Almost a year later, it's clear that UBS (UBS) got away with highway robbery...

Almost a year later, it's clear that UBS (UBS) got away with highway robbery...

In the wake of the banking crisis last March, the Swiss bank managed to scoop up one of its largest national rivals, Credit Suisse, for just over $3 billion.

Several banks at the time, including Silicon Valley Bank, First Republic Bank, and Credit Suisse, suffered from massive bank runs. Customers panic-withdrew their funds, completely wiping out the banks' liquidity.

So, to prevent Credit Suisse from collapsing, the Swiss government gave UBS about $100 billion in liquidity to help it take over Credit Suisse's operations. It was a merger that otherwise never would have gone through, as it meant combining the nation's two largest banks.

As of this past August, UBS had the highest quarterly profit of any bank ever. And the stock has been on a tear, too... It's up more than 50% since the takeover, having reached a 15-year high.

Investors seem to think this is only the beginning...

A few weeks ago, activist investor Cevian Capital even took a $1.3 billion stake in UBS, betting that its valuation will double over the next few years.

Specifically, Cevian believes that with Credit Suisse's assets, UBS should be valued similarly to its closest U.S. peer, Morgan Stanley (MS).

As we'll explain today, though that might be a compelling story, investors shouldn't get their hopes up waiting for UBS shares to double. In fact, the stock may not soar much more than it already has...

On the surface, Cevian Capital's idea makes sense...

On the surface, Cevian Capital's idea makes sense...

If you look at traditional valuation metrics – like price-to-book (P/B) ratio, for instance – UBS is about half the size of Morgan Stanley.

The P/B ratio compares a company's total value, as assessed by equity owners and creditors, with the value of the assets on its balance sheet (or "book").

The higher the P/B ratio, the more investors are willing to pay for the company's assets.

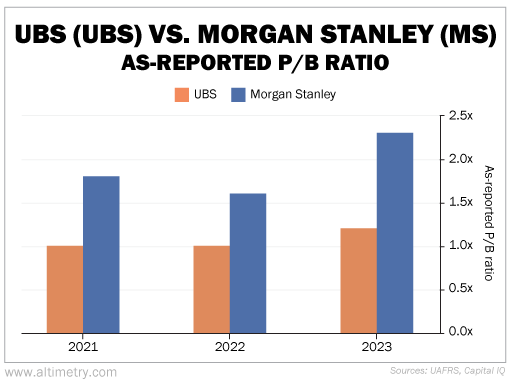

If we were to look at these companies' as-reported P/B ratios over the past few years, Cevian Capital's bet seems spot on.

Today, UBS trades at a P/B ratio of just 1.2 times, while Morgan Stanley trades at a P/B ratio of 2.3 times.

Check it out...

If UBS were to grow to be the size and quality of Morgan Stanley, then it would follow that its valuation should be in line with Morgan Stanley's. That would mean UBS's P/B ratio would double to about 2.4 times... and, as Cevian reasoned, that means its stock would double as well.

However, as-reported P/B valuations are flawed.

You see, UBS's assets are being massively overstated under as-reported accounting. The company has billions of dollars in goodwill on its balance sheet from various acquisitions. It also has billions of dollars in what are called pension assets...

Pension assets aren't assets in the traditional sense. As they're reserved for pension plans, the bank can't use that cash to lend money.

When we remove these nonoperating assets from the calculation, UBS looks like it's already valued like Morgan Stanley... Its Uniform P/B ratio goes from just 1.5 times at the time it bought Credit Suisse to 2.4 times today.

Investors waiting for UBS's stock to double are bound to be disappointed...

Investors waiting for UBS's stock to double are bound to be disappointed...

Cevian had the right idea with UBS. It was just too slow to act.

Yes, UBS is a great business. And it got a steal with its bailout of Credit Suisse.

However, under Uniform Accounting, the company is already valued similarly to Morgan Stanley. And as the stock has rallied more than 50% since the takeover... it seems as though the market has already rewarded the business for its transformation.

While the bank isn't overvalued, it's also unlikely to keep rising the way Cevian expects.

Regards,

Joel Litman

January 16, 2024

P.S. The recent run-up in stocks has a lot of investors feeling bullish today. But now – more than ever – is the time to be extremely cautious...

The same ironclad "law" of finance that predicted the 2008 financial crisis says the next three years could be painful for investors. A massive wave of bankruptcies is set to shake up the U.S. economy and markets... and it'll likely be much worse than what we saw in 2009.

If you're holding any stocks at all, you can't afford to ignore my latest warning. Click here for the full story.

Almost a year later, it's clear that UBS (UBS) got away with highway robbery...

Almost a year later, it's clear that UBS (UBS) got away with highway robbery...