Potential frills in the merger of the two no-frills airlines...

Potential frills in the merger of the two no-frills airlines...

A big transaction is on the radar...

The two most prominent no-frills budget carriers announced a potential merger earlier this month. Details confirmed that Frontier (ULCC) would acquire Spirit Airlines (SAVE) for about $2.9 billion, creating the fifth-largest airline in the U.S.

The merger is expected to be completed later this year, with Frontier owning more than half of the combined entity.

At first glance, this merger makes a lot of sense for both companies.

Frontier chairman Bill Franke spearheaded a turnaround at Spirit Airlines when he was its chairman there from 2006 to 2013.

The two firms also operate with similar business models, using older aircraft at lower costs. Furthermore, they both offer limited travel destinations, flying from a few primary carrier hubs. The merge should allow services to more than 145 destinations with 1,000 flights daily.

Based on these synergies, the combined entity should help the two airlines reduce costs.

Can these synergies help customers see any cost savings?

Can these synergies help customers see any cost savings?

Spirit Airlines and Frontier argue that consumers should experience benefits. The combined entity should have greater pricing power with its suppliers and lower costs.

"In a competitive industry like ours, the lowest costs always win," Frontier CEO Barry Biffle told analysts. "These low costs will, in turn, enable us to keep our fares low for customers."

Initial estimates have savings pegged at $1 billion annually as the newly combined company can provide alternative options to bigger carriers. The benefits would also extend to increased job opportunities.

But many analysts see these estimates as a bit of a ploy to appease antitrust regulators into signing off on the deal.

The most telling sign of potential issues comes with the stock performance of the other airlines in the industry.

The other major airlines saw their stock prices jump with the announcement of the merger, with the market coming down on the new combined airline struggling against the competition...

Let's look at The Altimeter to see how investors feel about the merger...

Let's look at The Altimeter to see how investors feel about the merger...

As the travel industry continues to see volatility with the pandemic, investors have largely been wary. As public sentiment slowly increases in confidence, travel has partially recovered from 2020's troughs.

The jury is still out if it's a win for customers regarding the Spirit and Frontier merger. But it's much easier to analyze whether Frontier investors should be excited about the merger based on Spirit's grades in The Altimeter... or if they shouldn't get their hopes up.

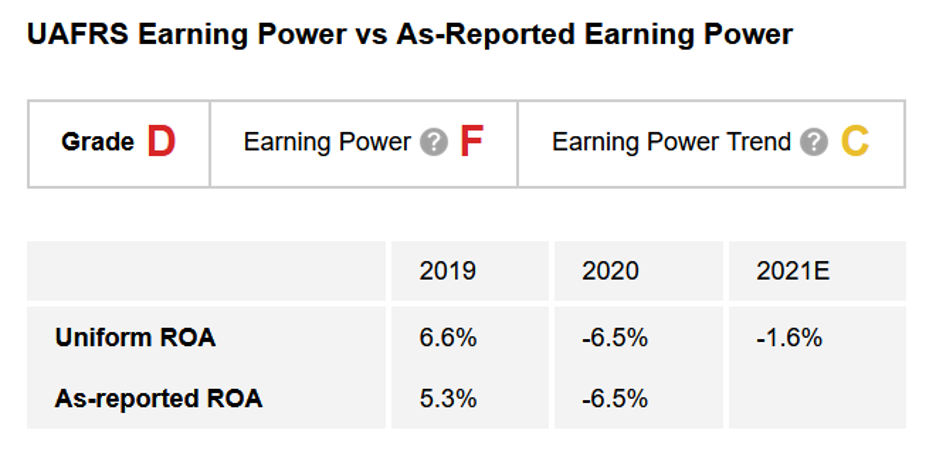

On an as-reported basis, Spirit had a Uniform return on assets ("ROA") of less than 7% even before the pandemic. The story only worsens as we see that its forecast for 2021 is pegged at negative 2%, which earns the company an "F" for Earnings Power.

Spirit partially makes up for its poor Earnings Power grade by showing improvement from a nearly negative 7% ROA to a projection of a slightly less awful negative 2% ROA business in 2021. Therefore, the company earns a "C" for Earnings Power Trend.

Overall, these two grades give Spirit Airlines a "D" for its overall performance. Put simply, The Altimeter's metrics aren't favorable for Spirit.

Thanks to The Altimeter, we can quickly see a company's background before investing and gauge whether an acquisition is a smart idea and what it means for the stock price.

The Altimeter suggests that Frontier will likely have to invest significantly in Spirit to turn it into a positive asset for investors as a combined business – and that's following two tough years for the airline industry in the wake of the pandemic...

But there are stocks beaten up by the pandemic that will come roaring back...

But there are stocks beaten up by the pandemic that will come roaring back...

And we've been pounding the table on this "Survive and Thrive" theme for the last 18 months.

For the theme, we select companies that the market hasn't priced for a recovery yet.

The "Survive and Thrive" recommendations that we select possess the fundamentals, business strategy, and favorable market dynamics to propel them forward this year and beyond...

In fact, Altimetry's High Alpha subscribers who followed our recommendations for "Survive and Thrive" have already seen stocks with gains of 57%, 87%, and 89%.

To learn more about the value that High Alpha unlocks – click here.

Regards,

Joel Litman

February 17, 2022