Dear reader,

In the world of investing, two of the most important – and scarce – resources are information and time.

Information, of course, allows you to make informed investment decisions. Having more data than the next guy gives you an informational advantage.

It's hard to get an informational advantage, though... especially as an individual investor.

Hedge funds hire fleets of analysts to monitor datapoints before companies even announce them. They have staff monitoring everything from retail foot traffic to predict the next quarter's sales data, to the water displacement from boats to analyze shipping capacity.

Having an informational advantage is important, but time is equally critical... and arguably more fleeting.

Practically as soon as a company announces quarterly sales and earnings data, its stock is already rising or falling in response to the news.

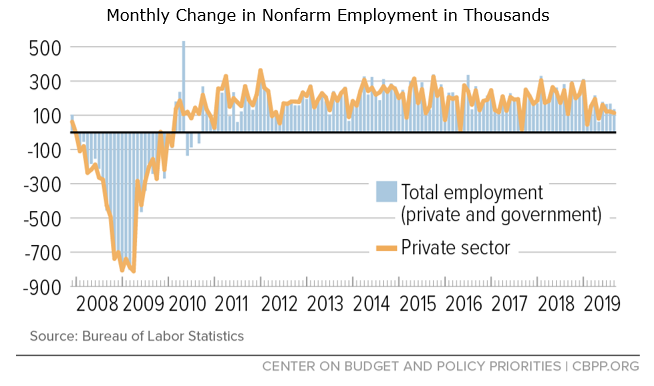

This same principle applies to economic data. On a monthly, quarterly, and annual basis, the U.S. Department of Labor publishes a series of economic indicators that have big implications for investors.

The Consumer Price Index ("CPI"), Real Retail Sales, and nonfarm payroll ("NFP") employment help investors understand factors like inflation, consumer spending, and overall economic health.

And the NFP figure has implications for all investors...

Foreign exchange traders spend hours modeling out their expectations for the NFP on a monthly basis so they can get ahead of large currency fluctuations. Everyone from stock pickers to macro investors watches the NFP for how it can impact the markets.

The NFP is one of the "big four" economic indicators that helps point to recessionary concerns. Similar to the timing problem around a company's earnings call, by the time the Department of Labor publishes the monthly NFP number, the market has already reacted. The chart below shows monthly nonfarm employment trends since the Great Recession.

However, there's a company that effectively offers a "sneak peek" into these employment metrics.

In fact, this business probably has even better job data than the government.

Automatic Data Processing (ADP) is the largest outsourced human-resources company in the world. It supplies payroll, talent, compliance, and benefit-management plans to more than 500,000 small businesses (between one and 50 employees) and thousands of larger businesses without dedicated HR teams.

Because it provides the backend work for tracking employees, payroll, and benefits, ADP has the largest and most up-to-date jobs report sitting in its database. Each month, ADP releases its own version of the nonfarm payroll report – the National Employment Report ("NER"). The company releases the NER a few days before the NFP, and many analysts view it as an excellent window into what the NFP will be.

In effect, the NER gives individual investors both information and time to react before the NFP comes out.

