The coronavirus pandemic is starting to reverse a longtime trend...

The coronavirus pandemic is starting to reverse a longtime trend...

After years of moving offshore, jobs might finally be returning to U.S. soil. For the bartenders, pilots, and tour guides still out of work, these fields are unfortunately still hurting. However, as Bloomberg explained earlier this month, American manufacturing jobs are likely on the cusp of a renaissance.

As more folks leave the cities and move to the suburbs, demand for new housing is reaching new peaks – which leads to new jobs in the construction sphere. In addition, these houses need to be populated with all manner of appliances, which leads to a second boom.

Due to the continued effects of the trade war – and more important, the weakening of the U.S. dollar – it has become more expensive than ever to produce goods in places like China. As the dollar becomes cheaper compared to world currencies, it can buy less than before from abroad. This means a new wave of consumer goods and other products being manufactured domestically.

Historically, manufacturing and construction have been the last industries to recover in a recession, due to the typical credit-constricted causes. However, this year, these two sectors are leading the charge of an economic recovery. As we've mentioned many times here at Altimetry Daily Authority, this recession is different in nature from previous downturns.

Over the next few months, it will be important to watch construction and manufacturing in the U.S. to help gauge the strength of the recovery. Additionally, big American firms like iPhone maker Apple (AAPL) that have historically manufactured their products in China may be reevaluating their production.

When Apple releases a new phone, one of the first things technicians do is take the phone apart...

When Apple releases a new phone, one of the first things technicians do is take the phone apart...

These folks like to look at the components, and find out which manufacturers produce them. Every piece in an iPhone is important, considering that more than 200 million of these devices are sold worldwide each year. People always want to see how Apple has upgraded its offerings and prioritized certain features.

This can help tell investors what companies in the Apple supply chain might see huge growth in the next year. When identifying big macro trends to invest in, it's often better not to focus on the primary companies, as growth for these firms usually gets quickly priced in.

Looking at the tertiary companies – the suppliers or contractors that work to produce these products – is often the better option. These firms are typically much less well-known, and investors can still benefit from trends even after the stock moves for the underlying primary company.

The suppliers and contractors sometimes have such concentrated business lines that they can be better plays on a big trend than the target company. The larger original equipment manufacturers ("OEM") like Apple are often more diversified and may see less benefits from one of their products doing well, because of that single product's contribution to the overall company's profitability.

Similar to how paying attention to the component providers is sometimes a better bet when looking at a tech company cycle, there might be a better way to play the construction and specifically U.S. manufacturing renaissance that may be coming...

Due to the factors we mentioned above, U.S. manufacturing is in a better spot than ever. The obvious winner of this likely shift is manufacturing facilities and companies based in the U.S.

However, other more concentrated winners are going to be firms that help build these facilities. These companies are likely to get additional work related to infrastructure spending with the move of facilities to within U.S. borders.

One company set to benefit from these trends is engineering and construction firm EMCOR (EME). It helps build manufacturing facilities through the design, installation, and operation of a variety of different aspects of the building process.

As demand for manufacturing facilities increases, EMCOR could benefit as well.

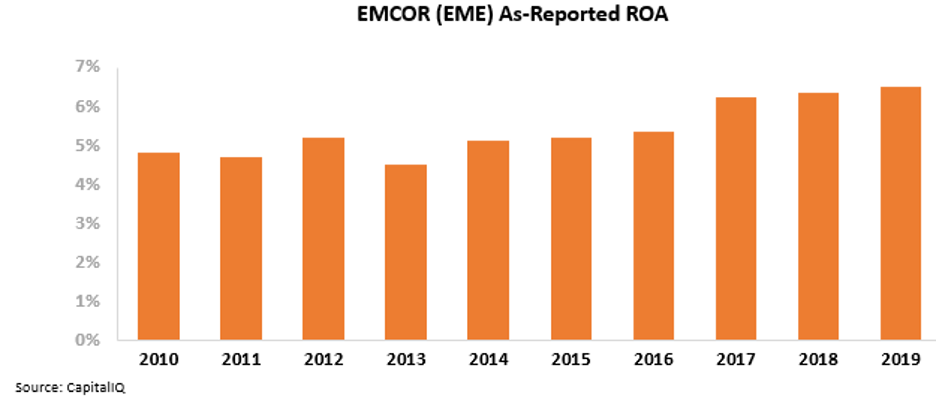

However, the company appears to be a low-return business that's struggling to break past cost-of-capital returns. EMCOR's as-reported return on assets ("ROA") has steadily held between 5% and 8% over the past decade. Investors seeing this would reasonably assume that the company has maxed out its profitability and will remain at cost-of-capital levels.

