Warren Buffett is well known for his disciplined approach to investing...

Warren Buffett is well known for his disciplined approach to investing...

However, Buffett's recent moves – or rather, his inaction – has investors scratching their heads.

In the third quarter of 2024, asset manager Berkshire Hathaway (BRK-B) paused its share buybacks for the first time in years.

The company is now sitting on more than $300 billion in cash and Treasury bills. This pile represents 27% of Berkshire's total assets – its highest ratio since 1998.

Many assume Buffett is waiting for the perfect deal. But his latest letter to shareholders suggests a different reason... He may be preparing for a leadership transition.

And this strategy could help Berkshire's next CEO, Greg Abel, inherit a clean slate.

Today, we'll explore why Buffett's pile of cash signals more than just discipline... It could also shed light on the businesses Berkshire might buy under its new leadership.

Competitive advantage is the key to picking great stocks...

Competitive advantage is the key to picking great stocks...

Buffett once said...

The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage.

A strong competitive advantage protects companies from intense matchups in the business world. Simply put, it allows them to maintain profitability above their cost of capital for longer.

To better understand Buffett's investing approach, we tracked how the largest U.S. companies leverage their competitive advantages.

We trained a machine learning model to assign competitive advantages for the 30,000 companies in our database... using parameters like business type, key words in 10-K filings, and profitability history.

After several rounds of testing, our model identified the four most durable competitive advantages. We then used these findings to examine Berkshire's holdings as of December 2024.

The company's portfolio shows that certain advantages are better than others...

The company's portfolio shows that certain advantages are better than others...

According to our research, nearly two-thirds of Berkshire's holdings have these four competitive advantages: brand, marketplace network, operating scale, and switching cost. Here's a breakdown of each type...

Brand: This competitive advantage allows companies to charge a premium for the same product or service, leading to higher gross margins. Coca-Cola (KO) is a good example.

Marketplace network: Businesses that operate large platforms attract both buyers and sellers, making it hard for new competitors to enter the market. The more traffic they generate, the more valuable they become. American Express (AXP) has this competitive advantage.

Operating scale: This helps companies achieve optimal margins by leveraging their size for cost or sales advantages. As production increases, costs drop, giving them an edge over smaller competitors. Think of Occidental Petroleum (OXY).

Switching cost: Companies that benefit from high switching costs make it difficult for customers to leave. For example, in the software industry, expenses like retraining staff and integrating new systems outweigh the benefits of switching to another provider. Apple (AAPL) is a good example.

Companies with these competitive advantages will continue dominating Berkshire's holdings once Abel takes over...

Companies with these competitive advantages will continue dominating Berkshire's holdings once Abel takes over...

And they can help investors figure out potential new buys.

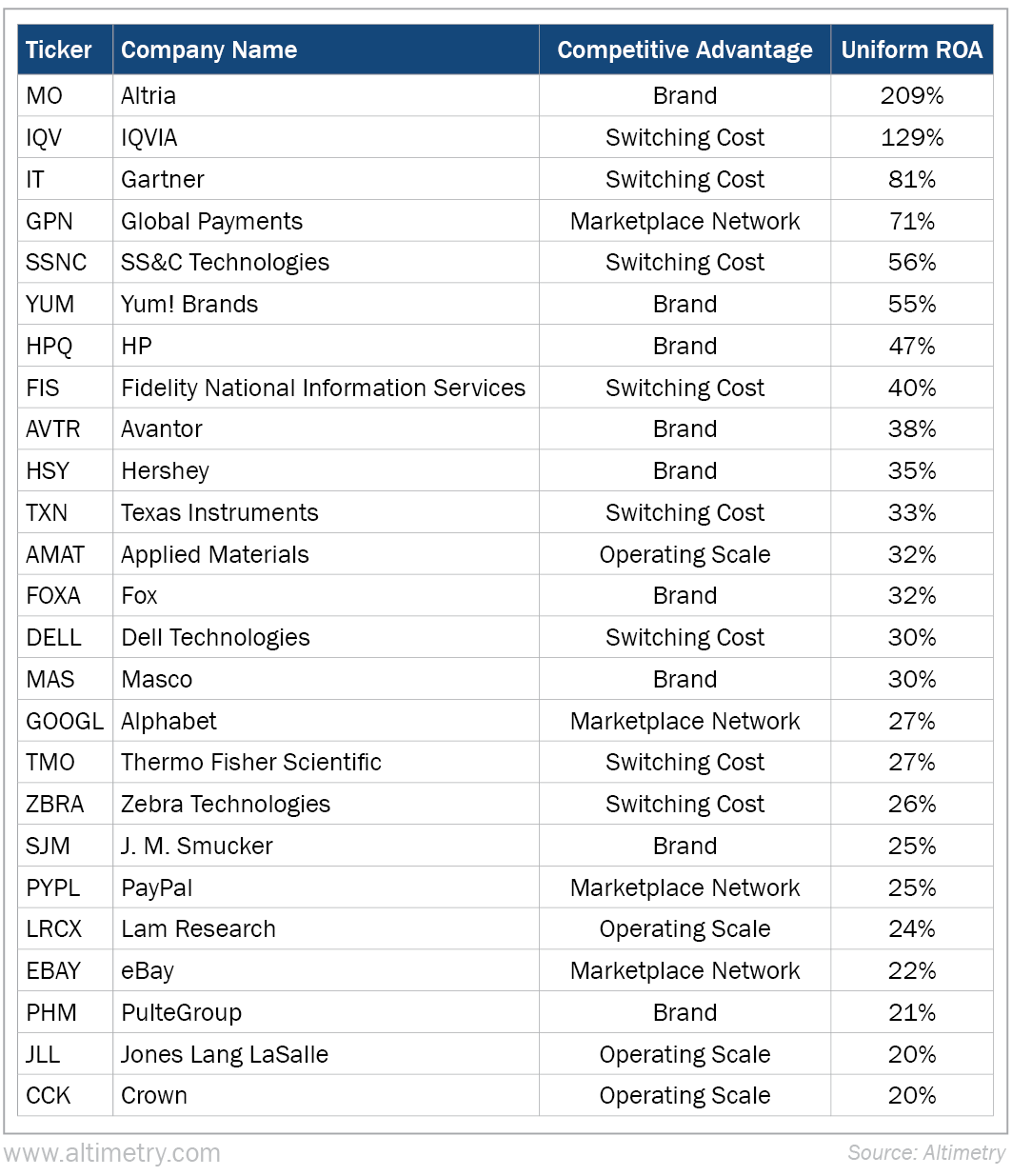

We focused on the largest U.S. stocks that have turned these advantages into high profitability – an average Uniform return on assets ("ROA") of 20% or more for at least five years.

Check out our findings in the table below, along with specific competitive advantages and ROAs from the past fiscal year...

These 25 companies best capture Buffett's investing strategy... They have the most durable competitive advantages, high returns, and cheap valuations.

That's what makes them ideal targets for Berkshire.

And we expect the company's future CEO to put Berkshire's massive cash reserve to work by pursuing these types of companies.

Investors looking for good opportunities might want to keep this list handy.

Regards,

Joel Litman

March 27, 2025

Warren Buffett is well known for his disciplined approach to investing...

Warren Buffett is well known for his disciplined approach to investing...