Low interest rates were supposed to stimulate the economy... but companies abused them.

Low interest rates were supposed to stimulate the economy... but companies abused them.

For the better part of a decade, businesses collected as much cheap credit as they could. They created a credit bubble propped up by corporate "zombies" – businesses that can barely afford the interest on their debt.

Regular readers know the U.S. recently saw a huge refinancing wave. Companies borrowed more than $600 billion in the first quarter... the most in three decades. They managed to delay corporate debt deadlines and somewhat relieved the credit side.

Not everyone got so lucky. Some – mostly small and midsized businesses – turned to banks for refinancing rather than the public markets.

Banks aren't as willing to lend as bond investors this year. Their rates have been several percentage points higher than the federal-funds rate (the interest rate that the Federal Reserve controls).

Many companies that borrowed from banks are operating from one debt payment to the next. Continued high interest rates aren't helping.

In short, corporate debt levels are rising – and not only in the U.S. If you're not worried about the "walking dead" spreading throughout the global economy, you should be...

Central banks around the world dropped interest rates for much of the past 10-plus years...

Central banks around the world dropped interest rates for much of the past 10-plus years...

And like in the U.S., foreign corporations piled on as much cheap debt as they could.

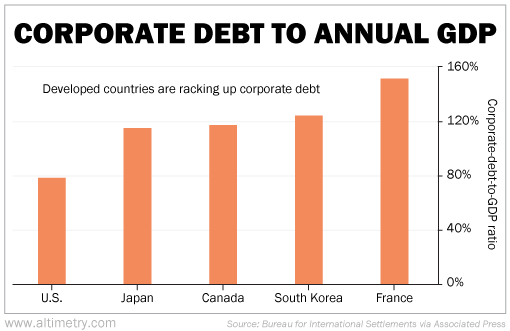

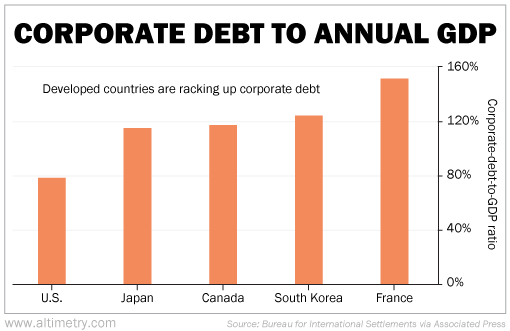

We can see this through corporate debt as a percentage of annual GDP. It's a useful indicator for monitoring a country's credit health.

For the U.S., corporate debt was around 50% in the 1980s. It reached around 80% last year.

That's a big jump indeed... but we're far from leading the way.

Japan's corporate debt is up to 115% of GDP. France's is above 150%... the highest of any major nation.

Take a look...

As you can see, the U.S. is far from the only nation with a zombie problem. About 25% of South Korea's companies are zombies.

And of the nearly 2,000 Canadian companies with public data, an astonishing 1,250 are zombies.

The existence of zombies is cause for concern. But so is their extinction...

Zombies tie up capital and resources that could be used in more productive ways. They hurt economic efficiency and growth. And they can distort the competitive landscape by capturing market share from healthier companies.

But walking dead or not, AP estimates they still provide jobs for 130 million people worldwide.

If a lot of zombies go under at once, the unemployment rate could soar. That's not an outcome any country wants to deal with. It would be a disaster for the global economy.

Of course, not all companies are buried in debt...

Of course, not all companies are buried in debt...

But credit risk can spread through fear and panic. Even the healthy businesses could get dragged down as the zombies start to topple.

It's a tough line to walk. But in the end, it's better to let these companies go under than string them along indefinitely. The sooner a zombie dies, the sooner a strong company can take its place.

That said, any such event is bound to shock investors in the short term. Investors need to be careful with countries that have a lot of zombies... including the U.S.

Once the bankruptcy contagion starts, no economy is safe.

Regards,

Rob Spivey

June 27, 2024

Low interest rates were supposed to stimulate the economy... but companies abused them.

Low interest rates were supposed to stimulate the economy... but companies abused them.