Editor's note: Every Friday, we showcase a featured topic from our YouTube show, Altimetry Authority.

This week, we tackle themes from today's episode, which airs at 8 a.m. Eastern time.

Read on below to learn about how AI is boosting Amazon's best business...

Amazon's (AMZN) days of expansion are over...

Amazon's (AMZN) days of expansion are over...

But not in the way you might think.

For decades, the e-commerce giant hired thousands of employees to support its retail and cloud businesses. It employs more than 1.5 million people around the world.

Now, AI is taking over much of that work. Tasks that once required whole teams – like writing internal software, predicting inventory needs, and answering customer questions – are handled by software instead.

And this is only the start. CEO Andy Jassy announced last month that the company will cut corporate staff over the next few years as it rolls out more AI tools.

This move is certainly a way to save money. But it's more than that. Amazon's future layoffs reflect a bigger change in how the company operates... especially in its most profitable business, Amazon Web Services ("AWS").

AWS already made big profits before AI...

AWS already made big profits before AI...

The segment makes money by renting out server space... and more importantly, by selling software, cloud services, and support on top of that.

This combination earns far more than Amazon's retail side. AWS has been the company's main source of profit for years. In 2018, it made up roughly 13% of sales and around 52% of profits.

And those numbers are rising as the AI revolution takes hold.

Every time a customer uses AWS storage, computing power, or advanced tools, Amazon earns revenue.

As businesses adopt AI, they need even more cloud capacity. Amazon already sells AI tools that help customers build and run their own models... which drives even more demand for AWS.

Meanwhile, the company is cutting costs inside AWS. It's using AI to handle everything from coding to customer service... and saving money in the process.

AWS brought in 17% of total sales last year and more than 58% of profits. In other words, as AWS uses AI more, it's getting even more profitable for Amazon.

But while Amazon embraces AI, investors aren't all that excited...

But while Amazon embraces AI, investors aren't all that excited...

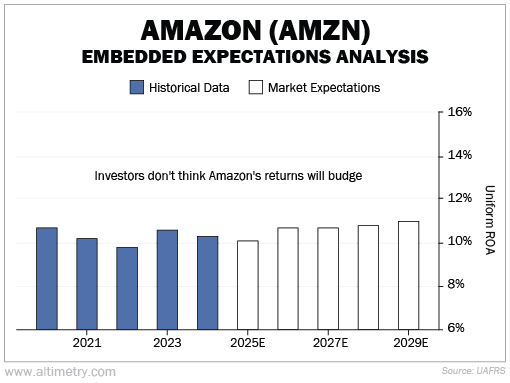

They don't seem to understand this Big Tech mainstay's transformation. We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Amazon's Uniform return on assets ("ROA") has held steady around 11% for the past five years. You might expect returns to rise as the profitable AWS segment gets even better.

But not investors. They think Amazon will stay right where it is...

We've already seen how much more profitable AWS can get in a few years. As Amazon rolls out more AI within the business, it should blow these expectations out of the water.

It's rare to see such low expectations for such an obvious AI winner...

It's rare to see such low expectations for such an obvious AI winner...

Amazon may not have the flashiest models of its peers... or the most prominent AI hardware. But it's a clear winner of the AI race.

We expect AWS to keep growing and boosting Amazon's profit. Most of the market isn't paying attention.

Investors who capitalize on this setup should expect solid gains in the years ahead.

Regards,

Joel Litman

July 11, 2025

P.S. We'll dive deeper into Amazon and AI in today's episode of Altimetry Authority. New episodes air every Tuesday and Friday at 8 a.m. Eastern time.

Check out our YouTube channel right here... and be sure to click the "Subscribe" button.

Amazon's (AMZN) days of expansion are over...

Amazon's (AMZN) days of expansion are over...