Dear reader,

Few can argue that World War II was the pivotal event of the 20th century. The deadly conflict thrust the U.S. into superpower status and has shaped foreign policy to this day. However, it's also worth understanding the impact of World War II on the American workforce.

After December 7, 1941, the course of history was altered as the Japanese military attacked Pearl Harbor and the U.S. entered the war. To fight in Europe and the Pacific, President Franklin Roosevelt spoke to the need for an "Arsenal of Democracy"... the U.S. would need to produce planes, tanks, and ships to fight the Third Reich and the Empire of Japan.

This need to rapidly industrialize while troops were sent to the front changed the face of labor in the United States forever. As men were drafted into the expanding armed forces, women were recruited to take on the manufacturing jobs that had traditionally belonged to men.

Five million women entered the workforce between 1941 and 1945 to meet the need of Roosevelt's Arsenal of Democracy. By 1943, the aircraft industry was populated by a majority of women, compared with only 1% in the prewar years. At America's industrial peak during the war, 18 shipyards built three Liberty cargo ships every two days, thanks to the largely female workforce.

Popular illustrator Norman Rockwell's famous 1943 image of a woman in blue overalls taking a lunch break with a rivet gun on her lap helped make "Rosie the Riveter" a cultural icon – representing female wartime workers across the country.

Despite the men returning home in 1945, the war normalized the image of women in the workforce. By the 1950s, more than 32% of women were working outside of the home. That number increased to 57% by 2016.

As more and more women entered the workforce over the past 70 years, companies have stepped in to help handle the housework that was once relegated to the stay-at-home housewife. Daycares have sprung up across the U.S., a culture around eating at restaurants has flourished, and maid services have become commonplace.

ServiceMaster (SERV) is one company that has stepped in to fill the needs of dual-working households.

In 1988, ServiceMaster acquired Merry Maids, a franchisor that sells cleaning services across North America and the U.K. Merry Maids is a favorite of both consumers and franchisers alike. A 2018 ConsumerAffairs report rated the business as its top cleaning service. Franchise Chatter also voted Merry Maids as the most profitable cleaning franchise last year.

This is just one brand in ServiceMaster's portfolio... Over the past 30 years, the company has pursued an aggressive strategy of acquiring and developing businesses in the residential services space – including popular pest-control service Terminix and property inspector AmeriSpec, to name a couple other brands. However, rather than reward ServiceMaster for this strategy, under GAAP accounting the company's returns have been punished.

