Constellation Energy (CEG) is changing it up...

Constellation Energy (CEG) is changing it up...

The company's main focus has been on nuclear for years. It boasts the U.S.'s biggest nuclear fleet, with enough capacity to power more than 16 million homes.

But energy demand is on the rise thanks to the AI revolution... And while nuclear power can satisfy some of that demand, it's not enough.

That's why Constellation made a surprise move about a month ago, when it bought fellow energy business Calpine for $16.4 billion.

Calpine is a major producer of natural gas and geothermal power producer. By expanding into new energy sources, Constellation is readying to deliver more reliable and diversified power.

In short, Constellation is preparing to fuel the AI space. But investors seem to be getting a little too excited about the stock today...

Constellation is solidifying itself as a major AI vendor for a simple reason…

Constellation is solidifying itself as a major AI vendor for a simple reason…

Existing nuclear plants aren't enough to meet today's demand.

The gap is only going to get bigger. We'll need about 90 gigawatts of new nuclear power to meet data-center demand by 2030, according to Goldman Sachs estimates. But we're only expected to have 10% of that power available.

And since nuclear projects take years to get through approval, we probably won't be able to narrow that gap with nuclear alone.

By expanding into natural gas through Calpine, Constellation is getting a step ahead. It will be bigger and more versatile as we enter this energy transition period.

Plus, it's expanding its footprint in Texas... where power demand is growing rapidly.

With so many tailwinds for Constellation, investors are likely tempted to buy in. That might not be such a great idea, though.

You see, Constellation stock is far too expensive today...

You see, Constellation stock is far too expensive today...

Investors already know Constellation is an important energy player. Shares soared 25% the day it announced the Calpine deal. And they're up an incredible 145% in the past year.

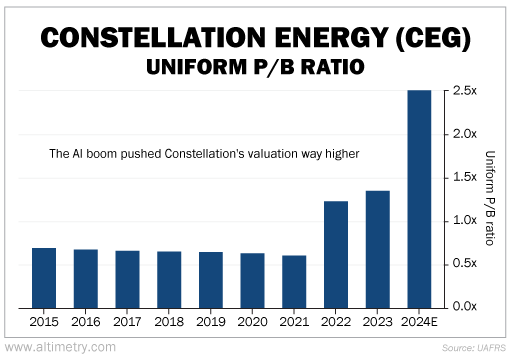

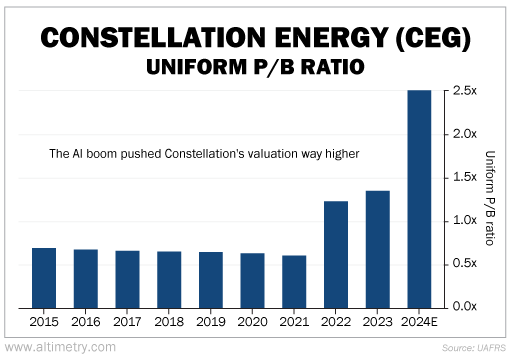

We don't expect much more upside from here. Based on its Uniform price-to-book (P/B) ratio, Constellation is already overvalued...

The Uniform P/B ratio compares a company's total value with the value of the assets on its balance sheet (or "book"). The higher the P/B ratio, the more investors are willing to pay for its assets.

Said another way, it measures how valuable investors think Constellation's assets are.

Before 2022, the company's Uniform P/B ratio was pretty stable, around 0.6 times.

Then came the AI boom.

Uniform P/B jumped to 1.2 times in 2022 as investors jumped on every AI-related opportunity. It hit 1.3 times in 2023... before doubling to an estimated 2.5 times in 2024.

Take a look...

Constellation is now sitting at its highest valuation of the past decade... by far.

The market expects a lot out of this business. Energy companies don't typically command high returns because they struggle to transform demand into high profits.

This is true for Constellation, too. Its Uniform return on assets ("ROA") has been at or below 5% since 2016, less than half the market average.

Investors seem set for disappointment where Constellation is concerned...

Investors seem set for disappointment where Constellation is concerned...

Sure, the company is set to dominate the energy industry. It's already getting more recognition as the U.S. considers nuclear a viable energy source again.

And it's diversifying into natural gas to solidify its strong position.

But investors just expect too much from Constellation. It has a long way to go before high demand turns into high profits... if it ever gets there.

At the end of the day, this is still a low-return energy business. Even the AI boom might not change that.

Regards,

Joel Litman

February 11, 2025

Constellation Energy (CEG) is changing it up...

Constellation Energy (CEG) is changing it up...