The massive infrastructure deal has the potential to revitalize the economy...

The massive infrastructure deal has the potential to revitalize the economy...

The Biden administration has been putting together a comprehensive infrastructure plan for accelerating the recovery from the coronavirus pandemic and stimulating greater economic growth.

Now that the significant stimulus package has been passed, the administration is looking for other ways to put the U.S. on a stronger footing.

For the past month, the news has been having a field day discussing the president's second planned legislative effort.

The new proposal consists of a $2 trillion plan, which would invest significant amounts of capital into everything from roads and railroads to bridges and fifth-generation (5G) broadband initiatives.

Part of the plan's capital allocation would also go toward clean energy solutions and other targeted industries within the economy.

If this infrastructure plan plays out the way the Biden administration hopes, it would have a "butterfly effect" to create new jobs in additional fields and help reposition the U.S. economy for new advancements in technologies over the next few decades.

And yet, one caveat we rarely hear mentioned when discussing this colossal infrastructure plan is that these spending strategies will require a large number of raw commodities – like iron ore, copper, and other metals and minerals.

The U.S. will be competing for access to these raw commodities with other major buyers such as China, which will then drive up prices.

And China has already been aggressively investing in infrastructure and has much stronger relationships with material suppliers. It has established contracts in place with large miners around the world in places like Brazil, Indonesia, Australia, and South Africa.

This might mean the U.S. could struggle to source enough raw materials for the ambitious infrastructure plan. More important, more players chasing the same raw materials set the stage for another commodity "supercycle," just like in the mid-2000s, if the Biden administration's proposal goes as planned.

If a supercycle does play out, one of the big winners would likely be Australia-based BHP (BHP)...

If a supercycle does play out, one of the big winners would likely be Australia-based BHP (BHP)...

It's one of the largest miners in the world – extracting everything from coal to iron ore, copper, zinc, and other metals.

If the U.S. becomes a big consumer of raw materials and builds relationships and contracts to drive greater demand in metals, BHP will benefit.

As we saw a decade ago during China's strongest increase in spending for infrastructure, BHP's biggest demand drivers tend to be things like large government spending projects.