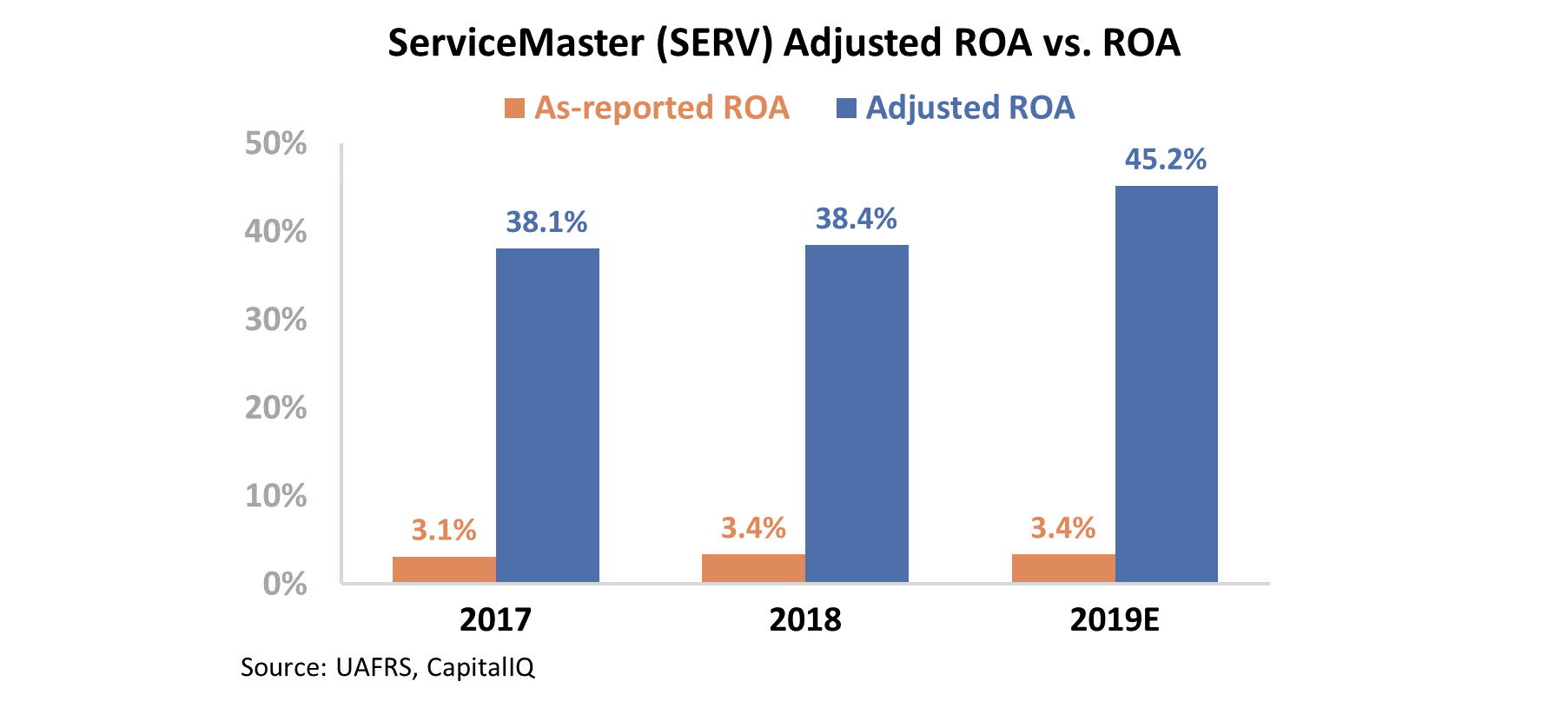

Due to ServiceMaster's acquisitions and development of its portfolio, the company's asset base is being overstated by the goodwill it is carrying on its balance sheet. A return that appears to most investors as a paltry 3% was actually 38% with Uniform Accounting metrics in 2018. Take a look...

As you can see, ServiceMaster has used its acquisitions to build a leadership position in its markets, rather than erode capital on fruitless purchases. Analyst expectations are for SERV shares to continue expanding their healthy returns into the rest of 2019.

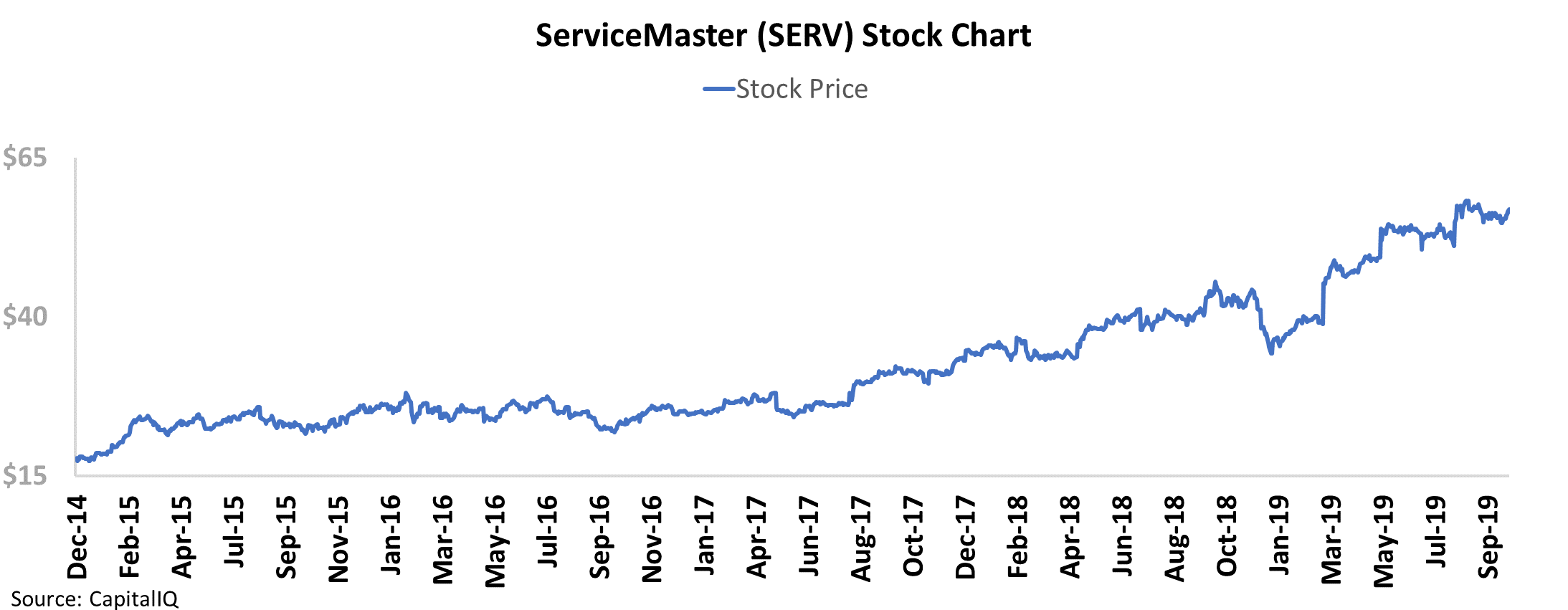

Even if investors understood that as-reported metrics were massively understating the company's profitability, they might shy away from the stock considering ServiceMaster's premium valuations. Since the company's initial public offering ("IPO") in June 2014, the stock has run from $17 to around $45.

