It's yet another way the coronavirus pandemic will change travel forever...

It's yet another way the coronavirus pandemic will change travel forever...

Like any longstanding institution, the airport was conceived of and designed years ago... with inertia reducing the potential of structural changes to the way we board our planes. This is especially true since the last great wave of change with the security measures implemented after the 9/11 attacks. The current traffic flow for most airports loosely resembles the letter "X."

Passengers from trains, buses, cabs, Ubers, and parking lots file into terminals, which represent the top of the "X." Then, they all converge to the security line, which is the central cross of the "X." Finally, after making their way through security, passengers then filter out to their separate gates, which represent the bottom of the "X."

This system has worked for years – airports can control the flow of people, and passengers build in extra time to make it through long security lines. However, a congregation of people in a security line – the intersection of the "X" – is hardly effective social distancing in the middle of a pandemic. Additionally, this system already hasn't been fully optimal for flyers in terms of efficiency.

So perhaps this presents an opportunity for airports to change their ways in the wake of the pandemic...

With the dip in air travel, Bloomberg recently reported that airports are taking the opportunity to make large, structural changes to the overall experience.

Casinos have already solved the problem of security monitoring with a large volume of people gambling simultaneously through complex, dynamic security systems that watch for cheating. Airports are looking to leverage these systems and other similar technology to get rid of the classic "X-shaped" terminal design.

As a first step for social distancing regulations, airports are placing a greater emphasis on the mobile phone – allowing push notifications for when to board planes, without packed herds of anxious passengers waiting to board. Airports are also creating touchless check-in technology through facial recognition and biometrics to speed up immigration checks to 15 seconds.

In addition, airports are integrating timed windows for passengers to go through security, with a UV light to clean luggage and belongings. Finally, staff at Qatar's Hamad International Airport are wearing "smart helmets" that asses body temperatures using thermal imaging.

While many of these innovations were driven by the need for safe travel in the near term, dismantling the traditional "X" process will create more pleasant and efficient terminals in the long run. Through forced innovation, the pandemic may help us reset and change how we interact with long-standing institutions... as well as make our travel experiences better.

Many airlines have gone bankrupt since the start of the pandemic...

Many airlines have gone bankrupt since the start of the pandemic...

At the peak of the shutdown, air travel was at a standstill – effectively crushing smaller airlines with little to no cash reserves.

Even as states and countries began opening back up, flying has remained largely subdued. In particular, business travel has hardly recovered over the past few months... Business passengers make up 75% of airlines' profits – it will be a hard recovery ahead.

Virgin Atlantic, LATAM Airlines, Flybe, and Compass Airlines are a few of the carriers to enter bankruptcy as a result of the economic turmoil. This highlights a key issue that the pandemic has helped expose...

Smaller companies in hard-hit industries are struggling to survive. Meanwhile, big firms with plenty of liquidity, easy access to credit markets, and government assistance (in some cases) have huge advantages.

In late March, the airline industry received $58 billion in government assistance, with the money disproportionately benefiting larger airlines.

This means when the pandemic is over, big companies will be able to "roll up" some of the struggling smaller ones. Even without any large acquisitions, larger firms will see increased market share simply due to less competition.

We call this phenomenon "survive and thrive." And alongside the "At-Home Revolution," it's another big theme emerging in the wake of the pandemic.

It's a phase we always see during economic downturns: consolidation by the healthy companies in the industries challenged by a recession.

One company with the potential to do this is Delta Air Lines (DAL). It's the second-largest U.S. carrier in terms of passengers, trailing only American Airlines (AAL).

Delta received $5.4 billion in aid from the U.S. government, solidifying its financial position throughout the pandemic.

Delta is no stranger to taking advantage of opportunities brought on by recessions. In the midst of the Great Recession in 2008, the company acquired Northwest Airlines for a total enterprise value $10.4 billion.

Delta also acquired or invested in multiple other smaller airlines in the wake of the recession. It was able to use its strong financial position as an industry leader to buy up weaker competitors.

Delta will likely be able to consolidate in a similar fashion after 2020, as smaller airlines struggle to pay their fixed costs amidst reduced travel.