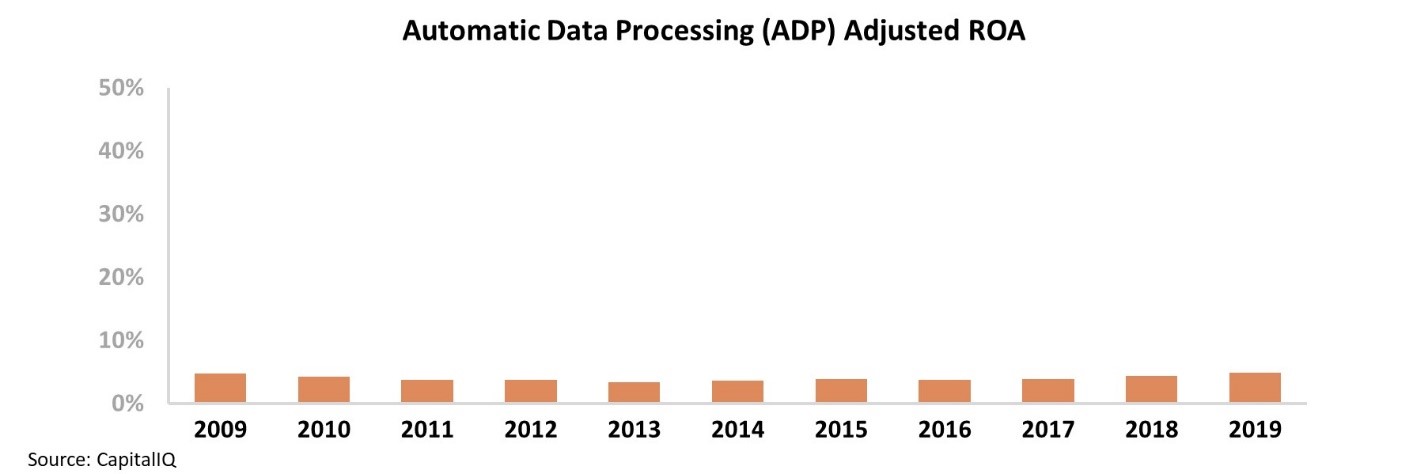

It's reasonable to assume that a company that has better data than the U.S. government – and has millions of people on its systems for payroll – would be generating significant income. However, according to GAAP data, ADP is not a company throwing off massive profits. In fact, its returns are pretty poor. Take a look...

When looking at as-reported financial data, ADP looks like a stable but weak company with a below-average return on assets ("ROA"). Since the Great Recession, ADP has seen ROA remain in the 3% to 5% range.

One might assume ADP's returns would rise and fall with the economy, considering the business's exposure... but ADP's as-reported ROA doesn't seem to have much connection to U.S. job trends.

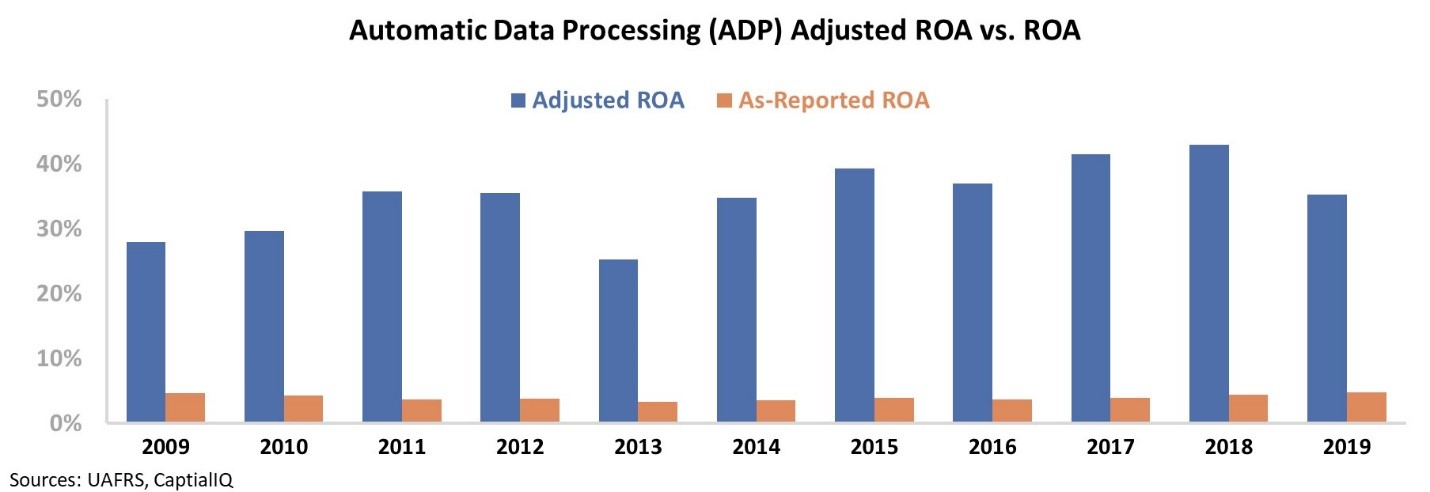

However, once we apply our Uniform Accounting metrics – adjusting for inconsistencies like treatment of goodwill, stock option expense, and accounting for payroll funds – the company's strong returns and economic exposure become obvious.

Not only is ADP's Uniform ROA following the same trend as nonfarm payroll, but the company's profitability is far stronger than as-reported metrics would suggest.

ADP's profitability is cyclical – in line with job data – but it is also improving over time, as the U.S. economy continues to improve.

Investors looking at ADP's as-reported results are not understanding the company's actual operating trends... and they think ADP is significantly less profitable than it actually is.

But the right data can give us better information and more time to make investment decisions. ADP's NER helps investors get a window into economic data, and Uniform Accounting helps investors get a better window into ADP's real operating performance.

Regards,

Joel Litman

October 31, 2019