Europe would've been better off letting a student fix its economy... not the experts…

Europe would've been better off letting a student fix its economy... not the experts…

Thomas Herndon was just a graduate student at the University of Massachusetts Amherst in 2013. And his economics professors gave him an innocent enough assignment...

Pick an economic study and recreate the results. There was nothing more to it.

At the time, the world was still recovering from the ripples of the Great Recession. The U.S. was well on its way... but much of the eurozone was still reeling.

Herndon decided to look at a paper by two heavyweight Harvard University professors – Carmen Reinhart and Kenneth Rogoff... The latter was a former chief economist at the International Monetary Fund.

The paper was called "Growth in a Time of Debt." When it was published in 2010, European officials were debating how to save the economy.

Did it make sense to bail countries out with debt, hoping to spur growth? Or should countries enforce austerity measures, slowing government spending as much as possible, and increase taxes to pay down debt quickly?

"Growth in a Time of Debt" examined how economies grow at different debt-to-GDP ratios... It basically pinned down how much debt was packed into the economy.

What nobody realized was that this study contained a grave and preventable error... one that a certain part of the AI ecosystem could help prevent in the future.

According to Reinhart and Rogoff's calculations, the magic number was 90%...

According to Reinhart and Rogoff's calculations, the magic number was 90%...

If a country's debt level surpassed 90% of its GDP, growth slowed dramatically.

The paper became a big part of post-Great Recession economic policy in Europe. Greece, Spain, Portugal, Ireland, and Italy all implemented austerity measures to avoid racking up too much debt. Greece also cut public-sector salaries, froze pensions, and increased taxes on cigarettes and alcohol.

But as it turns out... they likely would've been better off ignoring the advice.

You see, as Herndon tried to complete his assignment, he couldn't replicate Reinhart and Rogoff's results. He spent all semester on it. His professors even got involved. Nobody could come up with the magic 90% number.

After the semester ended, Herndon kept working on the project. He reached out to Reinhart and Rogoff, who sent him their Excel spreadsheets so he could look at the data. He was determined to figure out what he was doing wrong.

But he wasn't doing anything wrong. Reinhart and Rogoff had made the mistakes... Their analysis was riddled with errors.

Fixing the work of world-renowned economists...

Fixing the work of world-renowned economists...

The study supposedly covered 20 countries, yet the spreadsheet only analyzed 15. It was affected by gross outliers like New Zealand, which had one year of high debt and bad economic growth in 1951. That single year was weighted equally to 20 years of high debt and good economic growth in the U.K.

Herndon and his professors "fixed" the data. And they found that high debt isn't nearly as damning to growth as the paper claimed.

Many European nations made critical decisions based on that bad data. They may have been far better off doing the exact opposite. Most of their economies took years to recover. More than a decade later, Greece still hasn't bounced back.

Folks, bad data has been a problem for years. It's not easy to know whether you can trust a particular source or study... and it's not practical to recreate every study you want to use.

Companies have long been searching for a better way. And now, it's finally here.

Artificial intelligence can help, but only if you have reliable data...

Artificial intelligence can help, but only if you have reliable data...

That's where AI "enablers" come in.

Enablers aren't AI solutions themselves... They're companies that enable AI technology to work the way it's supposed to.

