A 17th century scheme is making a comeback in Japan...

A 17th century scheme is making a comeback in Japan...

In the time of King Louis XIV, French subjects who wished to save money were unable to simply invest in an index fund. Instead, many put their money in a "tontine" – where a group of people pooled their assets, and as members passed away, the survivors got a larger and larger share of the dividends.

This scheme faded in the 18th and 19th centuries, as investors became savvier at gaming the system and wanted less of their investments left to chance. Despite declining in popularity, it hasn't stopped murder mystery authors from using the investment vehicle as a plot device in their novels.

And as Japan's population ages and becomes disenchanted with the stock market, many are turning back to tontines to secure their retirement. With ultra-low interest rates and market uncertainty, seniors in Japan are resorting to unconventional methods to live in retirement. In the modern Japanese tontine, members begin paying into the system in their 50s and can receive payouts starting in their 60s.

It's a classic example of misaligned incentives potentially creating issues... The contributors are basically pit against each other in a zero-sum game of who lasts the longest. Despite this strange resurgence in Japan, let's hope that we can figure out better solutions to guarantee a healthy retirement...

Institutional expertise matters in stock picking...

Institutional expertise matters in stock picking...

Take a look at the unassuming picture below... do you recognize anyone?

First meeting of the "Graham Group" at the Hotel del Coronado in San Diego, 1968.

Source: The Snowball: Warren Buffett and the Business of Life by Alice Schroeder.

Left to right: Warren Buffett, N/A, Prof. Benjamin Graham, David Sanford "Sandy" Gottesman (First Manhattan Co.), Tom Knapp (Tweedy Browne), Charlie Munger, N/A, N/A, Walter Schloss (WJS Partners), N/A, Ed Anderson (Tweedy Browne), N/A, William Ruane (Ruane Cuniff and Sequoia Fund).

It's a Columbia class reunion in 1968 with students of value investing legend Benjamin Graham. Our eagle-eyed readers may be able to spot Berkshire Hathaway's Warren Buffett and Charlie Munger in the crowd next to Graham. Also pictured are Tom Knapp and Ed Anderson of fund-management firm Tweedy Browne... as well as investing giants Walter Schloss, William Ruane, and David Sanford "Sandy" Gottesman.

Each of these students of Graham generated massive returns over decades of investing...

For example, Buffett delivered annual returns of more than 20% from 1965 to 2017. Tweedy Browne produced 20% annual returns over a 15-year run. Munger quadrupled the market's return over a 13-year period. Schloss' WJS Partners outperformed the market by 15% per year over a 45-year period.

What a potent class reunion... It's rare for a group of individuals this successful to have such an obvious connection they can trace back to.

In December 1998, a similar gathering occurred. Six friends got together with an idea: Create a secure payment company to serve the needs of booming e-commerce sites. They eventually built PayPal (PYPL), and sold it to eBay (EBAY) for $1.5 billion. Afterwards, the six headed their separate ways, much like Graham's students...

- Max Levchin went on to create the first commercial CAPTCHA challenge-response test and co-found Slide.com.

- Peter Thiel went on to create a hedge fund that was Facebook's (FB) first outside investor.

- Luke Nosek pursued angel investing and was the first institutional investor in SpaceX.

- Ken Howery is the U.S. ambassador to Sweden.

- Yu Pan was the first employee at YouTube.

- And Russel Simmons co-founded Yelp after leaving PayPal.

This prestigious group partnered with X.com in 2000, which was led by Elon Musk. Yes, the Elon Musk who founded Tesla (TSLA), SpaceX, and other projects.

This group became known as the "PayPal Mafia."

Over the past 20 years, PayPal has gone from a small tool made by these men to a massive company with a $143 billion market cap.

