Amazon has changed retail, but has it paid off?

Amazon has changed retail, but has it paid off?

With the click of a button, you can have just about anything delivered to your doorstep in two days, if not sooner. It's the new normal to shop for household goods, furniture, electronics, clothes, and practically everything else without leaving our homes. Thank Amazon (AMZN) for that.

Many people tend to think of Amazon as an e-commerce company. With total control of its supply chain, it can ship any manner of goods worldwide at the cheapest possible price.

But offering goods as cheap as possible led many to assume Amazon has razor-thin margins. This attitude is summed up in a May 2017 Forbes article titled "The Amazon Era: No Profits, No Problem."

The assumption is that Amazon is too big, too sluggish, and has far too low margins to succeed.

So, is that true?

Amazon appears to be a normal e-commerce business...

Amazon appears to be a normal e-commerce business...

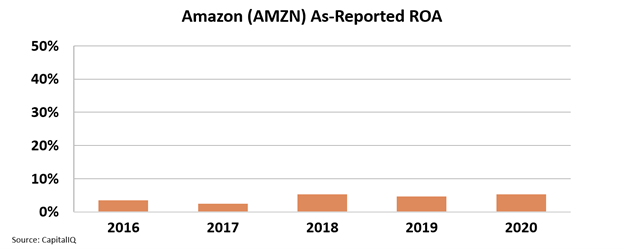

Looking at as-reported metrics, it would make sense why investors think Amazon is a low-margin e-commerce business that doesn't make any money.

Profitability appears to have languished, with its return on assets ("ROA") hovering around the cost of capital at 5%.

Despite dominating the e-commerce industry, Amazon seems to be just getting by and barely making a profit.

The as-reported metrics seem to confirm the common story about how Amazon is competing on razor-thin margins.

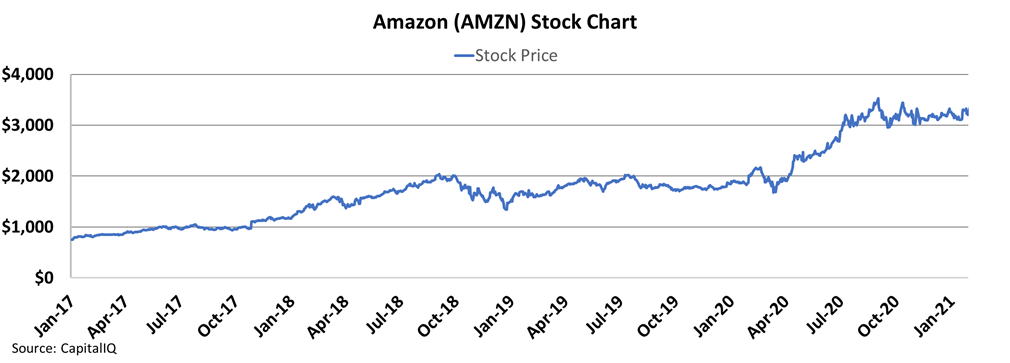

And yet, Amazon's stock continues to rocket higher.

So how has Amazon managed to take the spot as the fourth largest publicly traded company?

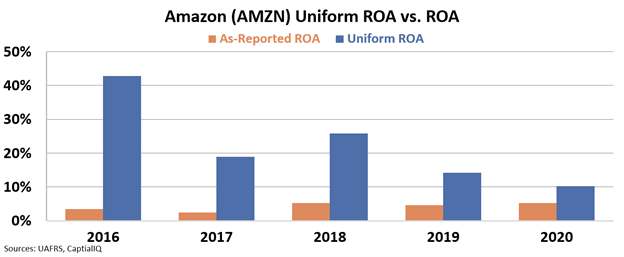

Uniform Accounting shows us Amazon is more profitable than as-reported metrics lead us to believe. Returns haven't been at the cost of capital levels and range from 10% to 40%.

In 2020, Uniform ROA was twice that of as-reported metrics, and in the past five years, Amazon has seen returns as high as 43%

So, where is the profitability?

Amazon makes about $140 billion per year from its e-commerce division, but that's only about half of what it pulls in each year.

The rest comes from the slew of Amazon's other divisions that people often overlook.

In 2006, Amazon launched Amazon Web Services ("AWS"), offering IT infrastructure services to businesses. While it didn't receive much press at the time, AWS runs more than 9 million websites today and dominates the cloud-computing market, with its 33% market share.

Given the asset efficiency of AWS, it makes a ton of money for Amazon.

Several under-the-radar divisions also drive Amazon's profitability...

Several under-the-radar divisions also drive Amazon's profitability...

Amazon Prime is a subscription that offers members free one- and two-day shipping. However, Prime also comes with music and video streaming on top of other benefits.

Amazon Marketing Group ("AMG") introduced targeted ads on external websites. Its decision to purchase Whole Foods, Zappos, and Ring was also essential in expanding its business portfolio.

Amazon has positioned itself to be far more than just an online retailer. In doing so, it has created a network effect that keeps customers coming back and buying into its other business divisions.

Its stock has gained as much as 219,000% since its initial public offering ("IPO") in 1997. Amazon's high return is not solely because of its dominance within e-commerce... And its hidden businesses are powering the engine.

Since 2017, AMZN stock has more than tripled...

Amazon is what we like to call an iceberg stock. Most people know about its e-commerce division, but that is just the tip visible from the surface. Multiple other divisions are the true drivers of Amazon's success.

Investors fail to factor in the profitability of Amazon's other divisions, which is why the stock has gone up so much. The market is repeatedly surprised by what Amazon can do.

Buying hidden businesses like Amazon early on can lead to massive long-term returns for investors...

Buying hidden businesses like Amazon early on can lead to massive long-term returns for investors...

While Amazon has proven it's far more than meets the eye, its days of blistering growth and multibagger upside are behind it.

But we've identified three little-known stocks taking a page out of Amazon's playbook... And I expect these companies to generate gains as high as 1,000% in the coming years.

That's why I just put together a brand-new, never-before-seen presentation detailing everything you need to know about these stocks – including the name and ticker symbol of one of my favorite "hidden businesses" – for free... no credit card or e-mail required.

Watch it right here.

Regards,

Joel Litman

January 26, 2022

Amazon has changed retail, but has it paid off?

Amazon has changed retail, but has it paid off?