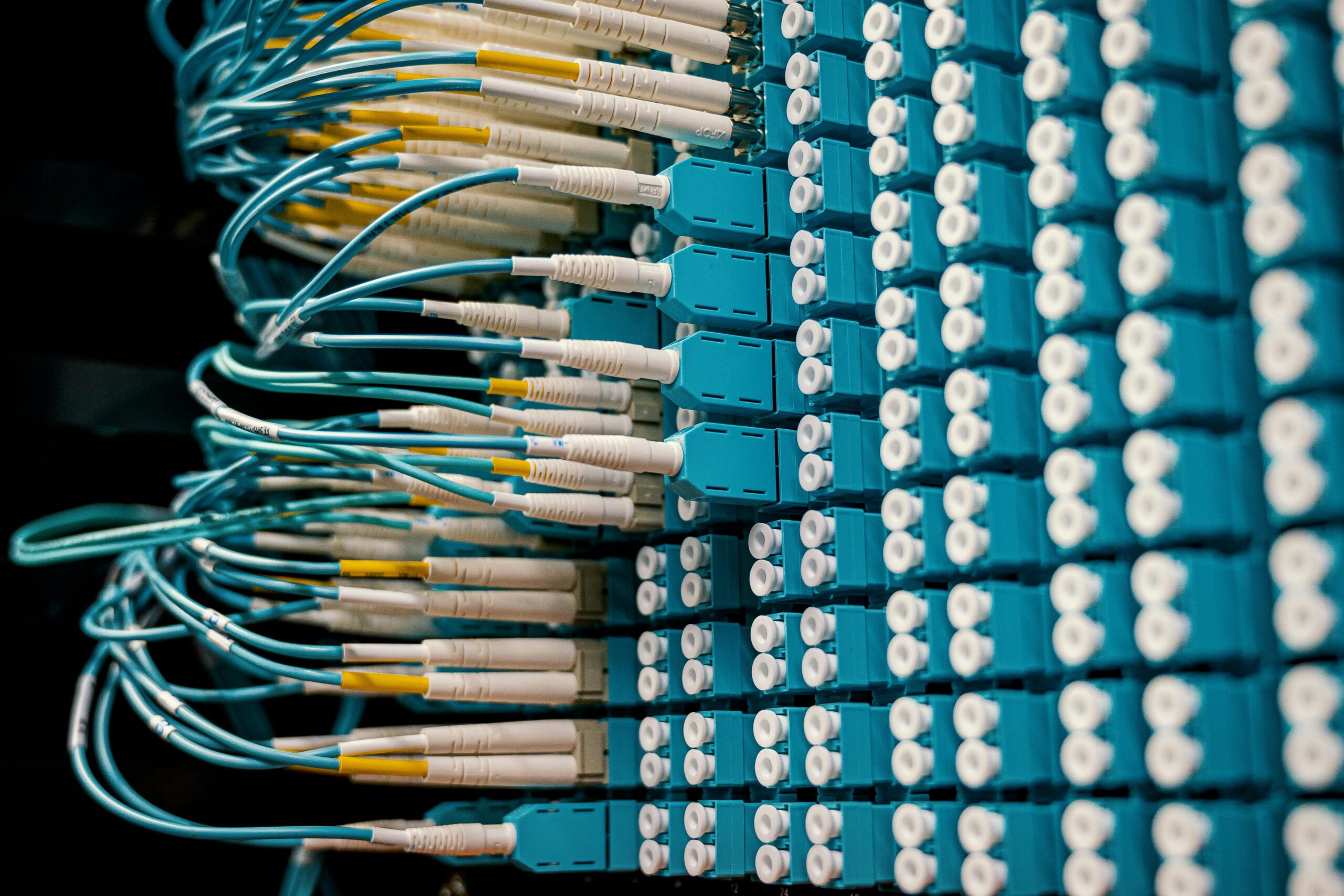

This in itself involves a pretty wide range of companies. Cloud-computing businesses provide a lot of the storage and data transfer needed to make AI work. Consulting firms help companies figure out how to build their businesses to use AI effectively.

Some enablers focus on modernization and data resiliency. These companies don't generate AI models themselves… They create software that helps organize customer data so it's ready for use in AI.

Most companies aren't ready to implement AI today... though they're starting to build the infrastructure for it.

That's why demand will explode for these enablers in the next few years. And their stocks should follow suit.

Regards,

Joel Litman

September 9, 2024

Europe would've been better off letting a student fix its economy... not the experts…

Europe would've been better off letting a student fix its economy... not the experts…