You may have been hearing, "May you live in interesting times..."

You may have been hearing, "May you live in interesting times..."

While this saying isn't truly a curse in some languages, the last few years have led many to rethink the premise.

Those hoping for calm after the lifting of pandemic-related restrictions are left feeling disappointed. The headlines of another crisis just kept rolling in with the war in Ukraine.

Even before the news around Ukraine broke, they were about important developments in the U.S.

Late last month, the U.S. Supreme Court heard a major climate change case that could be a watershed moment for regulators.

The case pertained to the extent that regulatory agencies like the Environmental Protection Agency ("EPA") can push regulations – not just for clean air, but for a much broader range of industries, too.

It could impact everything from health care regulations to workplace regulations, among others.

Thanks to the news cycle being focused on the serious situation in Ukraine, the high court's decision for this case is being buried.

Particularly, the debate in front of the court originates in whether the EPA has the right to pen wide-sweeping regulations for issues, such as air pollution.

Are fewer rules worse for the energy industry?

Are fewer rules worse for the energy industry?

Industry insiders are keeping a close eye on the progress made on this case for several reasons.

The U.S. Supreme Court currently has a conservative majority. In keeping in line with more of a conservative policy, the court tends to lean toward a light regulatory touch... which generally means less oversight on the industry.

Some of the discourse revolves around why the conservative justices hope to keep regulation light. One reason is they believe they would be tying the EPA up by issuing stringent guidelines.

While it is understandable that they don't want too much red tape preventing the EPA from performing its role, it might create other adverse impacts. Their lack of decisions may make the energy industry's life tougher by creating even more regulatory uncertainty.

If the Supreme Court justices can't issue broader decisions, the industry has a tougher time fully committing to initiatives because each direction from regulators might just be a one-off direction.

As it stands, while in this case the justices are deciding on the EPA, it raises the conversation of how much oversight is needed across many other kinds of regulation.

While those watching the situation unfold may be on the edge of their seats awaiting a decision, there is another solution to the uncertain regulatory environment.

Some companies are looking to run some of the cleanest energy solutions in the market today.

One company that seems to be doing that is NextEra Energy (NEE). They have been heavily committed to sustainable ways of generating energy with investments in renewable energy and nuclear power.

Today, the business has positioned itself as the largest renewable wind and solar energy generator. Furthermore, it has become a battery storage leader with multiple solar power plants.

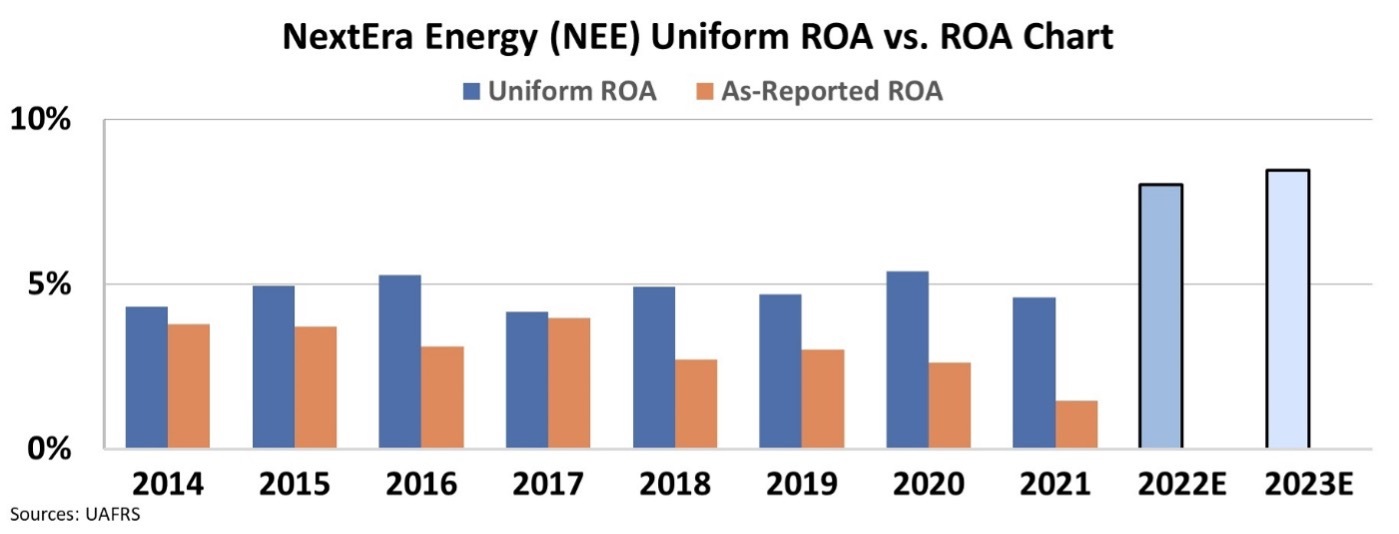

But its strength as a leader in sustainable energy isn't apparent when we look at its as-reported metrics.

Rather, it looks like that investment in clean energy has been a headwind for the business.

NextEra's return on assets ("ROA") in the last three years was below what it was the prior five years, signaling its productivity as an investment is declining.

Here at Altimetry, however, we use our Uniform Accounting framework to account for GAAP-based distortions in financials.

With this Uniform Accounting data, we see a company whose earning power hasn't dipped at all. Rather, it has remained remarkably stable while investing in green energy.

We can see that investing in green energy has been a good business, furthermore, that ROA is projected to inflect higher going forward, thanks to the investment in clean energy beginning to kick in.

While NextEra Energy's as-reported numbers may raise warning flags, the Uniform data shows a company well-suited to withstand regulatory and environmental concerns going forward.

While renewable energy stocks might be having their moment, there's a more stable corner of the market that few people are paying attention to...

While renewable energy stocks might be having their moment, there's a more stable corner of the market that few people are paying attention to...

Very few Americans realize this right now, but big money is now headed to this one subsector of the market... and I bet it's one that you haven't heard of before.

Larry Fink, the head of the world's largest asset manager BlackRock (BLK), says he thinks this corner of the market will create the next 1,000 billion-dollar companies. And I believe early investors stand to make an absolute killing as this trend starts to play out.

That's why I just published a brand-new presentation where I explain everything you need to know – including the name and ticker symbol of one of my favorite ways to profit, absolutely free... no e-mail or credit card required.

You can access it totally free of charge, right here.

Regards,

Joel Litman

March 9, 2022

You may have been hearing, "May you live in interesting times..."

You may have been hearing, "May you live in interesting times..."