Can the self-proclaimed king of electric vehicles ('EVs') remain on the throne?

Can the self-proclaimed king of electric vehicles ('EVs') remain on the throne?

Tesla (TSLA) CEO Elon Musk appears to believe he's now the king of EVs. Or, at least, that's what his new title suggests.

In a recent filing with the U.S. Securities and Exchange Commission ("SEC"), Musk listed his new title at Tesla as "Technoking." (He'll still keep his CEO position.)

And Tesla bulls are once again rallying around the stock yesterday after management announced strong production and delivery results for the first quarter of 2021.

Musk might think that Tesla reigns supreme in the EV space. But any investor who thinks Tesla is the only show in town is missing the real story...

The land of EVs is starting to get much more crowded, with a plethora of competitors entering the industry.

Tesla doesn't have the EV market all to itself as it once did. As any good business school professor would tell you, first-mover advantage doesn't secure a permanent competitive advantage.

Major U.S. automakers such as Ford Motor (F) and General Motors (GM) are releasing new vehicles and technology to compete with Tesla.

And other upstart EV companies like Nio (NIO) in China are looking to change the market for EVs entirely. Nio is selling its vehicles without the most expensive component – the battery. Instead, Nio offers to "hot swap" batteries at dedicated stations when customers are running low on power.

But Tesla's biggest competition may be coming from Europe...

But Tesla's biggest competition may be coming from Europe...

Herbert Diess – CEO of German automaker Volkswagen (VOW3.DE) – is looking to transform his company into an EV powerhouse.

Volkswagen – between its flagship VW, Audi, and Porsche brands – has recently been one of the largest growers in the EV space. It's the largest seller of EVs in Europe, and it anticipates that roughly half of its sales of new cars will be EVs by 2030.

The company may have only been playing an April Fool's joke last week when it released a press release saying it was rebranding its U.S. arm as "Voltswagen," but the truth is the rebranding will be fairly accurate if Volkswagen is successful in its strategy.

After its diesel emissions scandal in 2015, Volkswagen used the fact that it was mandated to invest in clean energy to set itself apart from other competitors as it attempted to get ahead of the other established car manufacturers to compete with Tesla.

And now, as Volkswagen has become a more mature player in the EV space, the company may offer useful insights for Tesla investors. Specifically, investors might be able to gain a better view into how Tesla is going to transform as it matures and settles within the space.

Looking at the as-reported metrics, Volkswagen's extensive innovation over the past few years hasn't led to big profits...

Looking at the as-reported metrics, Volkswagen's extensive innovation over the past few years hasn't led to big profits...

