I moved to 14 hours... and then to 16 hours. After that, I played with various schedules until I reached the one I've stuck with for the past year.

I drink plenty of water while fasting – particularly carbonated water. I also drink black decaf coffee and lots of peppermint or chamomile tea. Peppermint tea has valuable polyphenols which have several health benefits. (I'll cover this subject in a future Daily Authority.)

To the extent that our readers enjoy it, I'll be happy to share more of Dr. Fung's insights... as well as other experiences into discovering the "Fountain of Youth."

Next year marks the 100-year anniversary of a formula taught in every business school across the country...

Next year marks the 100-year anniversary of a formula taught in every business school across the country...

I'm talking about the "DuPont identity."

Created at chemical company DuPont, this simple formula is crucial to understanding the true profitability of a business.

So how did a chemical company create such a landmark formula? It is because of the specific needs of the firm to understand business performance.

DuPont was founded as a gunpowder manufacturer in 1802 by Éleuthère Irénée du Pont, who had fled to America in 1800 to escape the French Revolution. The company's original mill in Delaware provided roughly half of the gunpowder used by the Union during the Civil War.

After the turn of the century, DuPont continued to expand... investing in a plethora of industries, including chemicals and a controlling stake in General Motors. By the 1920s, DuPont Treasurer Donaldson Brown needed a way to measure the profitability of the discreet business units within the company.

DuPont wanted to understand if its segments were profitable.

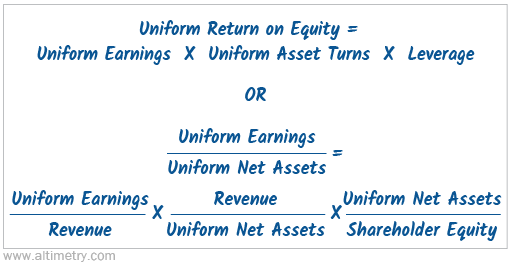

Donaldson pioneered what is known today as the DuPont identity, also known as the "DuPont formula." By only looking at revenue or costs, it was impossible to understand if a company was making money efficiently and if it could improve. The DuPont identity that is taught today distills profitability into four metrics: return on equity ("ROE") and its parts – leverage, earnings margin, and asset turns...

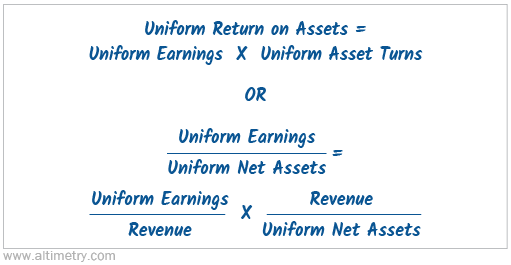

However, the original DuPont formula focused on return on assets ("ROA") because Donaldson wanted to focus on operating returns.

There's a distinctly nonoperating factor in an ROE calculation. The decision as to how much leverage a company or division takes on has nothing to do with its operations, but how it chooses to build its capital structure.

If we remove leverage from the equation, we get to the original Dupont identity... and we can get a focus on just the operating return of the business...

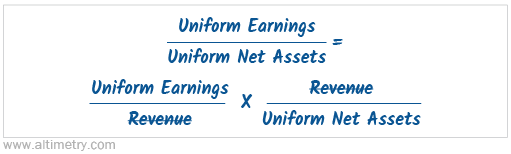

ROA is a clear measure of profitability because it shows how much money a business makes compared with the assets it used to generate its returns. This is calculated by multiplying a company's margins by asset turns. This can also be shown by canceling out revenue in margins and turns...

While most people are familiar with earnings – how much money a company makes after their costs – the concept of turns is more vague. Asset turns are how much revenue a company generates from its assets, or how efficiently a company generates sales.

When we teach the DuPont formula in analyst training programs, we often use the auto-supply industry as an example of the difference between margins and turns. Today, let's use Advance Auto Parts (AAP)...