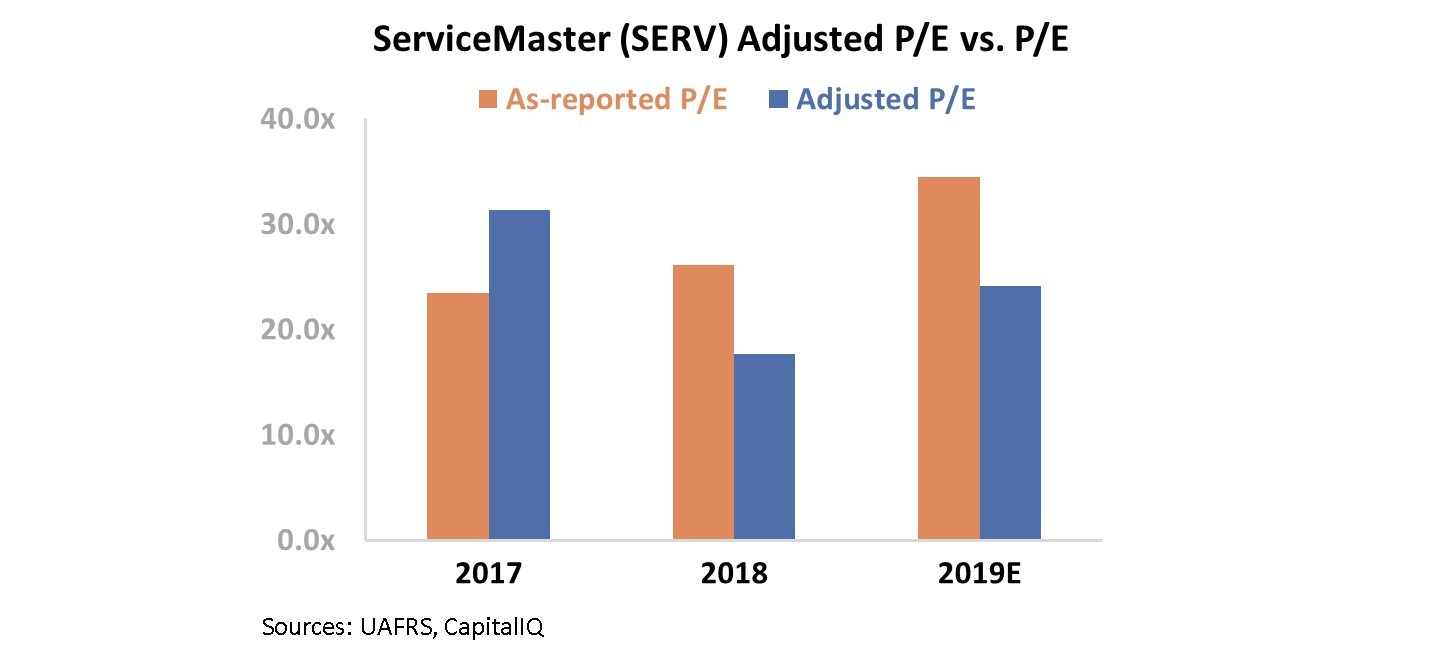

Today, ServiceMaster's as-reported price-to-earnings ("P/E") ratio is 34.5. The market already looks like it's paying up for the company's strong franchises.

In reality though, the market isn't paying a massive premium for ServiceMaster. Rather than sporting an as-reported valuation with a P/E ratio of 34.5 – almost 150% above the market average – ServiceMaster is currently trading for a Uniform P/E ratio of 24.1.

ServiceMaster is not a low-return, overvalued business. Once as-reported GAAP accounting is corrected, we can see that ServiceMaster is a high-quality business trading at reasonable valuations.

When presented with faulty data, it's easy for investors to overlook a company's competitive advantage in its space. Thanks to Uniform Accounting, we can see a business such as ServiceMaster in its true colors rather than write the company off.

Regards,

Joel Litman

October 24, 2019