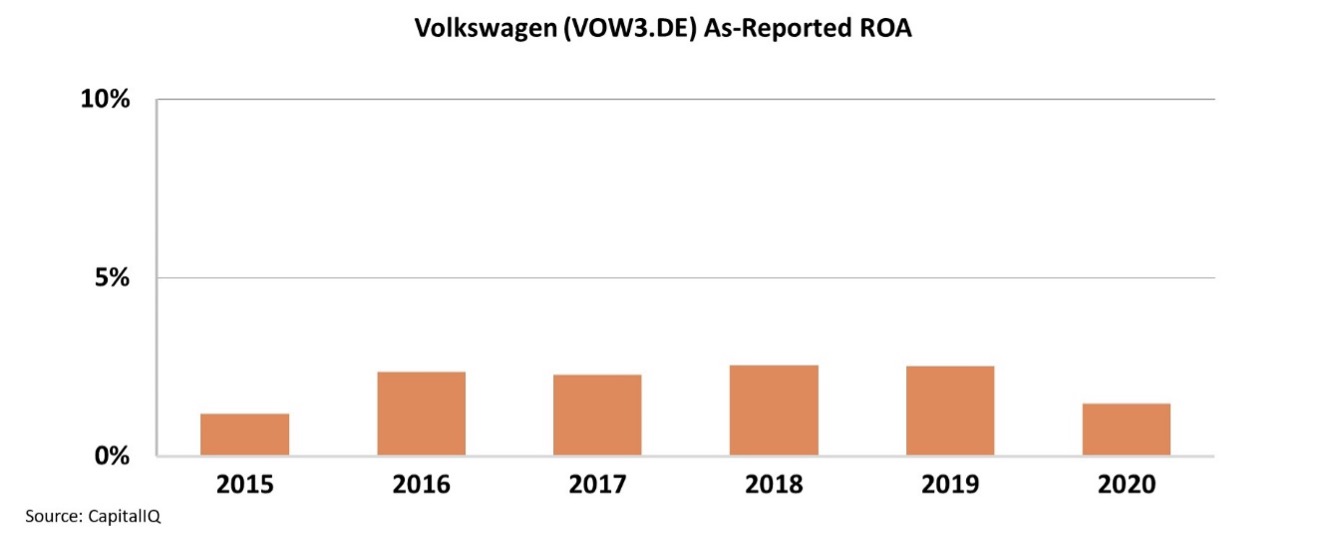

On a GAAP basis, the company's recovery after the 2015 scandal has been weak despite this investment. Returns moved slightly higher in the following years... but Volkswagen still only posted an as-reported return on assets ("ROA") of 2% last year. Take a look...

But once we use the right numbers, we can see that there's more to the story...

But once we use the right numbers, we can see that there's more to the story...

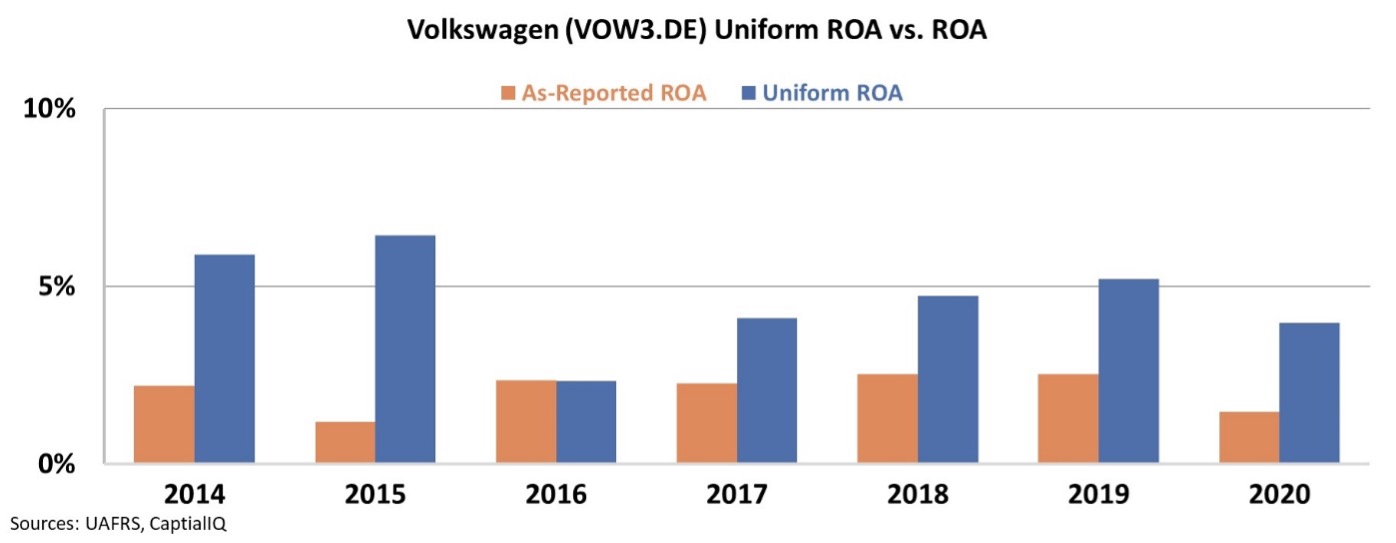

To eliminate the distortions in GAAP metrics, we turn to Uniform Accounting. After adjusting for special items, excess cash, and other distortions, we can see Volkswagen's real performance.

The as-reported numbers have consistently understated Volkswagen's earnings strength since the emissions scandal. However, even after we make the accounting adjustments, the company's Uniform ROA is still weak – hitting just 4% in 2020.

Even at the peak of Volkswagen's returns, when it was profiting from its illegal diesel technology, ROA levels only reached around 6%.

While Tesla investors are amped about the potential for EVs, they may want to temper their expectations for returns along the lines of what Volkswagen has generated. The EV space is getting crowded... and don't count on Tesla and its Technoking to see massive returns.

Regards,

Joel Litman

April 6, 2021

Can the self-proclaimed king of electric vehicles ('EVs') remain on the throne?

Can the self-proclaimed king of electric vehicles ('EVs') remain on the throne?