Shopify's (SHOP) recent hiring freeze could redefine the U.S. workforce...

Shopify's (SHOP) recent hiring freeze could redefine the U.S. workforce...

The e-commerce giant announced it will only approve new hires for roles that artificial intelligence ("AI") can't fill.

This comes on the heels of similar decisions by technology giant IBM (IBM)... and even smaller companies like Klarna, which provides payment solutions.

They're all pursuing an "AI first" strategy, mirroring Elon Musk's Department of Government Efficiency ("DOGE") mandate for the U.S. government.

Altogether, this illustrates a growing trend among tech companies to double down on AI capabilities. It's what they need to continue evolving... and dominate the competition.

Today, we'll explore how Shopify's AI-driven strategy is leading the pack... This technology could unlock big cost savings, boost profitability, and meet growing investor expectations. And, just as important, it's not the only company capitalizing on this trend.

AI is already shifting the company's financial outlook...

AI is already shifting the company's financial outlook...

Analysts have long speculated that AI could reduce operational costs, optimize products, and enhance user experience. And now, we're finally seeing tangible actions and results.

Shopify's pivot to AI is a strategic bet on efficiency and growth.

The company has already leveraged AI tools, like Sidekick and Shopify Magic, to boost productivity... These tools are helping merchants streamline and automate routine tasks.

With an AI-focused hiring approach, Shopify will scale its offerings without significantly growing its workforce. This will keep company costs in check.

Simply put, the company is using AI to redefine the future of work in the U.S. And, luckily, investors are catching on to the trend...

In fact, they seem to understand Shopify's full potential...

In fact, they seem to understand Shopify's full potential...

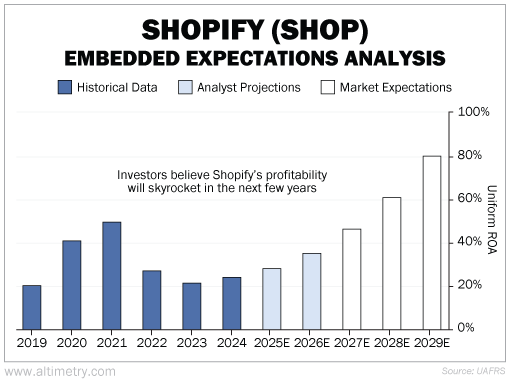

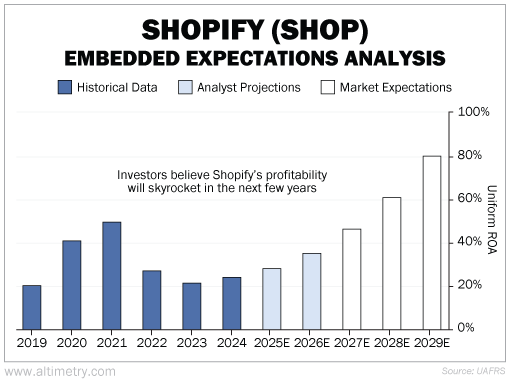

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

The company's Uniform return on assets ("ROA") has hovered around 23% since 2019. (We're setting aside two outlier years due to the COVID-19 pandemic.)

Analysts are projecting a Uniform ROA of 36% by 2026, thanks to the surge in the company's AI initiatives.

Similarly, investors expect Shopify's profitability to continue expanding and its Uniform ROA to reach an impressive 80% by 2029. Take a look...

In other words, the market is already pricing in Shopify's future gains from AI technology.

Wall Street has similar expectations for IBM... Its Uniform ROA is expected to improve over the next few years also thanks to AI.

This underscores just how powerful these tech investments can be. And it's encouraging smaller players (like Klarna) to get on the AI bandwagon, too...

That's why investors should look beyond the usual suspects...

That's why investors should look beyond the usual suspects...

Shopify's AI-focused strategy highlights an important evolution... Businesses must keep up with the latest technology to compete in a rapidly changing environment.

Right now, AI is revolutionizing the corporate playbook. And the companies that embrace this technology – big and small – could see exponential growth.

Folks, there are many potential AI winners out there. What's happening at Shopify will play out at scale in the wider economy...

Lots of smaller, under-the-radar companies may become critical players in the value chain. And they may offer even bigger upside potential than Shopify.

Regards,

Joel Litman

April 23, 2025

P.S. My colleague Rob Spivey and I have found a handful of promising, little-known AI stocks. And there's still time to buy in... for now.

In short, these companies are central to the next phase of AI adoption. We believe they could hand you a string of potential 100%-plus returns. But a crucial deadline is approaching fast.

If you don't act by May 1, you could miss your shot entirely. This could have huge implications for the U.S. stock market. Learn more here.

Shopify's (SHOP) recent hiring freeze could redefine the U.S. workforce...

Shopify's (SHOP) recent hiring freeze could redefine the U.S. workforce...