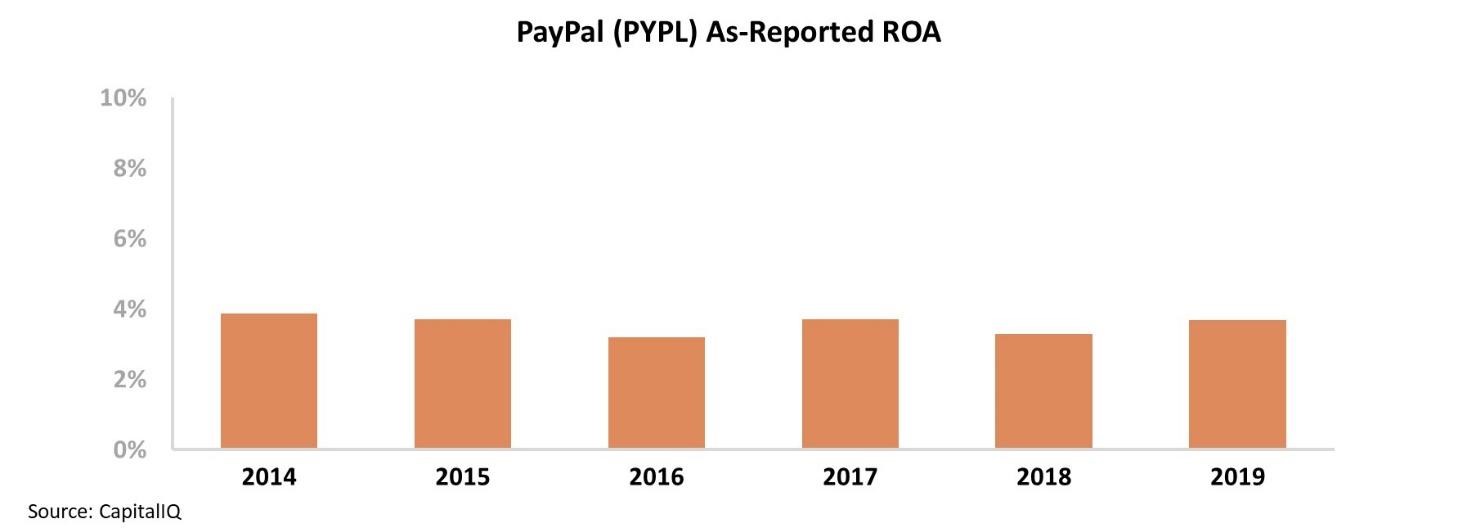

However, since it split off from eBay in 2015, PayPal has seen pitiful as-reported returns. With news such as its former parent dropping it as a primary payment platform, many investors are scratching their heads at the higher moves in the stock price – even as PayPal's return on assets ("ROA") has stagnated between 3% and 4%...

But these investors are left in the dark because they lack the insight provided by Uniform Accounting...

Over the past five years, PayPal has been pursuing a strategy similar to Facebook – aggressively acquiring any potential competitors to incorporate them into the PayPal ecosystem. For example, it recently acquired popular platform Honey for $4 billion in 2019.

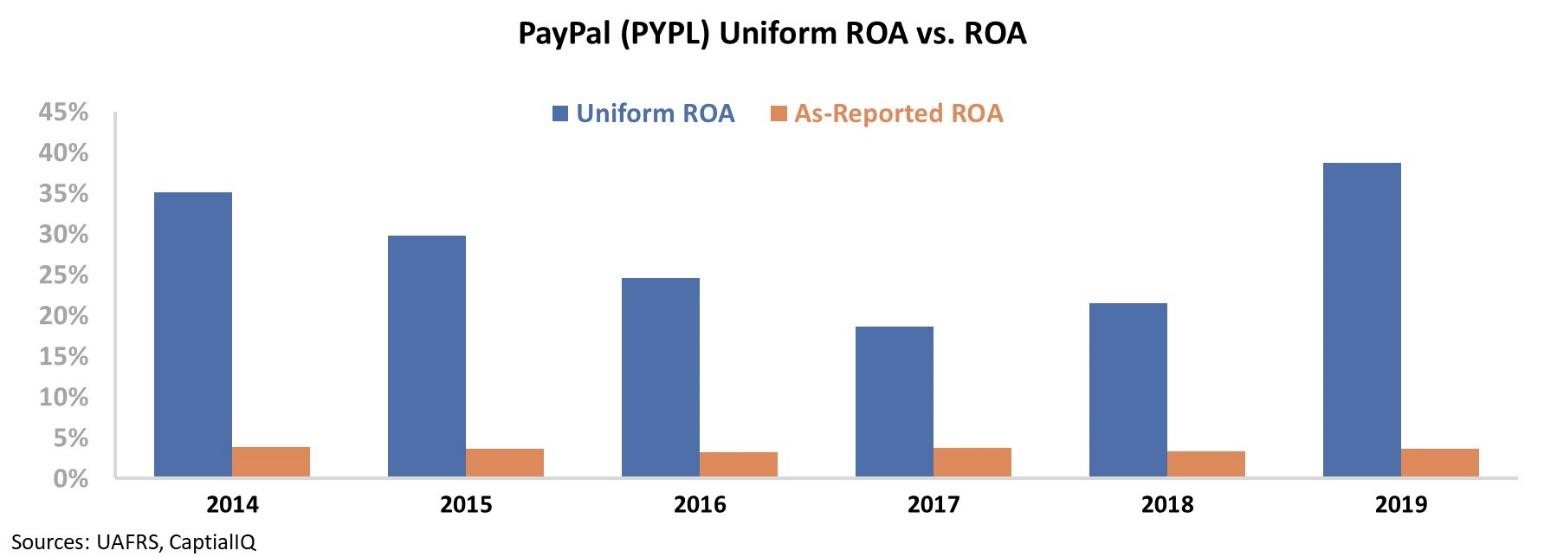

After we account for line items such as non-operating intangibles, stock option expense, and research and development (R&D), PayPal's true operating performance is revealed...

