Dear reader,

George Soros is one of the great thematic and macro investors of the past century.

He started Soros Fund Management in 1969 with less than $12 million in assets under management and with early partners including Jim Rogers and Stanley Druckenmiller. Soros rebranded as the Quantum Fund in 1973, and he took that $12 million and turned it into $8.3 billion in personal wealth by 2018.

Soros and Quantum are famous for having "broken the Bank of England" in 1992 by shorting the British pound, forcing the U.K. to devalue its currency. Quantum netted $1 billion in that trade and Soros became a legend.

In 1997, Quantum short the currencies of many Southeast Asian countries, identifying capital flow and sentiment inconsistencies that were unsustainable before the Asian crisis occurred.

Those are only a few of Soros' successful trades, but they highlight a basis for his investment strategy. He believes in the idea of "reflexivity" – the concept that financial markets are driven not just by fundamentals, but also by investor sentiment.

Investor sentiment based on a story or market feeds on itself both positively and negatively, creating virtuous and vicious cycles in the markets. That can lead to overreactions in bear markets. It can also lead to bubbles in bull markets.

As Soros himself has said...

Stock market bubbles don't grow out of thin air. They have a solid basis in reality, but reality as distorted by a misconception.

Soros' most successful trades have been to identify those moments of market misconception, and then take sizable bets to benefit from the bubble popping.

Over the past 25 years, there have been plenty of examples of these types of bubbles...

The Internet bubble of the late 1990s at one point caused tech giant Cisco (CSCO) to be valued as though its revenue would grow larger than the entire U.S. GDP.

The housing bubble and crisis of the 2000s was built on the premise that home prices would never go down, and eventually led to people with zero income buying mansions without background checks.

The fracking boom in places like the Bakken Formation in North Dakota had created upwards of 2,000 millionaires a year at its peak in 2012... before oil prices crashed from the massive growth in production.

Of course, the Internet bubble ended with the Nasdaq Composite Index not making new highs for another 15 years.

The housing bubble ended with the collapse of the entire U.S. – and global – financial system.

And the fracking boom ended with more than 200 oil and gas companies going bankrupt by late 2016.

Today, there are several fundamental trends that are starting to gain the characteristics that Soros would likely say are ripe for a bubble. Electric cars, the 5G revolution, artificial intelligence ("AI"), and the Internet of Things ("IoT") all come to mind...

