President Donald Trump has launched his biggest manufacturing push yet...

President Donald Trump has launched his biggest manufacturing push yet...

A March 31 executive order established the "United States Investment Accelerator" office to speed up federal funding for domestic semiconductor projects.

This may seem like a new initiative, but it's just rebranding the Biden-era CHIPS and Science Act of 2022.

Simply put, Trump wants to bring high-end chipmaking back to U.S. soil, reduce reliance on Taiwan and South Korea, and win the technology race against China.

There's also a new sense of urgency... The White House says it will shorten the grant-approval process from years to months. It also vows to clear permitting roadblocks and deliver funds up front.

And yet, the market doesn't seem to care. Chip stocks have pulled back in recent weeks amid renewed trade-war fears.

Investors are too focused on tariffs... They're missing the real news in one part of the semiconductor market.

Today, we'll explain why Trump's renewed policy could be a long-term tailwind for U.S. semiconductor-equipment makers... and why investors may be overlooking massive upside potential.

For years, U.S. leaders warned that America was too reliant on other countries for cutting-edge chips...

For years, U.S. leaders warned that America was too reliant on other countries for cutting-edge chips...

They felt it posed a national security risk, but the private sector dragged its feet.

Things started to change after former President Joe Biden signed the CHIPS and Science Act into law... Congress earmarked more than $50 billion to boost American chipmaking, with a focus on advanced fabrication.

Now, the Trump administration is doubling down on this effort...

The new Investment Accelerator office will issue grants within 100 days of project review. It will also act as a central hub to speed up the permitting process.

That should turbocharge domestic chipmaking, making semiconductor-equipment companies the top beneficiaries...

That should turbocharge domestic chipmaking, making semiconductor-equipment companies the top beneficiaries...

Firms like Applied Materials (AMAT) make the precision tools required to manufacture chips. Without these machines, you can't build fabrication factories.

And unlike chipmakers, equipment providers get paid before manufacturing any chips. They also don't face wild swings in price and demand.

The point is, U.S.-based fab construction will ensure that Applied Materials' order book grows...

Intel's (INTC) fabs are already underway in Arizona and Ohio... Taiwan Semiconductor Manufacturing (TSM) is ramping up its footprint in Arizona... and Samsung Electronics is building its biggest U.S. campus ever in Texas.

And all of them rely on Applied Materials' tools.

Yet, you wouldn't know it by looking at the stock's performance...

Yet, you wouldn't know it by looking at the stock's performance...

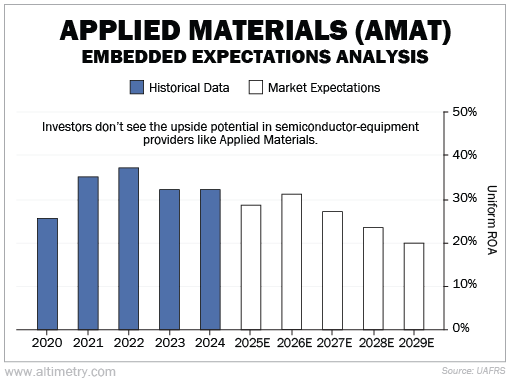

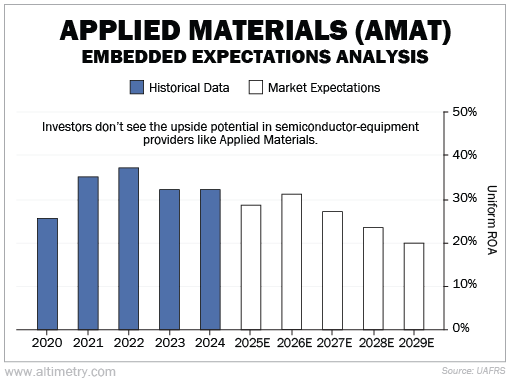

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Applied Materials' Uniform return on assets ("ROA") has ranged from about 26% to 37% for each of the past five years. So it's more than twice as profitable as the average company, which has a 12% Uniform ROA.

And yet, investors expect Applied Materials' Uniform ROA to fall below 20% by 2029. Take a look...

The reality is, Applied Materials is in great shape... And Trump's Investment Accelerator should boost it further.

Washington is fueling long-term demand for chipmaking tools...

Washington is fueling long-term demand for chipmaking tools...

In fact, its chip-manufacturing policy is pushing the U.S. to the front of the global tech race...

The Investment Accelerator is fast-tracking grant approvals and front-loading capital, forming a big tailwind behind semiconductor-equipment providers.

As chip leaders build plants across the U.S., companies like Applied Materials will face huge demand for their specialized equipment.

So even if trade tensions flare up, domestic manufacturing will likely stay on track.

That's a game changer in the semiconductor space... and investors should start paying attention.

Regards,

Joel Litman

May 14, 2025

P.S. Two legendary investors – one from Wall Street, the other from Silicon Valley – are joining forces to share an important warning on May 21.

Our friends Jeff Brown and Whitney Tilson are revealing the catalyst that can help investors double their money, or more, on five unique investments.

And it's all based on a new AI Super Chip that's 50 times faster than Nvidia's. It supports 120 trillion neural connections – and it will completely reshuffle the markets and the economy – regardless of where stocks go next.

No matter how you feel about AI – or the tech market – today, we strongly encourage you to get all the details here (including a free recommendation).

President Donald Trump has launched his biggest manufacturing push yet...

President Donald Trump has launched his biggest manufacturing push yet...