Dear reader,

Imagine an open-air space with modern lighting, trendy furniture, and free Wi-Fi. You can buy coffee and pastries from the barista at the counter... and sit at a table and use the device-charging stations for your laptop or iPad while you crank out that novel you've been working on for the past few years.

No, it's not the hip new coffee shop around the corner...

In 2017, banking giant Capital One Financial (COF) launched an initiative to turn select locations into chic cafés, replete with finance professionals side-by-side with baristas.

Looking at a bank's total number of branches used to be a great metric to determine how successful a bank's franchise was. Looking at branch density was an even better metric to gauge the strength of a bank and its market share. Now, banking institutions are trying desperately to profit off of their physical locations.

This attempt by Capital One is part of the recent pushback against digitalization of finances. Millennials largely reject traditional banking offerings. One study by Scratch reported nearly 75% of Millennials would be more excited by financial offerings from a technology firm such as Google or Apple rather than a national bank.

Clearly, younger generations are looking for different ways to store their money. The first company to tap into this trend would be able to leverage the significant deposits of Millennials. This is what Capital One is trying to get ahead of with its café offering.

But what if your favorite coffee brand was already doing this right now?

Through its card and mobile-payment app, Starbucks (SBUX) has been accepting a form of consumer deposits since 2011. The company's system is basically a bank, holding deposits.

However, this bank account pays no interest, and can only be used for coffee. I'm sorry to say it can't be used to buy Norah Jones albums anymore... Starbucks stopped selling CDs in 2015.

And yet, Starbucks currently has $1.6 billion on its balance sheet from its cards and app – stored value its customers have deposited. This staggering number would put Starbucks in the top 10% of financial institutions if it was a bank rather than a coffee company.

And this $1.6 billion is much more useful to Starbucks than any loan it could take from a traditional bank. While Starbucks customers get drink rewards by maintaining balances on their accounts, Starbucks pays no interest to these customers. And unlike digital-payment firms like Square or PayPal, Starbucks has no obligation to keep these funds in risk-free assets, as the funds cannot be withdrawn as cash – they can only be redeemed for the company's products.

Starbucks' interest rate on its loans vary from 0.5% to 5% depending on the maturity date. If it wants to borrow money to invest in the business, this is the rate Starbucks has to pay interest to grow. However, with customer-invested dollars, Starbucks doesn't have to borrow to invest in its business.

And if Starbucks chooses not to invest, it can earn what banks call a "carry" on that money. The company can invest that money and earn a modest return on it.

Most important, Starbucks is able to recognize a percentage of that $1.6 billion total as revenue, as consumers forget about their balances. In 2018 alone, the company recognized $155.9 million in "breakage" fees.

That's right... Starbucks earned $156 million on money that is effectively being lent to the company. With its payments system, Starbucks has flipped the traditional debt relationship on its head.

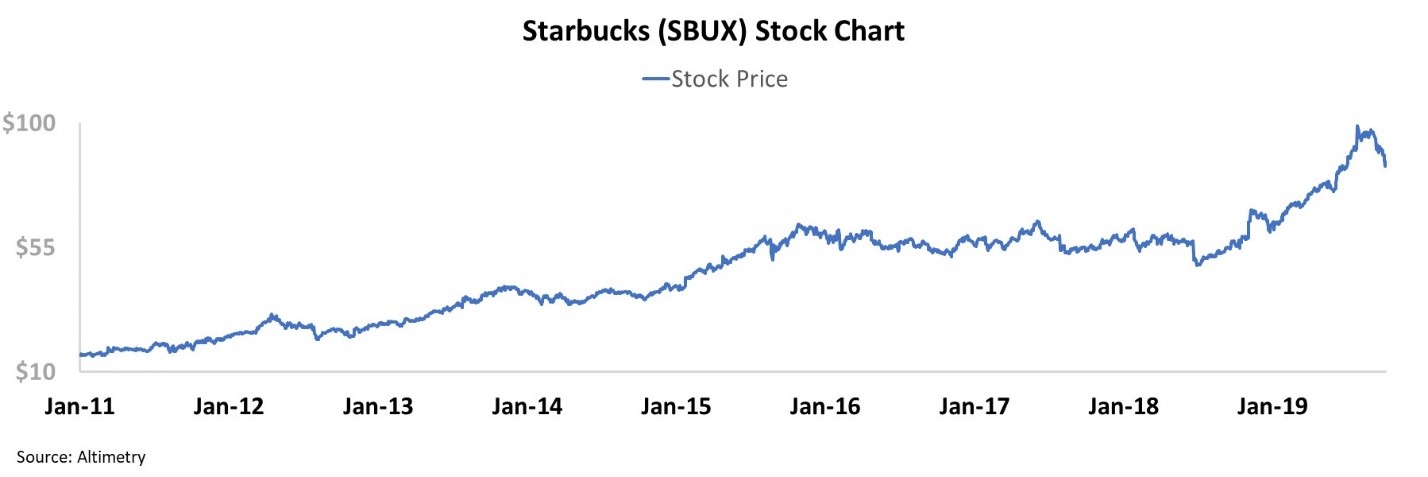

The market appears to realize this. SBUX shares have been soaring since 2010, and especially since 2018...

And yet, individual investors, and anyone else looking at the financials is likely scratching his head, because the numbers don't line up with the stock's moves.

