Asset management firm AllianceBernstein (AB) has long been a respected voice on the Street...

Asset management firm AllianceBernstein (AB) has long been a respected voice on the Street...

The research it publishes and its investment strategy have generally been viewed as forward-thinking, all the way back to the company's roots at Alliance Capital and Sanford C. Bernstein in the 1960s and '70s.

The co-heads of AllianceBernstein's equities department recently published an outlook for 2020. Like most equity research in general – especially macro research – the report at times feels like it's talking from "both sides of the mouth." It spends a lot of time discussing both the positives and the negatives for investors as we head into 2020.

A perspective like this can be confusing... because it's true. We're entering the year with a lot of positives and negatives from an economic outlook. Rarely do equity markets go directly up because everything is great – rather, they tend to climb a "wall of worry" higher.

Here at Altimetry, one of the reasons we spend so much time having a systematic and consistent macro framework is because without it, investors can get lost in the "noise" of reacting to headlines.

Many of the reasons why we're optimistic about 2020 are ones that the report highlights. Growth appears to be trending favorably, and the global economy doesn't seem to be primed for a collapse – as many thought at the beginning of 2019. As we regularly mention here in Altimetry Daily Authority, this is because the credit environment is healthy.

The report highlights several sectors and industries that regular readers will be familiar with... They're areas we've been identifying compelling stocks in.

You can read the full report right here. What do you think? What's your outlook for 2020? We'd love to hear your thoughts – send us an e-mail at [email protected].

The U.S. is entrenched in one of the worst addictive drug crises the world has ever seen...

The U.S. is entrenched in one of the worst addictive drug crises the world has ever seen...

It's a complicated story to summarize in a short format, but at its core, the crisis is centered around pharmaceutical companies and the American public.

We can trace the beginning back to the late 1990s, when health care providers made a costly decision. For the first time, they began prescribing opioids for chronic pain... not just for acute pain.

While legal opioids were historically used to treat temporary acute pain, many pharmaceutical companies began suggesting their use in long-term care situations. They downplayed their addictive potential and marketed them aggressively.

Studies were limited about the effectiveness of opioids in the long-term. Despite this, Americans were desperate for a solution... More than 100 million adults suffer from chronic pain.

Unfortunately, this led to rampant misuse. Studies estimate that between 21% and 29% of opioids prescribed for chronic pain end up being misused, and many of these users eventually develop an addiction or similar disorder.

Over the past year, we've seen major trials in Ohio and Oklahoma with huge settlements paid by different pharmaceutical companies, including Johnson & Johnson (JNJ), OxyContin producer Purdue Pharma, and a host of other producers and distributors.

While most Americans are placing the blame on the drug makers, it took an entire supply chain to build a crisis of this scale.

The full list of defendants in the current national lawsuit includes nearly 3,500 entities, spanning from drug makers to raw material suppliers.

It's easy to forget that pharmaceutical firms are really just chemical companies. Rather than focusing on chemicals that end up in agriculture or makeup, pharmaceutical chemicals are focused on the human body.

These drugs are made of compounds called active pharmaceutical ingredients ("APIs"). The API business is a huge part of the pharmaceutical supply chain – particularly for the opioid supply chain.

This is key to understanding the slew of recent opioid lawsuits. For example, Johnson & Johnson was ordered to pay one of the largest settlements, despite its opioid products making up less than 1% of all opioids sold in those markets.

However, most people don't realize that Johnson & Johnson owned America's largest API business during the time period under question in the trial. In addition to producing its own opioids, the company supplied nearly 60% of America's APIs – including APIs for Purdue Pharma.

With the opioid crisis in full swing and with no signs of slowing down, this is a damning realization for Johnson & Johnson investors. As more people make the connection between the company's true involvement in the ongoing lawsuits and its recently shaky financial performance, it might be time to put the stock on watch.

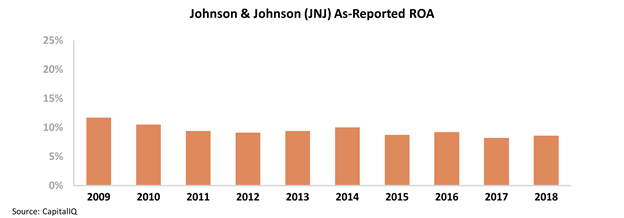

Over the past several years, Johnson & Johnson's profitability has declined towards decade lows, with the company's return on assets ("ROA") falling from stable 10% to 12% levels to just 8% in recent years. Take a look...

It's a concerning trend. Based on this chart, it appears Johnson & Johnson will need to significantly shift its business model to get back to historically average ROA levels as it continues to feel pressure from issues like the opioid crisis.

That said, this is a misleading and inaccurate view of the company's business.

For starters, Johnson & Johnson saw the writing on the wall with its APIs years ago. In reality, Johnson & Johnson sold Noramco and Tasmanian Alkaloids, the two companies that comprised its API business, to a private investor in 2016.

While this doesn't exonerate Johnson & Johnson from its involvement in the opioid lawsuit, it does relieve the company of any operational pressure once it has paid the settlements.

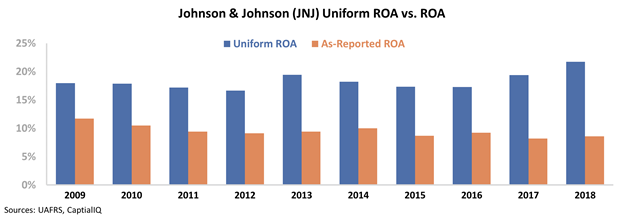

Additionally, another piece of information calls into question Johnson & Johnson's recent as-reported returns...

Despite as-reported ROA declining over the last five years, Uniform Accounting reveals the exact opposite trend. Once we make the proper adjustments to the company's financial statements – adjusting for inconsistencies like capitalizing versus expensing research and development (R&D), the treatment of goodwill, and the impact of non-cash stock option expenses – it's clear that Johnson & Johnson made the right decision by selling its API business.

Now, the company has been able to invest in more profitable ventures that will be viable in the long term... and this has pushed its Uniform ROA to a decade-high 22% in 2018. Take a look...

As-reported financials can not only misrepresent corporate profitability levels, but they can also directionally distort performance trends. For a company like Johnson & Johnson, this can be the difference between a concerning signal and an improving business.

Regards,

Joel Litman

January 23, 2020

Asset management firm AllianceBernstein (AB) has long been a respected voice on the Street...

Asset management firm AllianceBernstein (AB) has long been a respected voice on the Street...