Editor's note: Every Friday, we showcase a featured topic from our YouTube show, Altimetry Authority.

This week, we tackle themes from today's episode, which airs at 8 a.m. Eastern time.

Read on below to learn about Japan's changing attitude toward shareholders... and why the Nikkei 225 Index's new highs are just the start of the country's bull run.

For decades, Japanese shareholders were expected to stay silent...

For decades, Japanese shareholders were expected to stay silent...

The country's business culture emphasized stability and the morale of employees and customers over stock returns. Investors were supposed to keep quiet and let management run the show.

That mindset helped fuel Japan's "lost decades." The market peaked in 1989. Debt skyrocketed, leading to a wave of "zombie companies." Corporate profits lagged, and the Nikkei 225 Index went nowhere. It took 34 years to reclaim that 1989 high.

But something is changing in Japanese investing culture... A new breed of shareholder has started to break the silence. And a handful of activist investors are making waves.

They're demanding higher returns and better governance. Their presence is shaking up corporate Japan... and propelling the market higher.

Today, we'll explore how these activist investors are reshaping Japan's stock market... and why this may be just the beginning.

One man lit the match... and others are fueling the fire.

One man lit the match... and others are fueling the fire.

Few figures embody Japan's new era of activism more than Yoshiaki Murakami.

Once disgraced for insider trading in the 2000s, Murakami has reemerged as the country's most prominent activist. He's known in Japan as a "Mono iu Toshika," or, literally, an "investor who says things."

Since 2015, he and his affiliates have waged at least 80 activist campaigns. In one case, he forced one of the largest Japanese broadcasters, Fuji Media, to consider spinning off subsidiaries after he bought up a large stake.

In another high-profile campaign, he confronted major oil refiner Cosmo Energy, pressuring management to abandon a poison-pill defense and instead improve shareholder returns.

These aggressive tactics were once unthinkable in Japan. But Murakami has proved that activism can deliver profits. His firms and family now control more than $3 billion in Japanese equities. And their campaigns have inspired others.

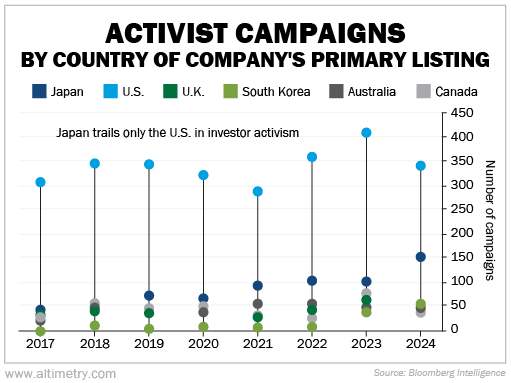

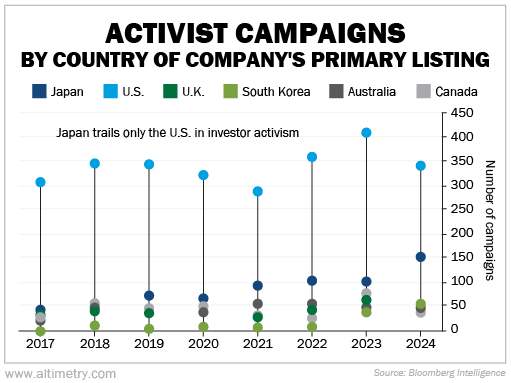

Activist campaigns in Japan nearly quadrupled between 2017 and 2024, hitting at least 146 last year.

That puts Japan second only to the U.S. in shareholder activism.

Funds like Effissimo Capital Management, Strategic Capital, and even global giants like ValueAct Capital and Paul Singer's Elliott Management have joined the fray. Their growing presence signals that activism is becoming part of the investing mainstream in Japan.

This shift hasn't come from activists alone...

This shift hasn't come from activists alone...

Policymakers have also been nudging companies toward more transparency and accountability.

Former Prime Minister Shinzo Abe introduced a corporate governance code more than a decade ago, encouraging firms to respect minority shareholders' rights.

More recently, Tokyo Stock Exchange head Hiromi Yamaji has campaigned to "shame" underperforming companies into improving, as we discussed just over one year ago.

The exchange even publishes lists of firms that submit turnaround plans. All of this is driving Japan's market to act more like the U.S., which is sending the market higher.

The Nikkei 225 reached a new high last year... And it has risen more than 20% since.

As activists put pressure on companies to stay competitive and keep shareholders in mind, Japan's markets should keep hitting new highs. This long-awaited rally has plenty of room to run.

Regards,

Joel Litman

October 10, 2025

P.S. We'll dive deeper into the forces behind the Japanese market's new highs in today's episode of Altimetry Authority. New episodes air every Tuesday and Friday at 8 a.m. Eastern time.

Check out our YouTube channel right here... and be sure to click the "Subscribe" button.

For decades, Japanese shareholders were expected to stay silent...

For decades, Japanese shareholders were expected to stay silent...