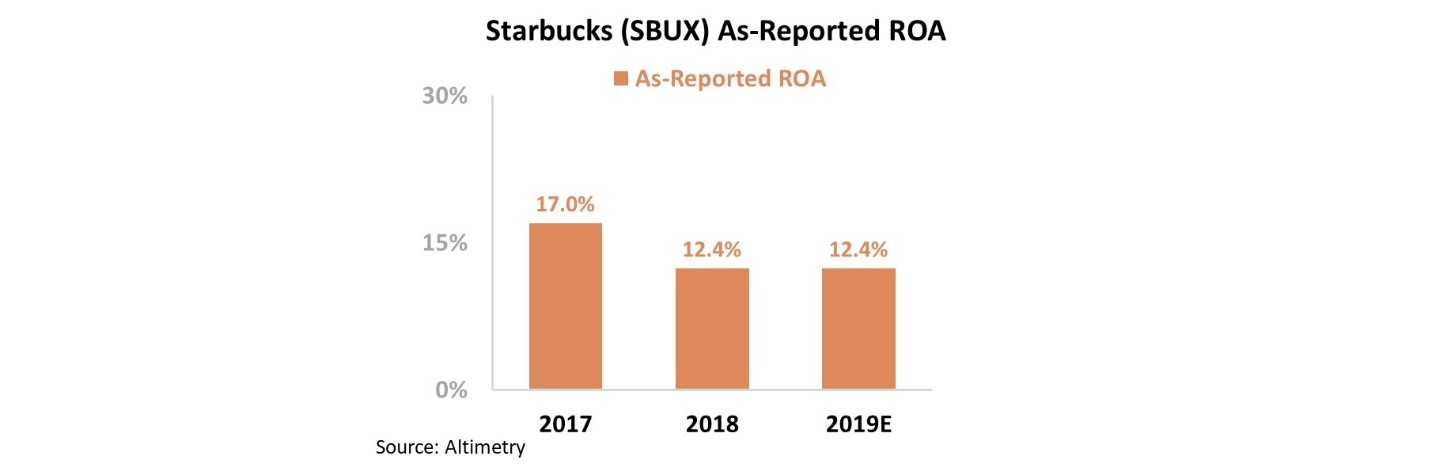

Currently, using as-reported metrics, Starbucks looks like a stock any rational investor would avoid. With a shrinking as-reported return on assets ("ROA"), the company appears to be losing its competitive moat. Furthermore, Starbucks is trading at a high price-to-earnings ("P/E") ratio of 29.2 – seemingly overpriced for a business in the consumer space.

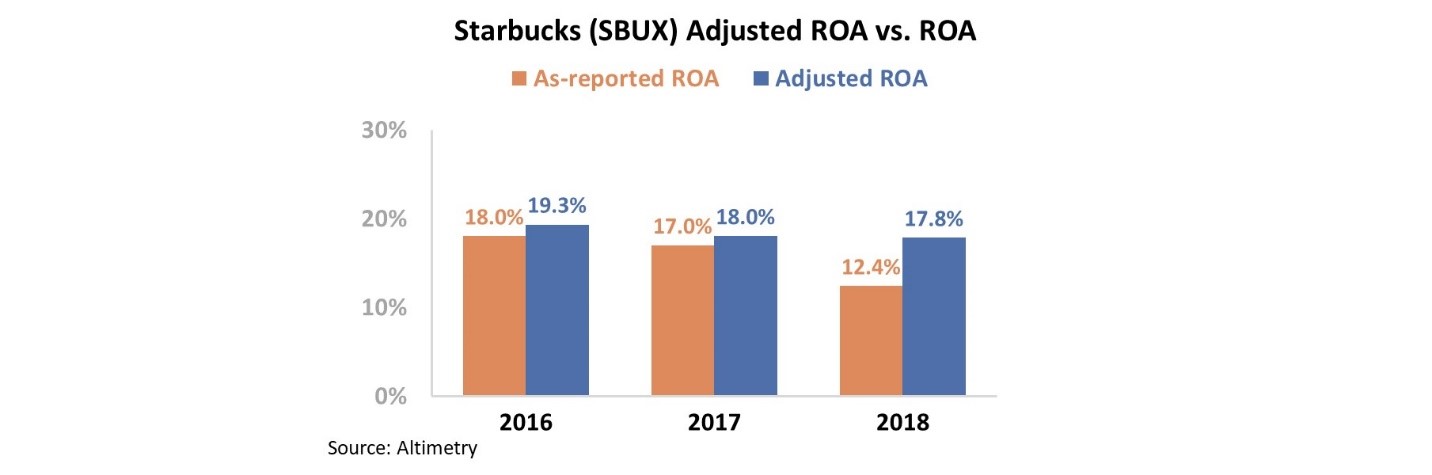

As you know, we specialize in Uniform Accounting – a more reliable way of looking at companies than the GAAP and IFRS accounting. By eliminating the distortions that are ever-present in traditional accounting metrics, we can dig into the true story for Starbucks.

While it appears that ROA has fallen significantly from 18% to 12% over the past three years, Uniform ROA has only eroded by 1%. Take a look...

This isn't a company with challenged, declining returns... This is a company that continues to throw off cash at a robust rate. And if its customers keep on letting Starbucks make money off them even when they're not buying coffee, this will continue for a long time after the last Starbucks Norah Jones album ends up in the trash heap.

This is just another example of how as-reported metrics have misled investors about the true underpinnings of a firm. Investors looking at GAAP numbers for Starbucks would have missed the last several years of gains... And they would still be on the sidelines now, when the company's strategies keep rewarding investors who see the real numbers.

While a traditional consumer business might not deserve such a highly traded multiple, as-reported metrics have distracted investors from the real story. Through its payment program, Starbucks has gained a significant advantage over its competitors in the space – deserving a pricing premium.

Regards,

Joel Litman

October 11, 2019