This oil giant has seen a banner year, but it needs to watch out for competitors who have also thrived...

This oil giant has seen a banner year, but it needs to watch out for competitors who have also thrived...

Oil prices are still near eight-year highs after a multiyear slump. Among those celebrating is the giant oil producer Saudi Arabian Oil (2222.SR), often referred to as Saudi Aramco. It just posted blockbuster profits last week.

The company announced it generated $110 billion in net income in 2021, more than double what it saw in 2020. But this success should not be attributed solely to rising oil prices.

Saudi Aramco also saw refining and chemical margins strengthen and benefit from the consolidation of its chemical business, Saudi Basic Industries Corporation ("SABIC"), into its results.

And yet, many think the crown jewel of Al-Saud's kingdom, second only to Apple (AAPL) at a market cap of $2.2 trillion, might need to watch over its shoulder for competition.

While the Saudis have been comfortable using their oil power and Aramco to push their political agenda, their neighbor to the east, Qatar and QatarEnergy, have been much more thoughtful in playing a long geopolitical game.

Whenever there is a top dog, someone is looking to overthrow them...

Whenever there is a top dog, someone is looking to overthrow them...

Amid the conflict in Ukraine, the Nord Stream 2 gas pipeline agreement between Russia and Germany has been terminated. This has caused a large spike in natural gas prices, and many countries have set out to find new liquid natural gas ("LNG") sellers.

Qatar, home to the world's largest recoverable gas reservoir of 900 trillion cubic feet, has much more exposure to this part of the industry than Saudi Aramco. So as customers start to turn to LNG to reduce energy costs, QatarEnergy could soon be a rising star to pay more attention to, leaving Saudi Aramco out in the cold.

QatarEnergy isn't public yet, but looking at Saudi Aramco, you can see how staggeringly profitable it is to sit on low-cost hydrocarbons, even when the world is talking about phasing out fossil fuels.

