Central bankers never want to make headlines...

Central bankers never want to make headlines...

When they do, it usually causes more harm than good.

These folks prefer to operate behind the scenes. They move quietly, nudging the economy along. If they're on the front page of global newspapers, it's probably for all the wrong reasons.

That brings us to the Bank of Japan ("BoJ")... which achieved some unfortunate celebrity when it raised its target interest rate last week.

Pundits are looking for an explanation for the U.S. market's recent drop. Many are now convinced the blame lies with the BoJ.

Big negative moves are scary... And it's natural to want to make sense of market panic with a simple answer. But as we'll explain today, Japan alone didn't cause the market's problems.

Anyone blaming the BoJ is missing the bigger economic picture.

Some media commentators are obsessed with the 'yen carry trade'...

Some media commentators are obsessed with the 'yen carry trade'...

The yen has had extremely low (and often negative) interest rates for years. U.S. hedge funds took advantage of this by borrowing tons of yen... and funneling it right back into U.S. or other international investments.

Put simply, they borrowed cheap currency to invest in more expensive markets. Since they're borrowing at such a low rate, pretty much any return is positive.

Excluding bank-to-bank lending, Japanese banks have made more than $890 billion (126 trillion yen) by lending to international borrowers. And that doesn't fully capture the size of the yen carry trade for investors, since plenty of non-bank entities participate.

By some metrics, it had become one of the most crowded trades on Wall Street in recent years. Then in 2022, the U.S. started hiking rates... and the pot got even sweeter.

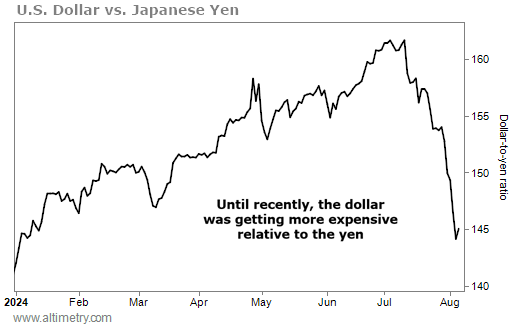

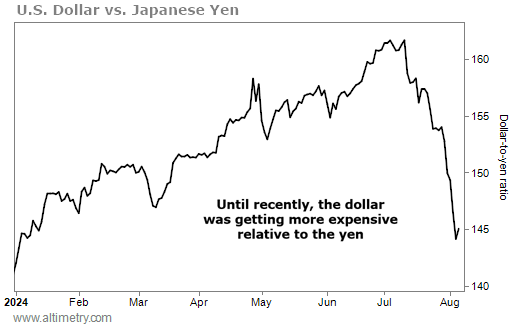

Thanks to the big interest-rate dislocation between the U.S. and Japan, the yen fell in value relative to the dollar.

In late 2021, before rate hikes took off, a dollar was worth around 115 yen. By early July 2024, a dollar was worth 160 yen.

Take a look...

The yen carry trade wasn't just offering cheap money to invest in the rest of the world.

As the value of the yen fell relative to other investments, so did the value of the debt these traders held.

Then, the BoJ took away the punch bowl...

Then, the BoJ took away the punch bowl...

It raised its target interest rate to 0.25% at the end of July.

Plus, it's now talking about going on a hiking cycle... just as the U.S. Federal Reserve is talking about cutting rates.

The yen trade is headed in reverse. A dollar is now worth around 145 yen, compared to 160 yen in July. Folks are drawing connections between the yen's rapid appreciation and the equally rapid pullback in U.S. markets.

According to this narrative, investors are rushing for the exits. They got scared they'd owe more money to close their carry trades in the future, so they sold out of their investments as fast as they could.

As the pundits paint it, if the BoJ hadn't started raising interest rates, the U.S. market would be fine. This must be just a minor technical pullback.

These folks are ignoring the real news behind the recent market turmoil... which originated on our side of the Pacific Ocean.

A lot of economic data came out in the back half of last week. And it changed the math for the U.S. economic outlook.

Employment is getting weaker. Manufacturing is at a multi-month low. Investors are seeing increased risk of an economic slowdown, so they sold U.S. stocks.

It's that simple.

Now, for some investors, that meant paying back their yen borrowings...

Now, for some investors, that meant paying back their yen borrowings...

And they had to buy back yen to do so.

Folks are also betting the yen will get stronger, since the BoJ is tightening while the Fed is likely easing.

These two factors pushed the yen higher. But that's the point... The unwinding of the U.S. macro bet likely pushed the yen's move. It's less likely that the yen carry trade caused the U.S. market to plummet.

If today's rout was because of the yen carry trade unwinding, this would be an opportunity for investors. But this move is about bigger-picture macro factors. You need to exercise caution before jumping in.

We're not calling for a bear market collapse and for the sky to fall on the market. That being said, U.S. economic data has changed for the worse.

We often say you should reserve stock investments for money you don't need to touch for five to 10 years.

If you're worried about how a pullback could impact you in the near term, you have money in the market that shouldn't be there.

Regards,

Rob Spivey

August 7, 2024

Central bankers never want to make headlines...

Central bankers never want to make headlines...