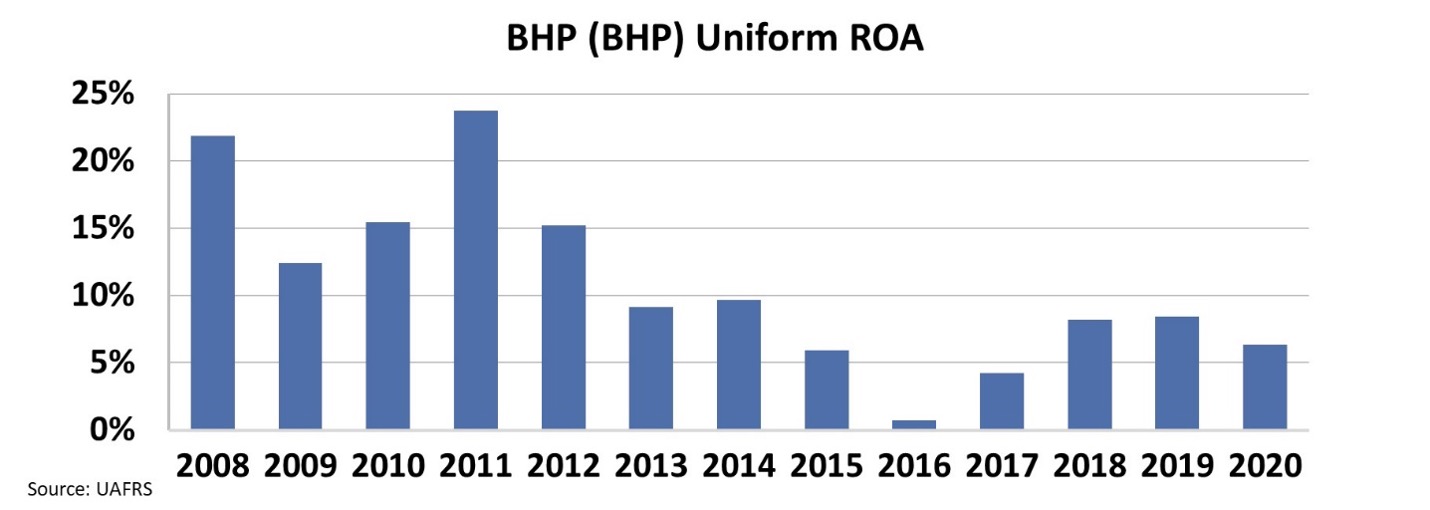

Looking at the Uniform Accounting metrics, we can see that BHP's Uniform return on assets ("ROA") peaked back then at more than 20%.

Since then, returns have faded as the commodity supercycle petered out. As a result, BHP's Uniform returns have hovered between 0% and 9%.

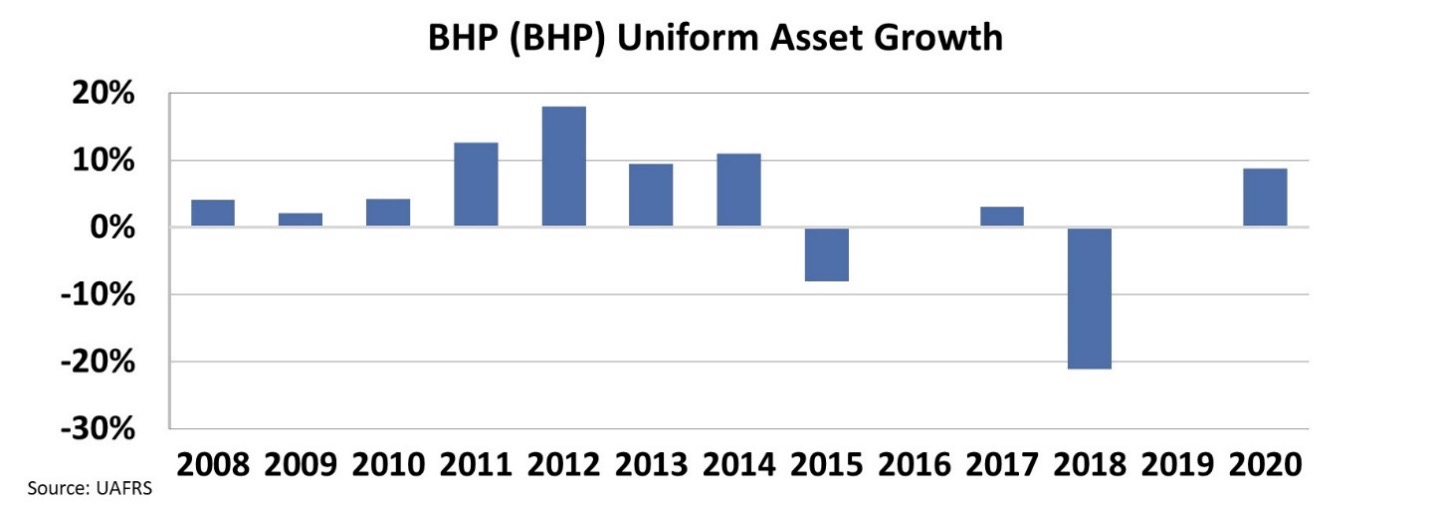

During the last supercycle, the company also rushed to expand its capacity in order to ensure it had as much capacity as possible to meet demand. As you can see in the chart below, BHP's asset growth peaked at 18% in 2012 but has since shifted lower...

That investment also contributed to the end of the supercycle. That phase ended not just because China stopped buying as much as it had before... but also because BHP and competitors brought a significant amount of new capacity into the market across various commodities.

But the real question for investors is if the market expects BHP to see another supercycle...

But the real question for investors is if the market expects BHP to see another supercycle...

Determining if the market has already priced in a return to these levels requires a different model than just looking at history.

Most investors determine stock valuations using a discounted cash flow ("DCF") model, which takes assumptions about the future and produces the "intrinsic value" of the stock.