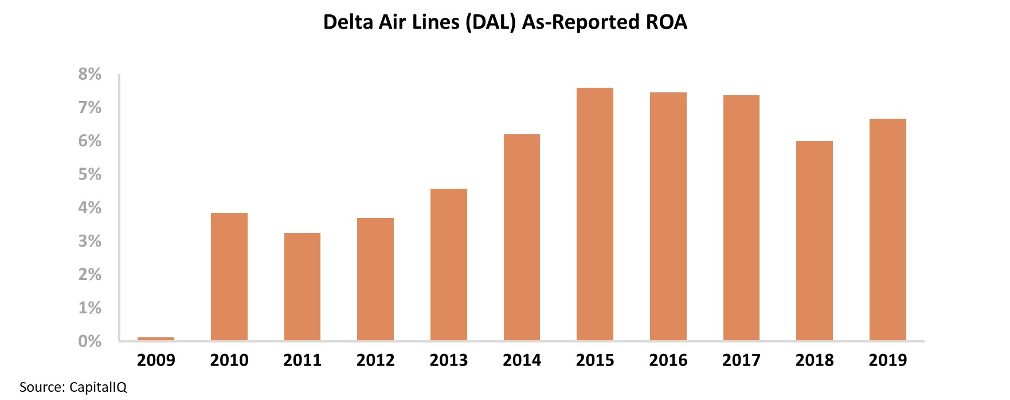

However, looking at Delta's as-reported financials, it's unclear how powerful this strategy was. After the Great Recession, the company's as-reported return on assets ("ROA") jumped from near zero in 2009 to 4% in 2010, before remaining stagnant through 2013. Since then, Delta's as-reported ROAs has risen slightly to 7% – just barely above cost-of-capital levels.

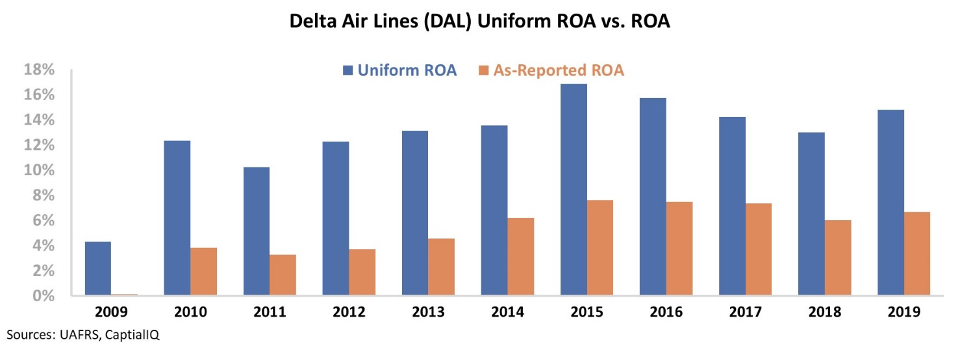

However, this picture of DAL's performance is inaccurate – pulled down by distortions in as-reported accounting. Due to the GAAP treatment of goodwill and operating leases – among other distortions – the market is missing the real story...

Delta was able to emerge much stronger from the last recession, and its consolidation efforts paid off with big returns.

Delta's Uniform ROA has been more than double the as-reported numbers from 2009 to 2019. Additionally, the company's returns accelerated at a much faster rate following the recession. After a brief dip in 2011, Delta's Uniform ROA continued to grow from 10% all the way to 17% by 2015.

Delta was able to effectively capitalize on its bigger size and emerge in a better position after the economic downturn. But the question now is whether Delta can do it again...

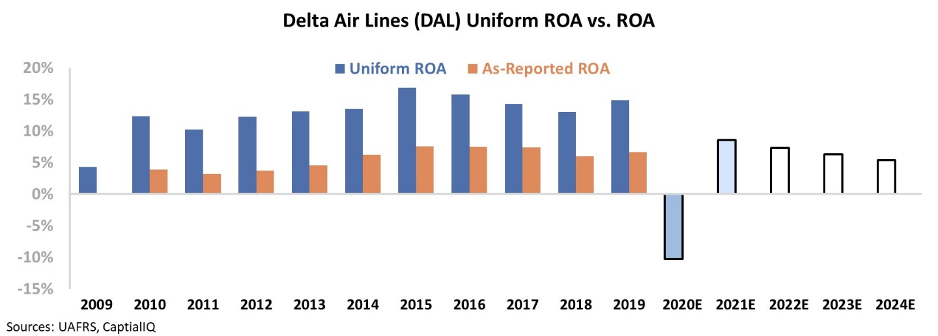

To understand if the market thinks the company can continue to create shareholder value, we can use the Embedded Expectations Framework to easily understand market valuations.

The chart below explains Delta's historical corporate performance levels, in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

As you can see, both analysts and the market expect returns to remain well below recent historic levels. Market expectations are for Delta to sustain 6% returns indefinitely – a level not seen regularly since before the Great Recession.

The market appears to have forgotten what a big player Delta is, as well as the company's ability to consolidate the industry to drive higher returns.

Ultimately, Uniform Accounting shows the true strength of Delta's business and the market's bearish outlook for the company.

Delta was able to benefit from the industry weakness in the wake of the last recession, but the market is taking a much more bearish view in the current crisis.

Without Uniform Accounting, investors would miss a high-return company that may be able to take advantage of sector consolidation... if the industry isn't permanently impaired.

Regards,

Joel Litman

August 19, 2020

P.S. We just found a "survive and thrive" company in the small-cap universe that has massive upside ahead. It's one of many we're likely to see as the market recognizes that some distressed industries aren't going be snuffed out permanently.

On Monday, we shared the full story for subscribers of our Altimetry's High Alpha newsletter. You can get immediate access to this brand-new recommendation with a subscription to High Alpha – learn more here.

It's yet another way the coronavirus pandemic will change travel forever...

It's yet another way the coronavirus pandemic will change travel forever...