This would make an increase in demand less compelling, as growing a cost-of-capital business doesn't actually create value for shareholders. EMCOR doesn't earn any outsized returns, but is merely meeting opportunity costs.

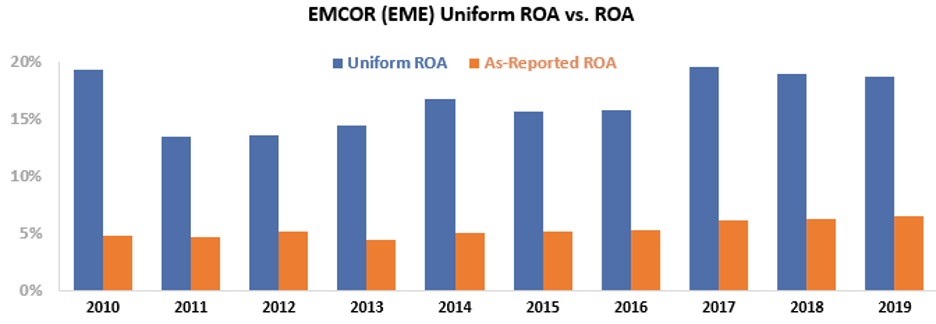

However, this picture of EMCOR's performance is distorted by as-reported accounting, including the misleading GAAP treatment of goodwill. The market has missed the mark on how successful EMCOR has been.

EMCOR's returns are actually well above cost-of-capital levels. This means the company will benefit from growth in demand, as each additional dollar is creating value for shareholders. EMCOR's Uniform ROA has been consistently between 14% and 20% over the past decade – more than double the as-reported figures seen over the same time frame.

However, to understand if the company can continue to create value for shareholders, we need to use the Embedded Expectations Framework to see EMCOR's market valuations.

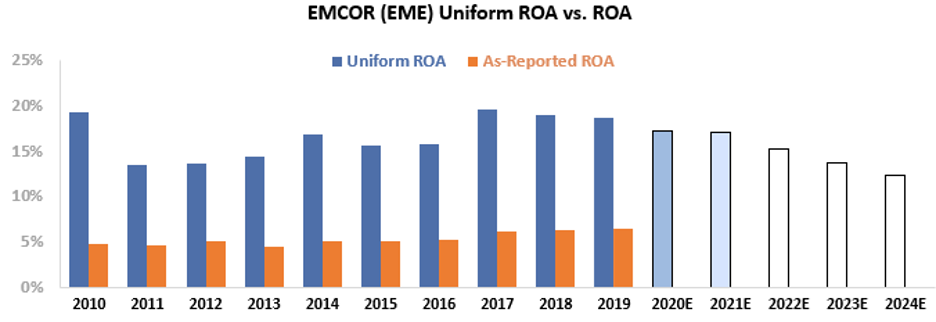

The chart below explains the company's historical corporate performance levels, in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

Both analysts and the market expect EMCOR's returns to shrink well below current levels. Market expectations are for returns to drop to 12% in 2024.

Considering the recent tailwinds behind manufacturing shifts to the U.S., this may be overly bearish. If EMCOR can successfully grow its business through building new facilities, these expectations would be much too low.

Without Uniform Accounting, investors might think the additional growth isn't creating value for EMCOR shareholders due to the company's low as-reported returns.

In reality, EMCOR has consistently produced returns greater than corporate averages... yet its market expectations remain low. If we do see a wave of investments into facility construction, EMCOR looks set to benefit... and so do its shareholders.

Regards,

Joel Litman

September 17, 2020

The coronavirus pandemic is starting to reverse a longtime trend...

The coronavirus pandemic is starting to reverse a longtime trend...