Companies are borrowing like there's no tomorrow...

Companies are borrowing like there's no tomorrow...

At first, it looked like it was mostly private-equity-backed businesses that wanted to give out big dividends before things went sideways.

But since then, borrowing has grown and grown. Investment-grade and high-yield public companies have now joined the fray.

Corporations issued $606 billion of debt in the first quarter. That's 40% higher than the first quarter of 2023... and the highest total since 1990.

It could be that companies are worried about geopolitical concerns surrounding the upcoming election. Or they might believe current rates are the best they'll get.

Either way... this development is completely changing how the debt landscape looks over the next few years.

High interest rates don't cause recessions...

High interest rates don't cause recessions...

Debt headwalls do.

Since the Federal Reserve began raising interest rates in March 2022, yields on new debt have skyrocketed.

Companies that could borrow at 2% or less are now lucky to lock in 5.5% interest rates. And riskier companies that have to accept high-yield rates are typically borrowing for 10% or more.

When companies have a ton of debt coming due, and they can't borrow more and can't afford to pay it off... they have no choice but bankruptcy.

The warning signs typically come a few quarters before catastrophe strikes. Cash flows, profitability, and overall financial health show signs of strain well before the actual maturity date.

Companies got used to nearly free debt. They haven't needed to pay high interest rates for years.

So when the Fed raised interest rates to their highest levels in decades... it seemed like a clear sign that borrowing would slow down.

We expected sky-high rates to scare companies away from refinancing...

We expected sky-high rates to scare companies away from refinancing...

But that doesn't seem to be the case. Even though interest rates have stayed at their highest levels in 20 years... companies are starting to borrow more.

All that borrowing is actually starting to push back the corporate debt headwalls that were piling up.

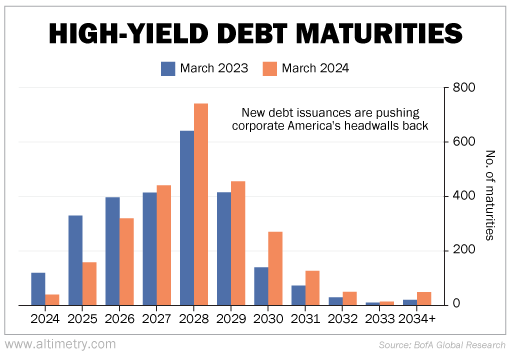

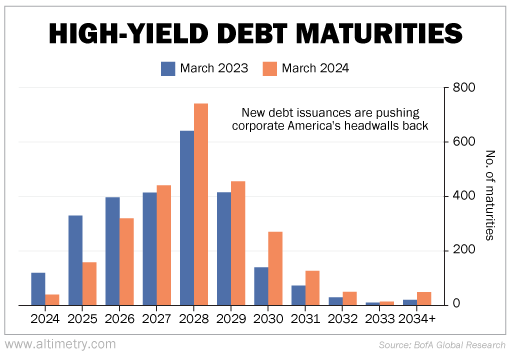

Take a look at the following chart. It shows debt maturities for the next decade-plus as of March 2023 and March 2024.

As you can see, the $606 billion in new debt issuances has significantly cut down on junk-bond and leveraged-loan debt maturities in the next two years...

Companies have cut 2024 debt maturities down by at least 75%. And they've cut 2025 debt headwalls in half.

Suddenly, the corporate-debt landscape looks far less intimidating.

Without a serious debt headwall, the market could easily keep climbing...

Without a serious debt headwall, the market could easily keep climbing...

We'll have to keep a close eye on the debt that remains over the next two years. And we'll have to see if companies can handle their higher interest payments.

As it stands, we could still get a wave of bankruptcies... even if it's smaller than we anticipated. If enough companies go under, it'll scare investors.

But this mass refinancing could keep the market afloat longer than we thought. It's yet another reason to pay attention to the debt environment.

Regards,

Rob Spivey

April 10, 2024

Companies are borrowing like there's no tomorrow...

Companies are borrowing like there's no tomorrow...