China no longer takes the cake as the U.S.'s top trade partner...

China no longer takes the cake as the U.S.'s top trade partner...

For many reasons, that title now goes to our southern neighbor, Mexico.

You see, despite the fact that the U.S. has long benefited from China's low-cost environment, there has been a range of issues when it comes to U.S.-China trade.

For starters, political tensions have been rising between the two countries for years... U.S. companies spent decades pushing as much manufacturing as they could to China to take advantage of its cheap prices. Then, in 2018, former President Donald Trump wanted to limit our reliance on China and instead boost industries at home.

He launched a trade war by imposing various tariffs that made it harder and more expensive to import goods from China. China responded in kind, and most of these tariffs are still in place today.

Then, the pandemic hit... which put even more strain on the U.S.-China trade relationship. China cracked down on COVID-19 hard, leading to massive factory shutdowns, global supply-chain shortages, and a lot of pain for American industry.

Our industrial leaders chose to act fast. Many started pulling production out of China and focused on "reshoring" back to American soil or "nearshoring" to our neighboring countries... like Mexico.

While U.S. trade with China has been declining in recent years, trade with Mexico has been steadily increasing. Between 1993 and 2020, bilateral trade between the U.S. and Mexico grew nearly 500%. And in the first four months of 2023, it totaled $263 billion... solidifying Mexico's spot as America's top trade partner.

As of July, Mexico made up 15% of U.S. imports whereas China made up 14.6%. And the gap seems to be widening...

More and more companies are looking to move their operations closer to home after the pandemic revealed just how difficult and costly it is to operate global supply chains.

And Mexico continues to be a great place for companies to do that, as it provides a similar low-cost environment to China's... albeit one that's much closer.

As we'll explain today, there's a wave of nearshoring headed for Mexico as American manufacturers continue to move their operations out of China. That transition can be complicated, costly, and time-intensive. And the companies they turn to for help are in great shape to reap the benefits...

Foreign direct investment ("FDI") is flooding into Mexico...

Foreign direct investment ("FDI") is flooding into Mexico...

In 2022, the U.S. invested $14 billion into the country. And this year, FDI into Mexico is already up more than 40%...

Yet, this is only the start of the U.S. nearshoring trend.

So far, Mexico has been a solid alternative to avoiding mounting supply-chain problems.

Not only is China getting less reliable, it's getting more expensive. In the ongoing U.S.-China trade war, both countries have imposed tariffs on all kinds of goods – from steel to furniture to audio equipment.

Meanwhile, the 2020 United States-Mexico-Canada Agreement (which replaced the 2008 North American Free Trade Agreement) makes trade with Mexico more appealing. It supports more balanced trade between the three countries, resulting in freer markets and more opportunity for economic growth.

That's incentive enough for more companies to start manufacturing in Mexico, which happens to be cheaper than in the U.S. and Canada. And it's why the Inter-American Development Bank expects nearshoring to add $35 billion of exports from Mexico to the U.S. in the coming years.

The issue is that moving your supply chain across the world is hard. It requires hiring a completely new labor force, finding or building manufacturing space, and spending the time and money to make the transition happen.

That's where companies like Flex (FLEX) come in...

Flex is a fabrication partner, meaning it helps other companies build their products.

It helps manufacturers with everything from the design process... to engineering and logistics... to real-time supply-chain management.

And it's well positioned to take advantage of this wave of nearshoring, as it has a big contract manufacturing footprint in Mexico. About 22% of Flex's sales come from the country.

So you see, Flex is already riding several tailwinds...

It's why we recommended the company in our Altimetry's High Alpha monthly advisory at the end of 2022.

Subscribers who followed our advice are up 20% in about nine months.

And we think the stock has more room to run...

And we think the stock has more room to run...

The market is underestimating the significant trade opportunities that Mexico is poised to offer in the coming years.

As a result, it doesn't seem to see the boost that Flex will get from the billions of dollars being invested into the country. Instead, the market is expecting Flex's profitability to crash.

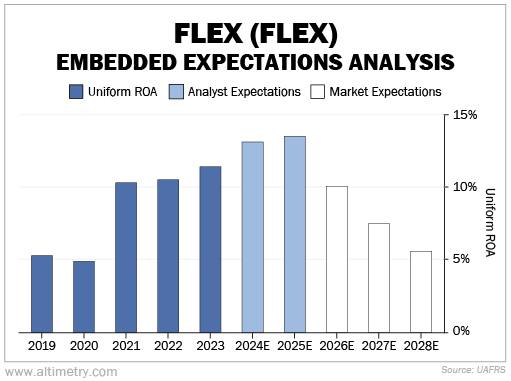

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At current valuations, investors expect Flex's Uniform return on assets ("ROA") to fall from 11% in fiscal year 2023 down to 6% in fiscal year 2028. On the other hand, analysts expect Uniform ROA to keep rising.

Take a look...

There's a clear disconnect here.

Flex has been getting more profitable as more companies nearshore to Mexico. Analysts expect this to continue.

However, the market doesn't seem to understand the tailwinds that will drive earnings higher. In fact, the market seems to think Uniform ROA will fall. The last time Uniform ROA was that low was in 2020... when the pandemic nearly shut down all manufacturing worldwide.

It's only a matter of time before investors catch on...

It's only a matter of time before investors catch on...

Mexico is now our biggest trade partner. It will get a big boost from the wave of nearshoring and the billions of dollars in expected exports in the coming years.

And as we said earlier, this is just the beginning...

Plenty of companies are still in the long, slow process of shutting down operations in China and nearshoring to countries like Mexico. So demand for Flex's services isn't going away anytime soon.

That's why we expect the company's Uniform ROA – as well as its share price – to rise even further.

The market has yet to realize all the tailwinds behind Flex. That leaves plenty of room for investors to capitalize on this opportunity.

Regards,

Joel Litman

September 26, 2023

China no longer takes the cake as the U.S.'s top trade partner...

China no longer takes the cake as the U.S.'s top trade partner...