Investing when the market bottoms out...

Investing when the market bottoms out...

His "The Intelligent Investor" column each Saturday in the Wall Street Journal should be appointment viewing if you haven't already been reading it.

He is incredibly well respected in journalism and in the world of investing. That has earned him the role of editor for the revised version of Benjamin Graham's investing essentials tome, The Intelligent Investor: The Definitive Book of Value Investing.

Naturally, I smiled a few weeks ago when I saw him write a good teaching story in his column. It was about a Tennessee investor in 1939 who, right after Adolf Hitler invaded Poland, called his broker, and told him to buy $100 worth of every stock in the U.S. stock market that had dropped to less than $1.

That investor was none other than John Templeton. He's one of those we talk about when we teach how great investors think.

Here's one of his most famous quotes: "The four most dangerous words in the English language are 'this time it's different.'"

When Hitler invaded Poland, everyone panicked. But Templeton understood it was the right time to go in the opposite direction...

Templeton ended up with 104 stocks in this portfolio, including 34 bankrupt companies. Within five years, he sold them all, quadrupling his money as nearly all his picks ended up selling at a gain. (He also became a billionaire with his pioneering use of global mutual funds.)

So, it's a useful reminder that the best time to invest is often when it's the most uncomfortable.

Listening to the masses and being contrarian is an integral part of our Market Phase Cycle analysis...

Listening to the masses and being contrarian is an integral part of our Market Phase Cycle analysis...

Certain patterns provide leading, lagging, and coincident indicators of bull and bear markets. Our Market Phase Cycle macroeconomic analysis was built on studying these historical patterns.

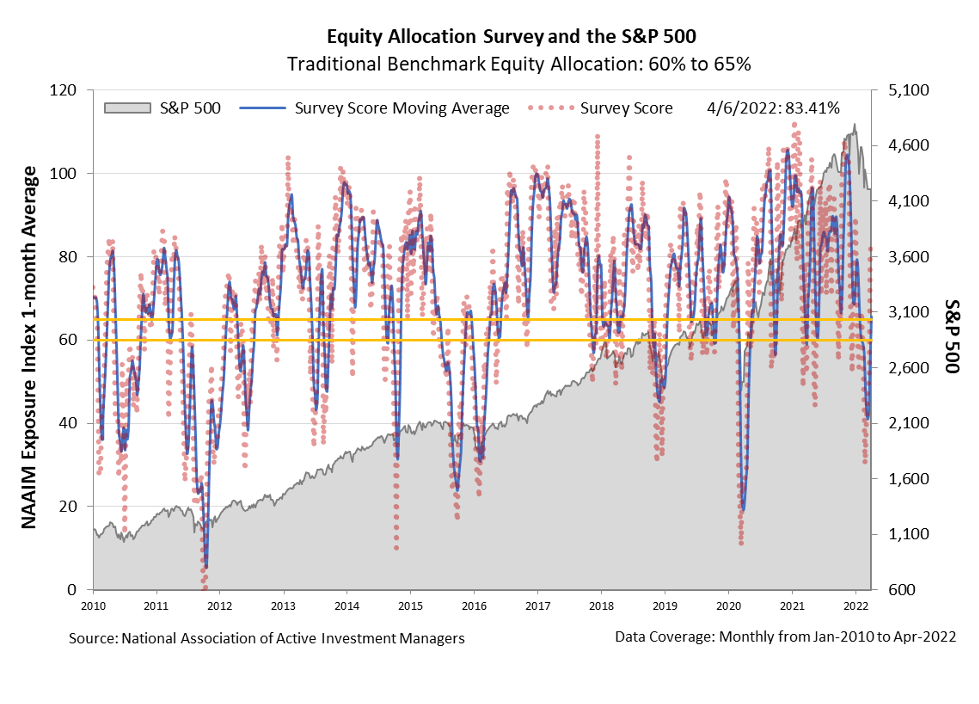

One of the things we like to look at for sentiment is active equity investor sentiment. This tracks, in survey format, how long the market equity investors are at any given time, from zero to 200%, if leverage is being used. Amid the panic about the invasion of Ukraine, this has dropped to exceptionally low levels.

The following chart shows the National Association of Active Investment Managers' data on investor sentiment, and the blue line shows the moving average.

From this, we can see that in early 2022, sentiment fell first thanks to inflationary concerns, then fell to a low of 30% at the beginning of March, when Russia invaded Ukraine.

Sentiment has now started to creep up within the last few weeks and currently sits above long-term averages, at 83%.

This tells us that while investors aren't overly bullish or bearish, they are trending toward bullish.

This is still below where sentiment was for most of the coronavirus pandemic...

This is still below where sentiment was for most of the coronavirus pandemic...

Since the pandemic, equity investor sentiment has been volatile but still elevated. After reaching very low levels in March 2020, it's been frequently at levels approaching or above 100% starting in September 2020.

Until geopolitical concerns recently shifted this sentiment, we saw some of the most consistently bullish investor readings over the past 10 or more years.

Given the uncertainty regarding the war in Ukraine, there's a chance that investors could grow more bearish. If that's the case, it's important to remember Templeton and his actions.

He didn't panic when the rest of the market did, and in the long run, that decision proved to pay off with large gains.

Regards,

Joel Litman

April 11, 2022

P.S. Amid fluctuations in the market, there's going to be one major investing trend in 2022 – and few Americans have heard of it before. And I believe it will result in by far the biggest investment gains over the next decade. Watch my brand-new presentation – and learn the No. 1 way to play it, ticker symbol included for free – right here.

Investing when the market bottoms out...

Investing when the market bottoms out...