If there's one man to thank for Japan's stock market recovery, it's Hiromi Yamaji...

If there's one man to thank for Japan's stock market recovery, it's Hiromi Yamaji...

Yamaji is a former investment banker who took over as head of the Tokyo Stock Exchange. He's also chief operating officer of Japan's Exchange Group... which controls Japan's stock exchanges.

In the past few years, he has been pushing hard to bring Japan's corporate culture in line with the U.S. He's hoping Japanese stocks will follow suit.

His efforts looked extremely successful earlier this year. Japan's stock market hit a new high for the first time in more than three decades.

Then Japan hiked interest rates at the end of July... and the "yen carry trade" started to unwind.

International investors had borrowed yen at extremely low interest rates to invest in higher-yielding markets. When the Bank of Japan signaled it was willing to raise rates, some of these investors rushed to close their trades.

Investors panicked about the Japanese stock market. Even though it has rebounded somewhat, the Nikkei 225 Index is still 10% off its all-time high from earlier this year.

That said, this was a pretty short-term pullback... after a pretty slow and steady multiyear rise higher. And much of that rise is thanks to Yamaji.

Today, we'll take a look at some of the changes Yamaji has pushed for... and whether it could be the start of a larger transformation for Japan's economy.

Yamaji realized many Japanese corporations fostered a culture of survival... not growth.

Yamaji realized many Japanese corporations fostered a culture of survival... not growth.

That's how Japan ended up with so many "zombie companies"... or companies that couldn't even afford the interest on their debt. Japanese banks were happy to prop up these zombies with easy access to liquidity, rather than letting them die.

Yamaji wasn't satisfied with that approach. He embarked on a campaign to "shame" companies that weren't performing well and didn't have plans to improve their performance.

The Nikkei now publishes a list of companies that have submitted performance improvement plans. To avoid embarrassment, a lot of companies are rushing to get their names on the list.

They were forced to find ways to boost their stock performances... by improving corporate governance, issuing dividends, and buying back shares.

Yamaji has also prioritized travel to other countries, meeting with money managers to increase foreign inflows. Twenty non-Japanese companies are supposedly in the process of listing their stocks on Japanese exchanges.

In short, Yamaji's approach has driven significant investment into Japanese companies from foreign investors. The market value of the Tokyo Stock Exchange is up by $1.73 trillion since Yamaji took over.

And the stocks on the exchange have earned all that extra value...

And the stocks on the exchange have earned all that extra value...

You see, Japanese companies are making more money than ever before.

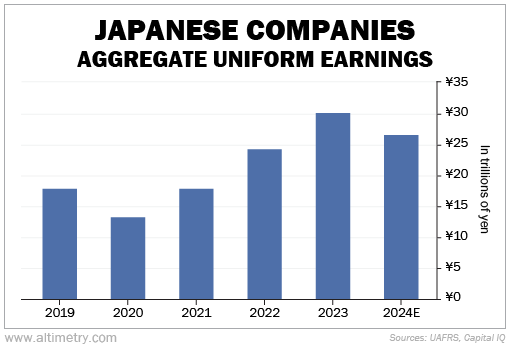

Take a look at the following chart. It shows aggregate Uniform earnings for all major Japanese companies.

Uniform earnings reached an all-time high in 2023. And 2024 is expected to be the index's second-best year ever...

As you can see, Yamaji's work has been paying off big time. The first year he took over, in 2021, aggregate Uniform earnings only reached 18 trillion yen. They already surpassed 25 trillion yen this year.

And until the yen carry trade took a hit, Japan was attracting more foreign investors than it has in years.

Yamaji wants Japan to regain its place as a regional financial hub akin to Singapore or Hong Kong...

Yamaji wants Japan to regain its place as a regional financial hub akin to Singapore or Hong Kong...

And while it won't be a completely smooth ride... he seems to be making the right moves.

The yen carry trade was a major hiccup. If the Bank of Japan keeps hiking rates, that could spook investors further.

That said, Japanese corporations are becoming more profitable. The Japanese market as a whole is becoming more attractive to global investors. We doubt Yamaji will let the recent dip deter him.

Japan could be a good market to invest in for the long term.

Regards,

Joel Litman

August 22, 2024

If there's one man to thank for Japan's stock market recovery, it's Hiromi Yamaji...

If there's one man to thank for Japan's stock market recovery, it's Hiromi Yamaji...