The press loves to report on fortunes won and lost by entrepreneurs...

The press loves to report on fortunes won and lost by entrepreneurs...

This is why the story of Lex Greensill's meteoric rise and fall has been making the rounds over the past few weeks. Despite the mind-boggling amount of money made and lost, this swift change in fortune comes in a sleepier industry than most.

Lex Greensill isn't a mining tycoon, hedge fund director, or real estate empire builder. Rather, he built his Greensill Capital finance company in the often-overlooked world of working-capital financing – arguably one of the most staid and boring parts of the finance world.

Suppliers will always try to secure their payment as soon as possible. Meanwhile, customers want to delay paying as long as they can. Greensill provided a high-demand service by providing credit to suppliers, so they could get cash quicker than customers would pay.

Greensill lends money and then waits until the borrower's customers pay the bills (called "receivables") – which cover the loan.

Next, Greensill packaged up this short-term debt and sold tranches of it to investors across the globe looking for yield.

If the process sounds vaguely familiar, it's because this financial product is a collateralized debt obligation ("CDO") – the same asset class that fueled the 2008 crash in real estate. This time around, it was corporate receivables being chopped up, not mortgages.

As concerns over Greensill's credit worthiness came to light and Credit Suisse and others pulled funding, the financing firm experienced a downward spiral. Unable to back up its loans, Greensill was forced to declare bankruptcy.

Greensill's story goes to highlight the danger of trusting "sleepy" industries. While CDOs themselves aren't dangerous, a lack of proper risk controls can topple any finance company... no matter how "boring" a market segment it invests in.

Many of Greensill's customers could have been waiting for payments from a company we'll take a closer look at today...

Many of Greensill's customers could have been waiting for payments from a company we'll take a closer look at today...

This business highlights the power of working capital management to create value for shareholders.

It has done a great job of managing its working capital over the years. We can see how by looking at one of the key metrics investors and analysts use to measure working capital utilization: the "cash conversion cycle."

This metric measures in days the time it takes from when a company buys its inventory to when it collects the cash from selling its finished product. It considers when the firm pays suppliers, how long it takes to convert that raw inventory into a finished good, and when it gets paid by customers.

The lower the cash conversion cycle is, the happier management and investors become. At a higher number, the company is waiting on payment or is taking a long time to produce. A company that has a cash conversion cycle of 360 days has to wait a year from when it pays for its inventory until it actually gets paid by its customers. This ties up cash and lowers a company's asset turns, which are a key part of profitability.

On the other hand, a company that can make its suppliers wait to get paid, while also getting paid quickly by customers can create something special – a negative cash conversion cycle. That means the company gets paid by customers before it even has to pay its suppliers!

When customers are trying to stretch bills this long, companies turn to a company like Greensill to get cash from sales sooner... and one master of the cash conversion cycle is beverage giant Keurig Dr Pepper (KDP).

Keurig Dr Pepper has seen its cash conversion cycle drop from an already absurdly low negative 95 days in 2018 to an impressive negative 155 days as of 2020. This means the company collects cash for the products it sells almost half a year before it finally gets around to paying suppliers.

That is a license to print money, as it means Keurig Dr Pepper is in essence getting a loan from its suppliers for that 155 days.

To see how valuable this is for the company's profitability, we can turn to our Altimeter tool...

To see how valuable this is for the company's profitability, we can turn to our Altimeter tool...

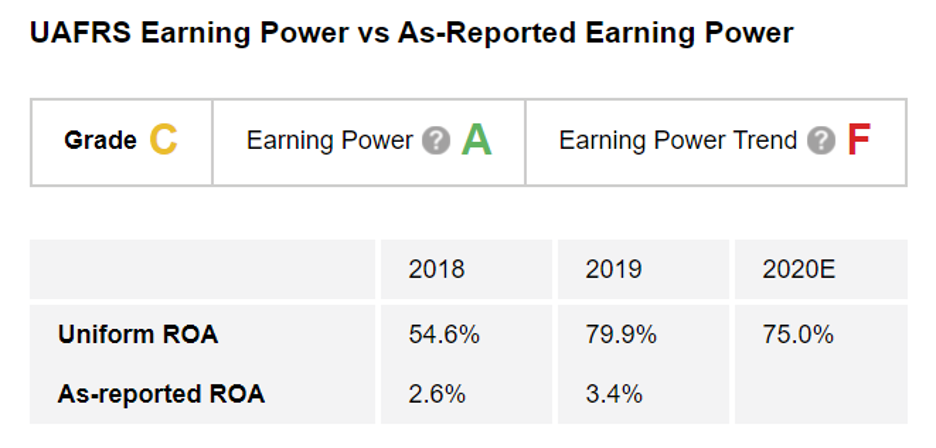

Using the power of Uniform Accounting – which removes the distortions in GAAP financial metrics – The Altimeter generates easily digestible grades to rank stocks based on their real financials.

After making adjustments though Uniform Accounting – including properly showing how well Keurig Dr Pepper does managing its net working capital – we can see that the company's return on assets ("ROA") has been robust thanks to this strategy. This metric came in at 80% in 2019.

That's far higher than the as-reported ROA of 3%. Through stellar asset turns and unlocking supplier capital, Keurig Dr Pepper gets an "A" grade for Earnings Power in The Altimeter.

In the near term, the company's Uniform ROA is expected to drop to 75% in 2020 due to pandemic-related headwinds. This means Keurig Dr Pepper gets an Earning Power Trend grade of "F"... but the pandemic's effect is likely to be transitory.

If Keurig Dr Pepper can continue leveraging business relationships in 2021 and beyond, profitability is likely to rebound... and that will warrant high Performance grades in The Altimeter.

While Keurig Dr Pepper has impressive working capital management and a Uniform return far greater than GAAP metrics indicate, that alone doesn't mean it's a good stock to buy...

While Keurig Dr Pepper has impressive working capital management and a Uniform return far greater than GAAP metrics indicate, that alone doesn't mean it's a good stock to buy...

If the market is already pricing in these returns and more, it may be a name to avoid.

That's where we can again turn to The Altimeter to understand Keurig Dr Pepper's real valuation and market expectations.

If you're already an Altimeter subscriber, you can click here to see the grades for the company's valuations.

If not, click here to find out how to gain instant access to the Uniform Accounting data you're missing out on... not just for Keurig Dr Pepper, but also for thousands of other publicly traded companies in The Altimeter database.

That way, you can make smart stock picks yourself using the right data.

Regards,

Rob Spivey

March 18, 2021

The press loves to report on fortunes won and lost by entrepreneurs...

The press loves to report on fortunes won and lost by entrepreneurs...