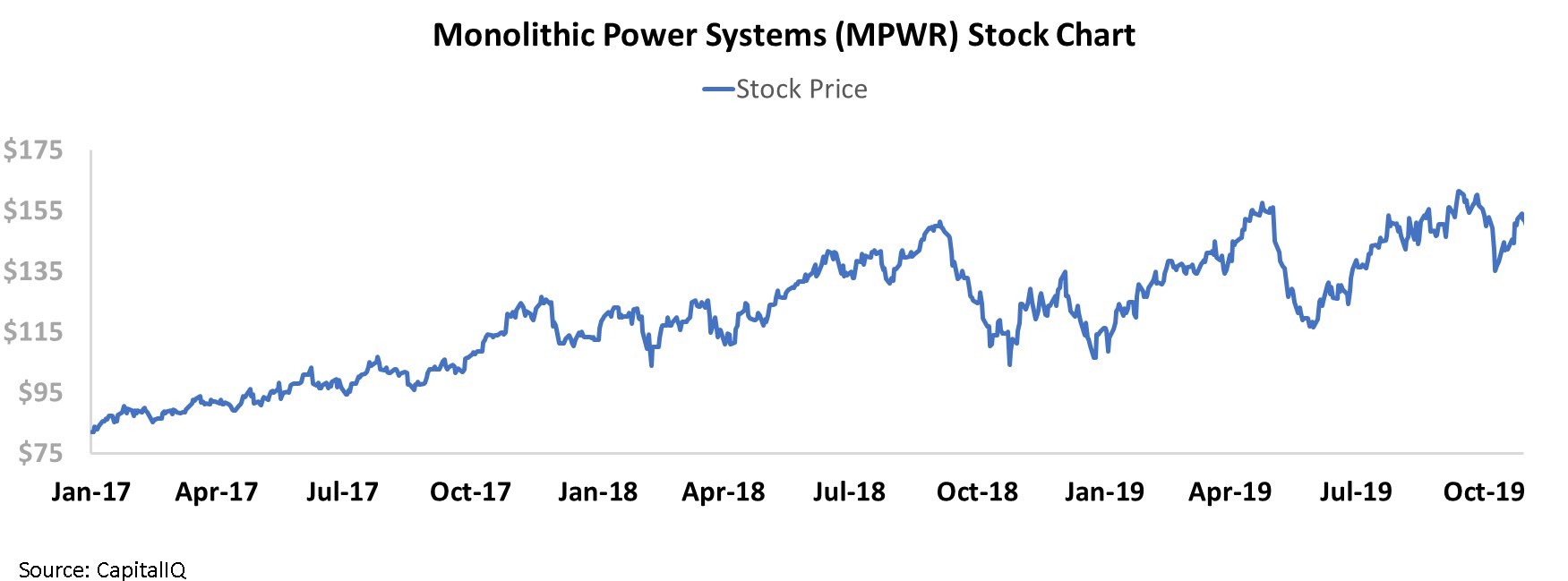

And Monolithic Power Systems (MPWR) is exposed to a few of these trends. The company creates the semiconductors that control electric cars, sound systems, and the telecom infrastructure essential to 5G. MPWR shares have risen rapidly in recent years, doubling from around $80 in 2017 to roughly $160 today as investors have grown excited about the company's opportunities.

Using as-reported metrics, Monolithic has seen steady increases in profitability over the past three years. And its exposure to the cutting-edge markets of electric cars and the upcoming 5G revolution is driving the company's fundamentals.

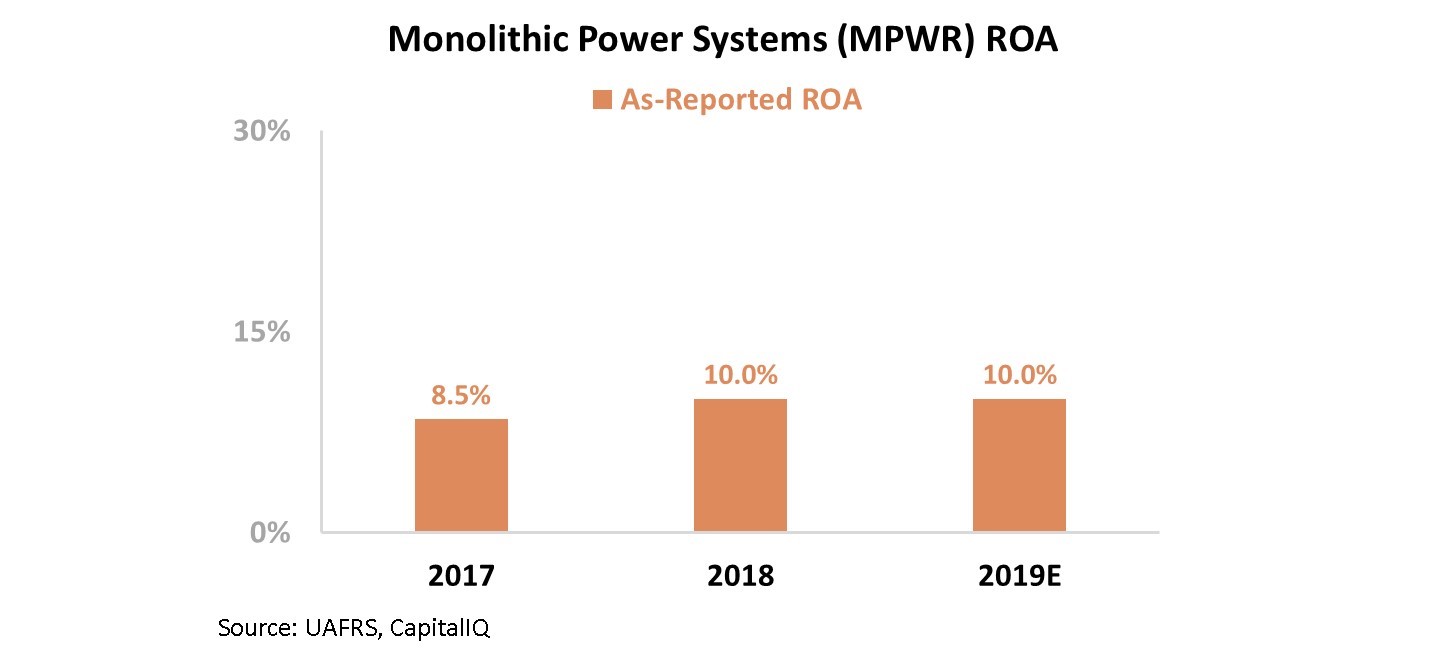

So it would make sense for Monolithic's return on assets ("ROA") to be improving over the past several years. As-reported accounting metrics paint a picture of improving returns since 2017, jumping from 8.5% to 10%.

However, the as-reported numbers aren't telling the complete story...