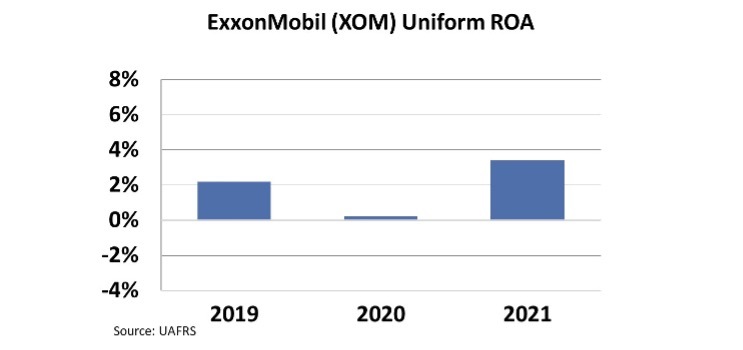

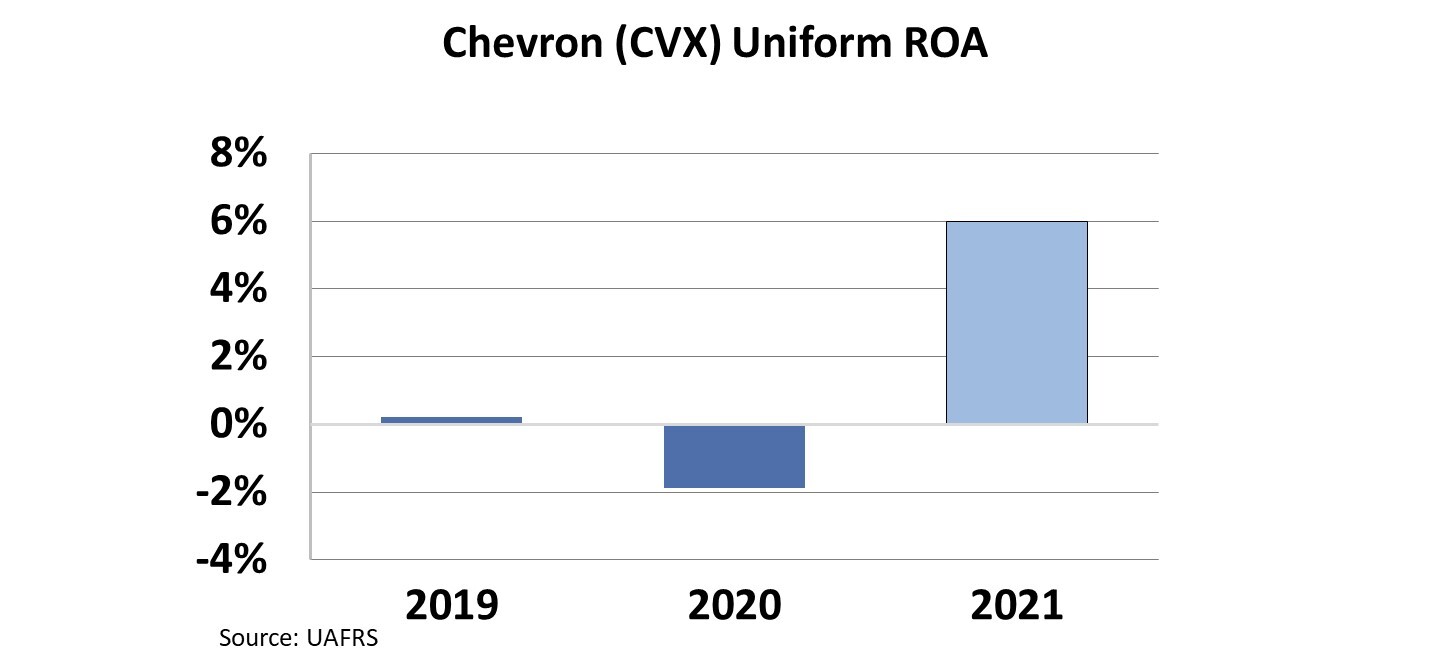

Many oil companies have faced terrible profitability pressure in the past half-decade. ExxonMobil (XOM) has seen Uniform returns well below the cost of capital at 3%, while Chevron (CVX) has fared better, expecting returns of 6% in 2021.

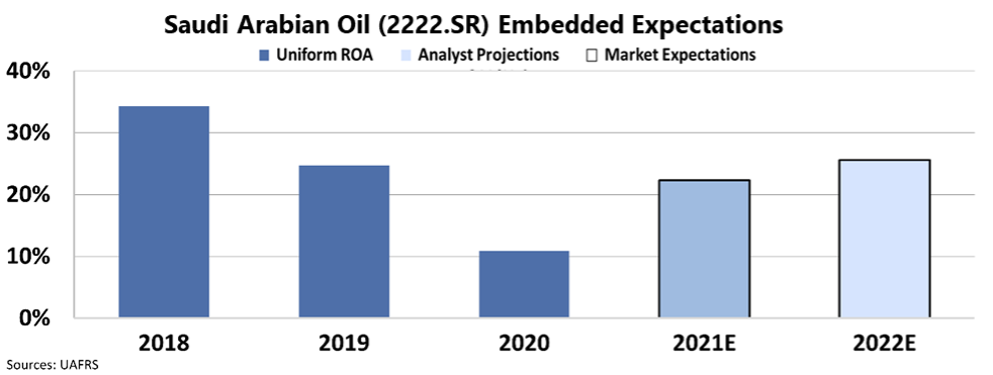

Uniform return on assets ("ROA") shows us that wasn't necessarily the case for Saudi Aramco. The company's ROA was as high as 34% in 2018.

Although it fell to 11% in 2020 during the pandemic, that's still well above its cost of capital.

Let's see how Saudi Aramco is expected to perform in the future...

Let's see how Saudi Aramco is expected to perform in the future...

By utilizing our Embedded Expectations Analysis ("EEA") framework, we can see historical returns and what a company is forecast to do in the future.

In the chart below, the dark blue bars represent Saudi Aramco's historical corporate performance levels in terms of ROA. Meanwhile, the light blue bars are Wall Street analysts' expectations for the next two years.

In 2021 and 2022, Uniform ROA is forecast by analysts to bounce back above 20% after lower oil consumption during the pandemic pressured returns.

Along with shifts in the energy market, surging demand for oil and gas is revealing new opportunities for energy contracts and commerce deals.

Saudi Aramco is looking for ways to protect its presence in energy markets by combining excellence in oil production with innovation. In doing so, the company aims to continue its dominance in the long energy game. Meanwhile, as a private company, we will have to wait and see how QatarEnergy looks to disrupt this dominance with its LNG play.

As the second-largest company by valuation globally, Saudi Aramco wields an enormous impact on both the oil market and global equity markets. But with its largest private rival, investors do not realize the possibility that Saudi Aramco may be displaced.

Regards,

Joel Litman

March 30, 2022