Sebastian Siemiatkowski once championed artificial intelligence ("AI") as the ultimate tool that would reshape entire industries...

Sebastian Siemiatkowski once championed artificial intelligence ("AI") as the ultimate tool that would reshape entire industries...

About a year ago, the CEO of Swedish "buy now, pay later" company Klarna touted that AI could improve efficiency, accuracy, communication, and the customer experience.

He said that it could cut costs, boost profits, and complete tasks much faster than human employees.

In fact, AI had been so instrumental to Klarna's day-to-day operations that the company stopped hiring workers... as AI could essentially do all of the jobs that humans do.

However, his tone has somewhat changed since then...

Siemiatkowski now worries that AI could ultimately replace even his own work as CEO.

He's not alone. Countless companies are developing AI for various purposes today. And there are very real worries that this emerging tech could soon replace most (if not all) of the traditional jobs.

That said, as Siemiatkowski has lamented in the past, there are still very real benefits to incorporating AI into a business's daily operations.

So today, we'll dive into this major change sweeping through the workforce – including one company that stands to profit from the way companies use AI going forward.

AI is transforming how businesses operate, allowing them to achieve more with fewer people...

AI is transforming how businesses operate, allowing them to achieve more with fewer people...

Complex tasks like data analysis, customer service, and software development are no longer reliant on large workforces.

Siemiatkowski's Klarna, for example, reported that its AI assistant does the work of 700 full-time customer-service agents.

Said another way, businesses can now automate entire teams.

We've said before that companies that don't incorporate AI into their daily operations will fall behind.

Those that enable and support the adoption of AI, though... and help other companies do so... stand to benefit in a big way.

Take Microsoft (MSFT), for example...

It's no secret that Microsoft is at the center of the AI boom.

For starters, it's a major investor in ChatGPT creator OpenAI. It invested $1 billion in the company back in 2019 and, as of last year, has plowed almost another $13 billion into OpenAI since then. Today, it has a nearly 50% stake in the business.

On top of that, Microsoft has been hard at work developing its own AI tools. For instance, it has rolled out an AI assistant called Copilot, which users can access right from their desktop computers. And it's building up its Azure AI suite of cloud-based AI services, which powers AI tools and applications for corporate customers.

Microsoft is already widely used by most individuals and businesses across the country... and folks are only getting more eager to use its products as they scale up their AI tech.

Now, as we recently covered in a Hidden Alpha special report, "Get Rich in the U.S. of AI," Microsoft isn't just a supplier of AI – it also uses these tools to make its own operations more efficient.

Despite the company investing billions of dollars to fund AI projects, CEO Satya Nadella hasn't been getting any requests to increase headcount... across any of Microsoft's businesses.

The company is effectively replacing the need to hire new talent by relying on the tools it's developing. And it's working.

Even though Microsoft isn't actively growing its employee count, it's forecast to grow revenue by $33 billion this year.

Considering that most of the company's operational costs come from employee salaries and benefits rather than machinery, that's a great sign that it'll be able to mint cash in the months and years ahead.

That alone should have other companies chomping at the bit to try to follow its lead.

The market, however, doesn't seem to realize this...

The market, however, doesn't seem to realize this...

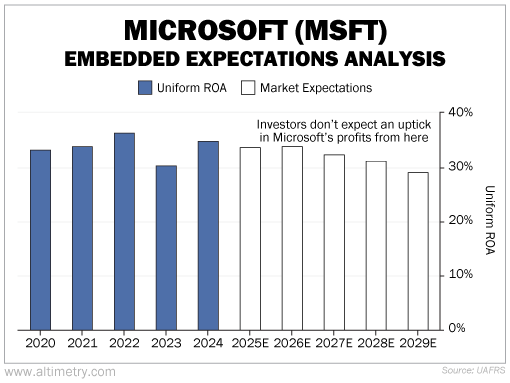

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

As you can see, Microsoft has averaged a Uniform return on assets ("ROA") of about 34% over the past half decade.

And yet, investors currently expect Microsoft to get less profitable... not more. Microsoft is forecast to see Uniform ROA fall to just 29% by 2029.

Take a look...

The market is missing just how powerful AI is for Microsoft's business.

Not only is Microsoft lowering costs and getting more efficient internally thanks to its AI tools... but its sales are likely to continue growing like crazy as more and more companies incorporate AI into their operations.

Microsoft isn't just enabling the AI shift – it's leading it...

Microsoft isn't just enabling the AI shift – it's leading it...

By using AI to drive its own operational efficiency while supporting other businesses, Microsoft is positioning itself to dominate the AI industry – and it's doing so profitably.

Somehow, the market is still underestimating Microsoft's potential despite the bullish outlook.

For savvy investors, that may be where the real opportunity lies... because there's every reason to believe that Microsoft will be able to maintain its strong returns, if not send them even higher.

Regards,

Joel Litman

January 28, 2025

Editor's note: AI helps people and corporations do more with less – and the U.S. government has noticed. In just the past couple years, government spending on AI has surged 1,200%. And with big organizations like the CIA and the Pentagon pushing for new, multibillion-dollar AI contracts, it's unlikely to slow anytime soon.

Every new contract could send another AI stock soaring. Every new approval could see a new group of insiders get rich. Every new deal could create another massive AI opportunity.

So if you missed the AI boom... or wished you played it differently... you're about to get a rare second chance. To learn how you can take advantage of what Joel is calling the "U.S. of AI," click here.

Sebastian Siemiatkowski once championed artificial intelligence ("AI") as the ultimate tool that would reshape entire industries...

Sebastian Siemiatkowski once championed artificial intelligence ("AI") as the ultimate tool that would reshape entire industries...