The company is a massive distributor of auto parts in the U.S. With large stores and differentiated products, Advance is able to charge a large margin for its merchandise. However, the cost to run its stores is high, so its asset turns are low.

In comparison, Murphy USA (MUSA) runs gas stations – which also sell limited auto parts in rural areas of the U.S. By selling a commodity product in gasoline, Murphy is unable to charge a large margin. However, the company is still efficient because it has high asset turns. By selling a lot of gasoline and spare parts in cheap locations, Murphy has a comparable ROA despite a completely different business model.

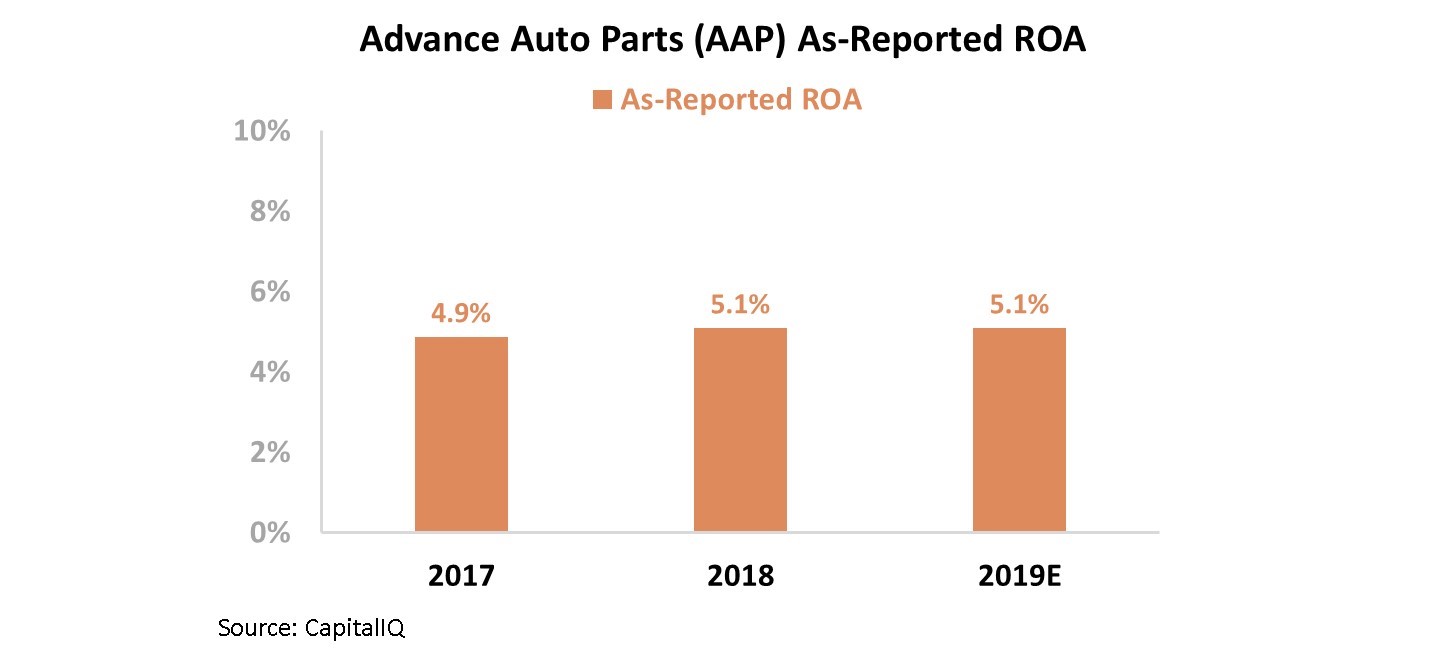

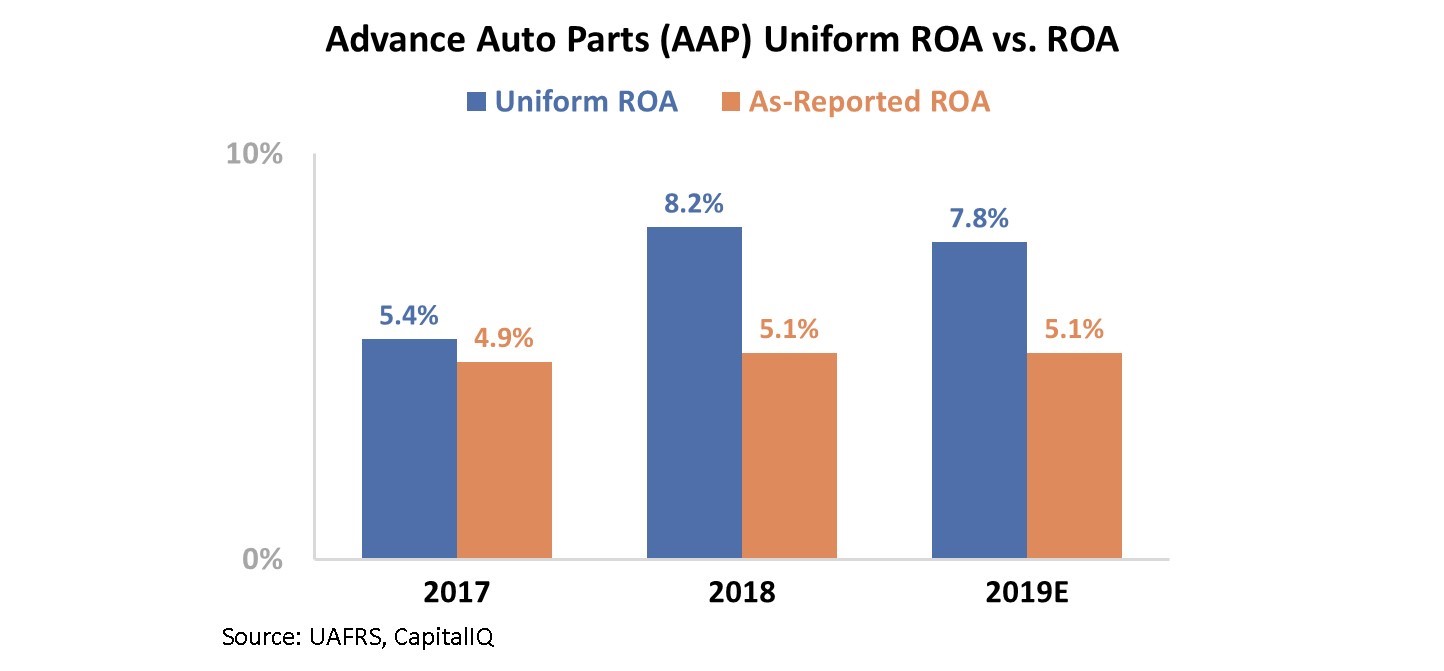

Considering the importance for margins when looking at Advance's returns, it's significant that the market has missed a fundamental change in this metric. Looking at Advance's as-reported ROA, it appears that the company has seen a stagnant ROA around 5%. Take a look...

But because of the treatment of goodwill, operating leases, and other adjustments, Uniform earnings have been misrepresented... and earnings margin has a direct relationship with ROA.

These distortions have hidden the reality of a substantial improvement in Advance's ROA over the past year. Rather than hovering around 5%, Uniform ROA has improved from 5% in 2017 to 8% last year...

Over the past year, the market has missed this sudden spike in operating performance... Advance's stock price has remained flat near $150 per share. However, as the company continues to improve and the market begins to catch on, there could be upside ahead.

Looking at margin on its own has gotten a lot of investors and managers into trouble over the past hundred years – hence the importance of understanding the DuPont identity.

But even if you understand this formula, if you use as-reported metrics when analyzing companies, you're still going to end up with the wrong insights.

Regards,

Joel Litman

December 6, 2019

The responses have been coming in all week...

The responses have been coming in all week...