However, here at Altimetry, we know models with garbage-in assumptions only come out as garbage. Therefore, we've turned the DCF model on its head with our Embedded Expectations Framework. We use the current stock price to determine what returns the market expects.

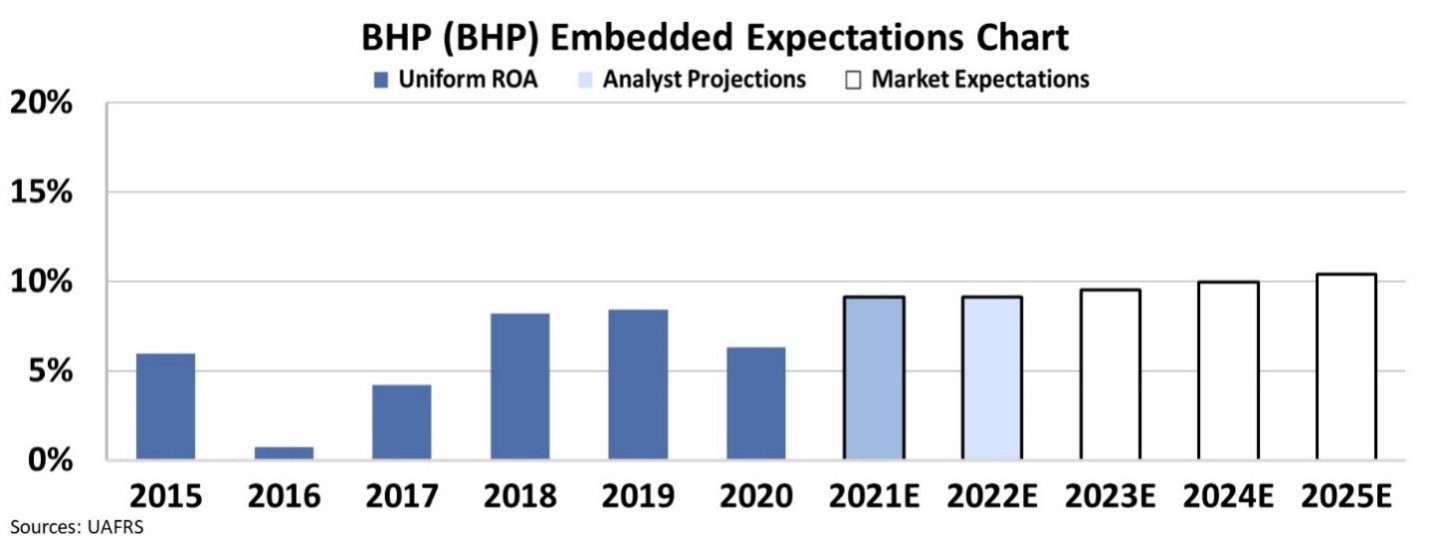

In the chart below, the dark blue bars represent BHP's historical performance levels in terms of ROA. The light blue bars are Wall Street analysts' expectations for the next two years. Finally, the white bars are the market's expectations for how the company's ROA will shift in the next five years.

Right now, Wall Street forecasts BHP's Uniform ROA to improve to 9% by 2022... which could mark the beginning of the supercycle.

With this expected growth, the market is pricing in Uniform ROA to improve to 10% by 2025. The market thinks BHP's profitability will stay well above recent mid-cycle levels of around 5% to 6%.

It looks like the market is already pricing in a surge in demand for commodities for the next few years... So it might be starting to pay attention to this trend.

However, Uniform Accounting shows how successful BHP could be if infrastructure spending really plays out the way the Biden administration suggests. BHP could see profitability as strong as it was back in the mid-to-late 2000s – well above 10%.

If a supercycle occurs and BHP's Uniform ROA levels rise to double digits, the market may be leaving money on the table. If you believe Biden's infrastructure plan will see the light of day, BHP could be a name to consider for riding this trend.

Regards,

Joel Litman

April 20, 2021

The massive infrastructure deal has the potential to revitalize the economy...

The massive infrastructure deal has the potential to revitalize the economy...