Starboard Value has had enough of Autodesk's (ADSK) leadership...

Starboard Value has had enough of Autodesk's (ADSK) leadership...

In a recent letter to shareholders, the activist fund claimed Autodesk didn't share the findings of an audit investigation before its board member nomination deadline... to potentially sway the outcome.

And according to Starboard, that investigation found Autodesk manipulated free cash flow, a key executive compensation metric.

Starboard has a lot of experience with tech companies like Autodesk, which makes design software. (Its most famous offering is AutoCAD, used in engineering and architectural projects.)

In addition to its more than $500 million stake in Autodesk, the fund has been involved in businesses like GoDaddy (GDDY), Salesforce (CRM), and Wix.com (WIX). When it has gone active in the past, those stocks have more than doubled the S&P 500's gains over the same period.

Starboard is now pushing for Autodesk to improve margins, change the way it handles communications to shareholders, and make changes to the board. It also wants Autodesk to explain why it failed to hit 2023 profitability targets set in 2019.

Autodesk has ignored these demands so far. And even if it listened, we doubt it would make much of a difference...

Starboard isn't wrong... Autodesk's profitability has stopped getting better.

Starboard isn't wrong... Autodesk's profitability has stopped getting better.

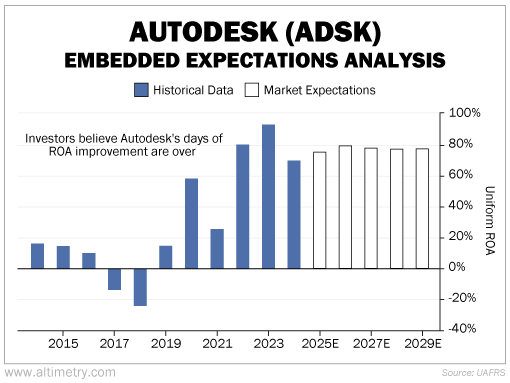

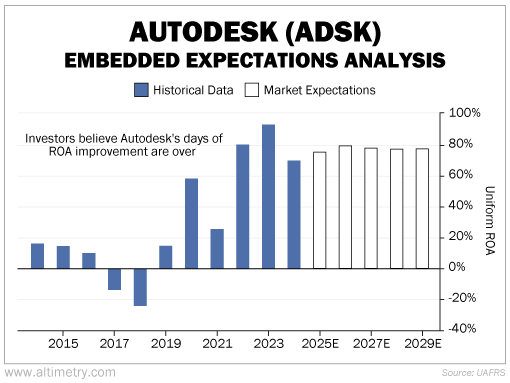

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA works a lot like a betting line in a sports bet. We use Autodesk's current share price to calculate what investors expect from future performance... and compare those forecasts with our own.

It tells us how well our "team" (the company) has to perform to justify the market's "bet" (the current price).

Autodesk used to operate on what's called a "perpetual license model." Put simply, customers paid a lot of money up front to buy Autodesk's software... and owned it forever.

Under this model, Autodesk's Uniform return on assets ("ROA") was in the low double digits.

In 2016, the company moved to a Software as a Service ("SaaS") model. It now sells subscriptions to its software, which tends to mean much stickier revenue.

Uniform ROA jumped from near-zero to more than 90% by 2023. But in fiscal 2024 (Autodesk's fiscal year ends in January), returns dropped back down to 70%. And the market expects them to settle around 80% in the long term.

Take a look...

Starboard argues that last year's drop in returns is due to management's shoddy performance. The fund thinks a new board will revive the uptrend.

However, for once... we're on investors' side.

Autodesk is doing what we'd expect from a SaaS business...

Autodesk is doing what we'd expect from a SaaS business...

These companies tend to cap out around high-double-digit returns.

Take SaaS superstar Adobe (ADBE), which has hovered around 60% to 70% Uniform ROA since at least 2019... or small-business software giant Intuit (INTU), which has averaged around 50% Uniform returns in the same time frame.

Starboard is pushing hard to squeeze out a little more shareholder value. There's a good chance that it's running in circles. It doesn't seem like Autodesk will be an overachiever among SaaS businesses.

We wouldn't necessarily blame management for this company's slowing growth. It could simply be that Autodesk's SaaS transformation is complete... and the well has run dry.

Regards,

Joel Litman

August 1, 2024

Starboard Value has had enough of Autodesk's (ADSK) leadership...

Starboard Value has had enough of Autodesk's (ADSK) leadership...