Rather than see returns stagnating over the past six years, the company's Uniform ROA has been consistently greater than 18%. Furthermore, due to the success of PayPal's acquisitions, returns have improved significantly from 19% in 2017 to 39% last year. Take a look...

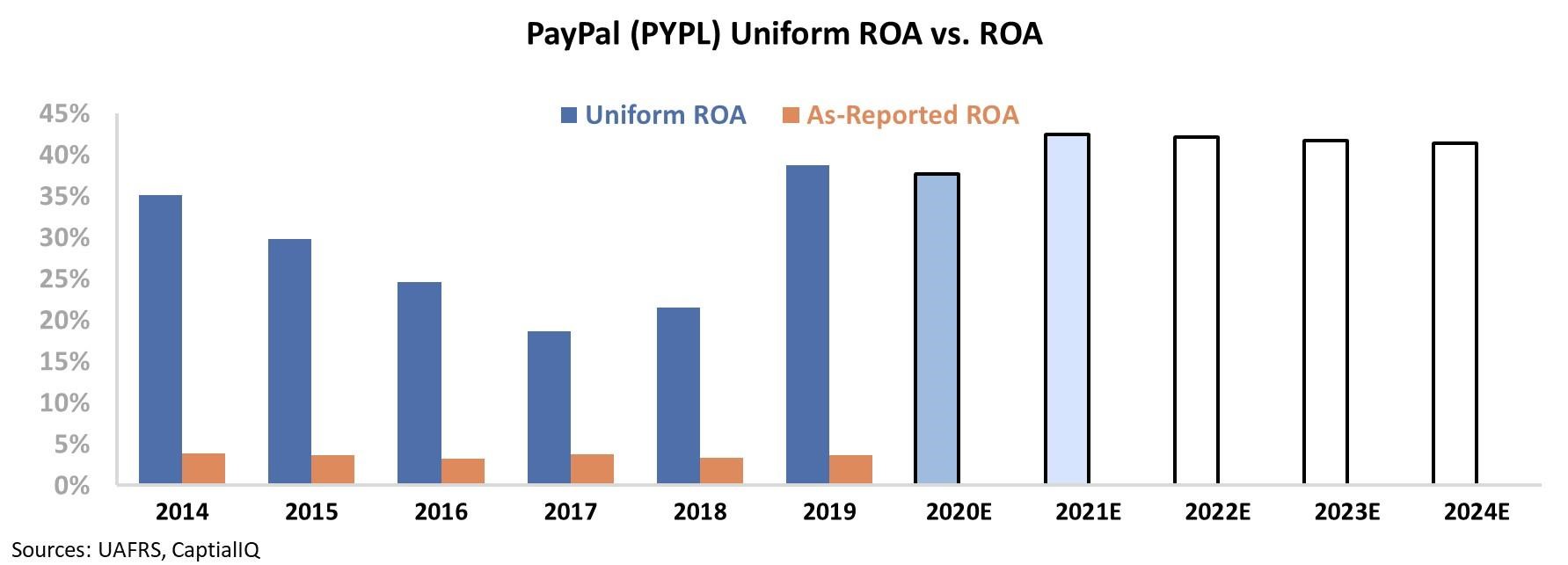

The chart below shows PayPal's historical corporate performance levels in terms of Uniform ROA (dark blue bars) versus what sell-side analysts think the company is going to do for this full year and next year (light blue bars) and what the market is pricing in at current valuations (white bars).

As you can see, market expectations are for the company to see returns hold steady near 41% – rather than continue to improve from 2017 lows.

As PayPal leverages its internal talent and executes on its acquisitive strategy, there may be room for the business to buck market expectations and see continued success.

The company that those six PayPal Mafia members started still looks like it has room to run higher from here... but you likely wouldn't know it without looking through the lens of Uniform Accounting.

Regards,

Joel Litman

March 3, 2020

A 17th century scheme is making a comeback in Japan...

A 17th century scheme is making a comeback in Japan...