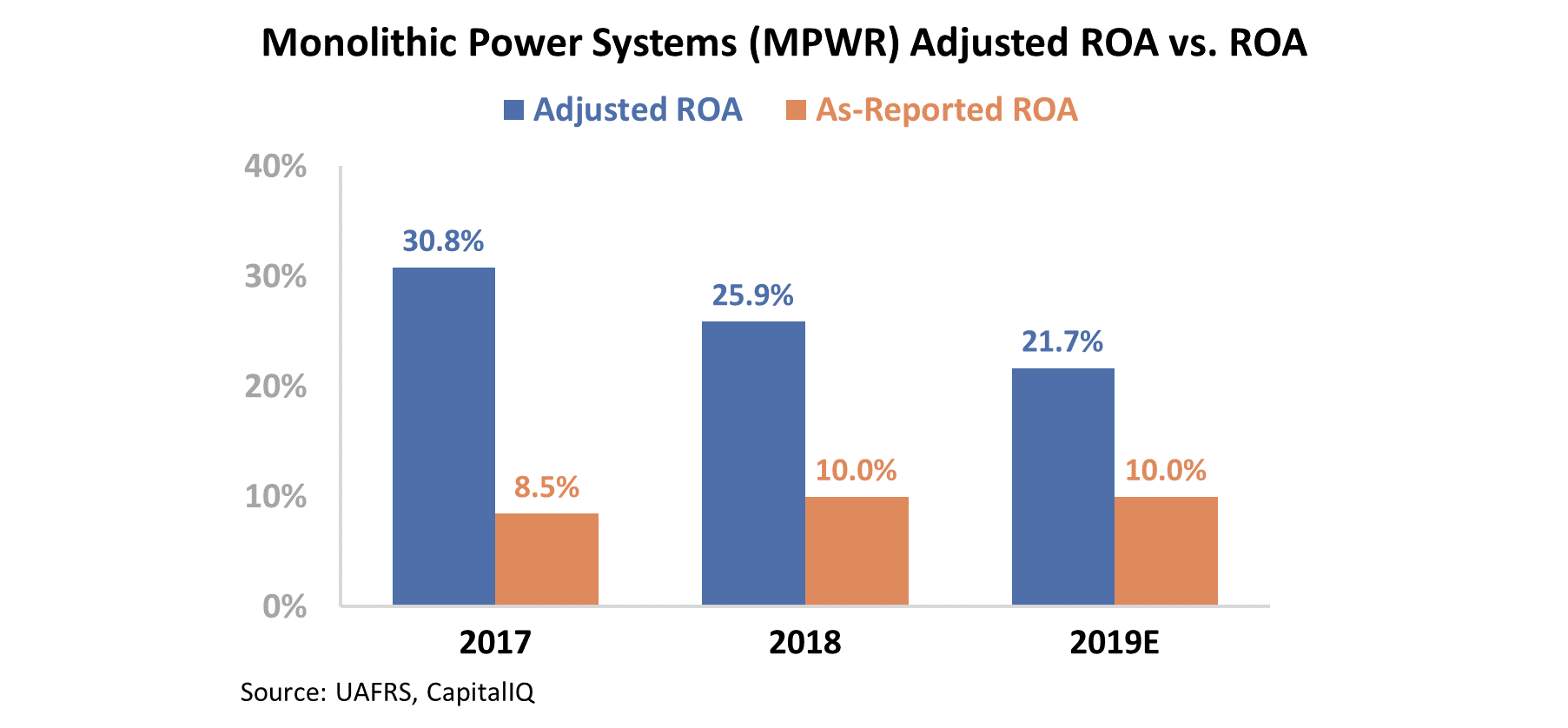

When we use our Uniform Accounting metrics to factor in stock options, excess cash, and other adjustments, we can see Monolithic's true ROA is much higher than the as-reported numbers reflect...

But more importantly, returns have declined by almost one third in three years, from 31% in 2017 to 22% today.

That decline is especially concerning since the company trades at premium valuations... The market thinks Monolithic is improving its business as these big thematic trends accelerate. Monolithic's Uniform price-to-earnings ("P/E") ratio is 32. That's a 50% premium over market-average valuations.

While as-reported metrics are showing a company benefiting from tailwinds that investors should be excited about, the real numbers show something very different... They're flashing warning signs about Monolithic's premium valuations.

Based on Uniform Accounting, we should be watching out for Soros' concept of reflexivity and what it could mean for Monolithic's stock price... sooner rather than later.

Regards,

Joel Litman

November 15, 2019

P.S. Our next issue of our new research service, Altimetry's High Alpha, is due out on Monday, November 18. In it, we've found a business with explosive growth ahead that the market is completely ignoring.

Our Uniform Accounting metrics show a company with strong returns and improving margins. In fact, we think this stock has 100%-plus upside once the market realizes its mistake. Don't miss out on this recommendation – you can learn more about High Alpha right here. (As a reminder, Altimetry Partnership members have access to this service already.)