AI mania is officially out of control...

AI mania is officially out of control...

Even a mention of the technology is enough to send a company's stock soaring. Earnings calls are turning into a competition for who can name-drop "AI" the most.

And that's exactly what we're seeing with one popular clothing-rental provider.

This business recently said it was using AI to help boost sales. Its stock more than doubled on that news alone.

If that sounds ridiculous... it's because it is.

This company has done nothing but lose money. But as you'll see, investors are so caught up in the AI frenzy that they're completely ignoring the fundamentals.

Rent the Runway (RENT) has supposedly gone through an AI transformation...

Rent the Runway (RENT) has supposedly gone through an AI transformation...

Don't fall for it.

In the clothing-rental service's latest earnings call, CEO Jennifer Hyman painted a rosy picture of margin and cost improvements.

She said Rent the Runway has "turned the corner." And she said it's working on using AI to improve its search feature... which thrilled investors.

While it has yet to turn a profit, Rent the Runway now expects revenue growth of 1% to 6% this year.

To be blunt, we doubt that will happen.

Rent the Runway booked a massive $113 million loss in 2023. Sure, that's a slight improvement from its $139 million loss in 2022... but it still has a long way to go.

Shares shot up more than 160% the day after earnings. Never mind that the company is still nowhere close to breaking even.

Investors are so caught up in the AI mania that they don't seem to mind...

Investors are so caught up in the AI mania that they don't seem to mind...

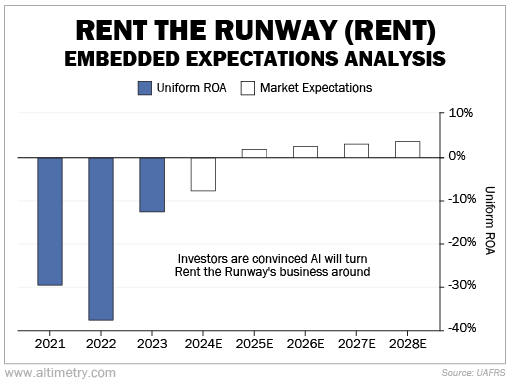

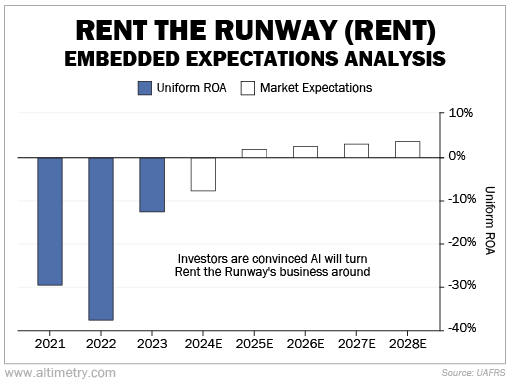

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Rent the Runway's Uniform return on assets ("ROA") has been negative since it went public in 2021. The company isn't projected to turn profitable until 2025, when returns might finally reach an unimpressive 2%.

Clearly, AI isn't doing much for the business. But the market still expects Uniform ROA to approach 4% by 2028... close to breakeven.

Take a look...

Even this mediocre projection is optimistic... considering Rent the Runway has done nothing but lose money.

Shares have been on a one-way trip lower since 2021...

Shares have been on a one-way trip lower since 2021...

They're down a split-adjusted 97%. And that's since the recent earnings boost.

Again, this company has yet to turn a profit. Investors are so caught up in the AI mania that they're ignoring the warning signs.

Don't get caught up in the hype. Rent the Runway has had years to turn its business around... We'll believe it when we see it.

Regards,

Rob Spivey

May 8, 2024

AI mania is officially out of control...

AI mania is officially out of control...