Last month, the World Economic Forum ('WEF') held its first-ever online conference...

Last month, the World Economic Forum ('WEF') held its first-ever online conference...

The group's annual meeting in Davos, Switzerland, is typically a big gathering of business leaders, economists, and political figures from across the globe.

At this year's virtual event, interviews from two executives from big financial-services firms – Barclays (BCS) CEO James Staley and JPMorgan Chase (JPM) asset- and wealth-management head Mary Erdoes – stood out to us.

First, both were pessimistic regarding the work-at-home environment. Staley claimed that it wasn't sustainable. And as Erodes explained...

If you ask anyone today, it feels like it is fraying, it's hard, it takes a lot of inner strength and sustainability every single day to continue to focus and to not have the energy you get from being around other people.

Many folks are starting to get worn out by working at home... but as a result of mutating strains, the coronavirus may persist in some form. These speakers highlight how companies will need to effectively manage their remote environments through 2021.

But that wasn't all...

But that wasn't all...

Staley also spoke to economics as well. He highlighted that small companies and consumers are raising cash reserves in the bank and paying off borrowings.

As a result, there's a rising level of pent-up demand for goods. If quarantine restrictions begin to ease, spending could boom – and the artificial "dam" to spending could burst.

Staley compared this possibility to the "Roaring Twenties," when the global economy surged in the decade after the 1918 influenza pandemic and the end of World War I.

If a second Roaring Twenties occurs, some industries that are downtrodden now could win big...

If a second Roaring Twenties occurs, some industries that are downtrodden now could win big...

Throughout the pandemic, casinos have suffered.

With the coronavirus restricting normal operations for physical casinos, these companies have attempted to keep the lights on using online gambling – which has become more popular – while maintaining their physical presence for when things return to normal.

For example, Las Vegas casino floors – operating at limited capacity since last year – have seen restrictions ease. Capacity recently went from 25% to 35%... and in mid-March, will move to 50%. And yet, the market isn't pricing in any glimmer of hope for casinos in a recovery.

With continued coronavirus headwinds, many investors and rating agencies have a bearish outlook for the industry.

Specifically, credit markets still have an overly pessimistic outlook...

Specifically, credit markets still have an overly pessimistic outlook...

Just consider Boyd Gaming (BYD). The company owns roughly 30 casinos in Vegas and across the U.S.

Today, Boyd needs to operate efficiently to survive the downturn. So far, this has allowed it to keep the lights on so that it can profit online and in person once pent-up demand is released.

Equity investors may already be pricing this in, with BYD shares surging more than 350% since their March 2020 lows. And yet, the major rating agencies are still skittish on Boyd's debt...

Specifically, Moody's (MCO) gives Boyd a highly speculative "B2" rating. This corresponds to an implied 25%-plus risk of default over the next five years.

Considering a possible rebound for casinos as the world moves toward getting better control over the coronavirus, there's a disconnect between this extreme rating from Moody's and Boyd's real credit risk.

So using Uniform Accounting, let's take a closer look...

So using Uniform Accounting, let's take a closer look...

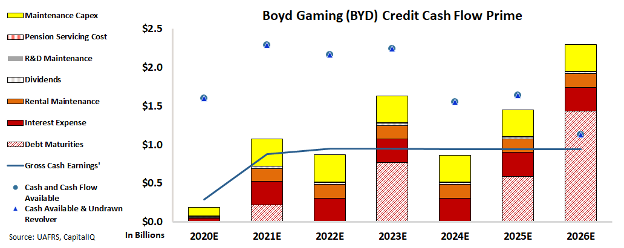

By cleaning up the numbers and removing the distortions inherent in GAAP metrics, our Credit Cash Flow Prime ("CCFP") analysis is able to get to the heart of Boyd's true credit risk.

In the chart below, the stacked bars represent the company's obligations each year for the next five years. These obligations are compared to cash flow (blue line), cash on hand at the beginning of each period (blue dots), and undrawn credit revolver (blue triangles).

Fundamental analysis highlights that Boyd's cash flows should exceed operating obligations – all obligations other than debt maturities – over the next few years. Cash flows and cash on hand should service all obligations until 2026, when the company faces a $1.4 billion debt wall.

However, Boyd Gaming has a full six years before this obligation – giving it time to improve cash flows or refinance that debt maturity.

Boyd isn't a name in distress... The company seems well-positioned when looking at its debt through a Uniform Accounting lens.

As our CCFP analysis highlights, the highly speculative "B2" rating from Moody's isn't in line with reality. Instead, here at Altimetry, we give Boyd a safer "XO" rating. This is equivalent to a "Baa3" rating from Moody's, which corresponds with less than a 2% chance of default within the next five years.

Ultimately, Uniform Accounting and the CCFP analysis show how Boyd's credit risk profile is much safer than what rating agencies believe.

The company could be set up to benefit from a second Roaring Twenties... and that would surprise Moody's and investors alike, who are using distorted GAAP metrics.

Regards,

Rob Spivey

February 24, 2021

P.S. Even if we do see an economic boom, not everything will go back to "normal" once the pandemic recedes. Some of the changes we made will stick... And right now, you have a chance to position your portfolio correctly – ahead of time.

Here at Altimetry, we've found the 11 companies set to benefit the most from this "At-Home Revolution." Learn how to access our research for 75% off the regular price right here.

Last month, the World Economic Forum ('WEF') held its first-ever online conference...

Last month, the World Economic Forum ('WEF') held its first-ever online conference...