Russia's invasion of Ukraine changed more than the geopolitical landscape...

Russia's invasion of Ukraine changed more than the geopolitical landscape...

It altered the West's entire supply chain.

In the face of the war, the Western world swiftly stepped up to back Ukraine. The U.S. and its allies could supply arms on short notice because they had some excess lying around.

But believe it or not, these countries don't have an endless supply of leftover weapons. If they want to keep supporting Ukraine – and address threats in other regions – they'll need to ramp up production of a lot of defense equipment.

Admiral Rob Bauer is a distinguished military officer within NATO. According to the Wall Street Journal, Bauer has explained it this way...

Every war, after about five or six days, becomes about logistics.

NATO members are supposed to spend 2% of gross domestic product ("GDP") on defense. Only around half are expected to hit that target next year.

That means a lot more countries are going to have to up their defense spending soon. And there's much more to making weapons than calling up your local defense contractor.

Defense companies themselves rely on industrial supplies sourced from a lot of different sectors. For instance, the U.S. Navy is looking to refurbish four of its major shipyards. That project isn't just an investment in traditional defense.

It's also an investment in construction and infrastructure.

The U.S. has to bolster its industrial base. It's the only way to meet the ever-growing demand for defense equipment.

So today, we'll examine what this influx of spending means for American industry... and for investors.

Defense spending makes the supply-chain supercycle stronger...

Defense spending makes the supply-chain supercycle stronger...

Longtime subscribers are already familiar with the supply-chain supercycle. It's our term for the current wave of U.S. infrastructure investment as we bring production closer to home.

Industrial companies have already started to benefit from these investments. The turmoil of the Ukraine war is powering this cycle even higher.

The Navy refurbishment project we mentioned could cost anywhere between $21 billion and $50 billion. That's tens of billions of dollars going right back into the U.S. economy... all from one project. There will be plenty more like it.

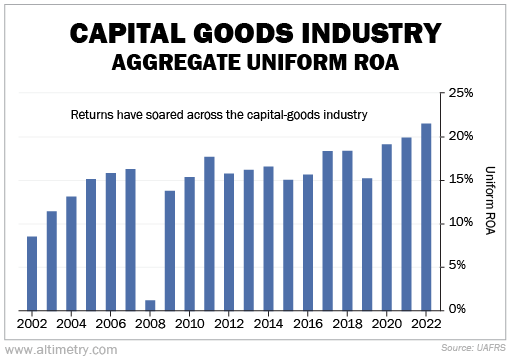

That's probably why the capital-goods sector, which includes both defense and industrial companies, has been surging recently. Uniform return on assets ("ROA") reached an all-time high of 22% last year.

Take a look...

With the exception of a brutal 2008, capital-goods companies have averaged a 15% Uniform ROA.

Now, the U.S. and other countries are ramping up infrastructure investments. Returns are rising... and should only get higher from here.

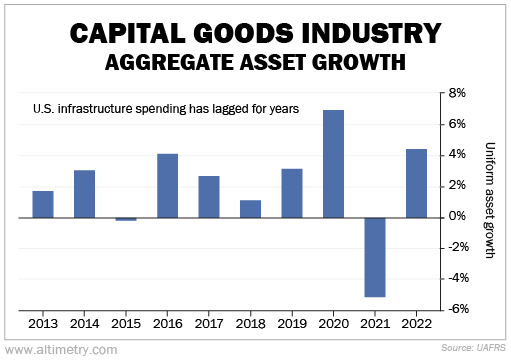

At the same time, it has been a while since the industry has grown. The U.S. has seriously underinvested in infrastructure. Everything from public roads to manufacturing plants are about as old as they've ever been.

Over the past decade, the capital-goods industry has only grown about 2% per year.

Here's what it looks like...

The industry has started growing a bit faster since 2020. But it has been a long time since it had a solid investment cycle. That's no longer sustainable... If we don't start investing soon, our infrastructure will fail us.

As capital-goods companies ramp up their investments, they should grow even faster.

So we have strong performance that's getting stronger... and renewed growth potential...

So we have strong performance that's getting stronger... and renewed growth potential...

Taken together, that signals a promising opportunity for investors.

Industrial companies form the backbone of defense production and supply chains. The U.S. government and its allies are already pouring money into defense. These pivotal industrial players stand to win big as this trend takes off.

And as defense spending gains momentum, that spending should trickle through the entire capital-goods sector.

There's still time for investors to capitalize on the industry's growth potential.

Regards,

Rob Spivey

July 20, 2023

Russia's invasion of Ukraine changed more than the geopolitical landscape...

Russia's invasion of Ukraine changed more than the geopolitical landscape...