For the past month, interest-rate cuts were all anyone paid attention to...

For the past month, interest-rate cuts were all anyone paid attention to...

It's certainly a big deal that the Federal Reserve cut rates for the first time since 2020. And the cut came in at 50 basis points instead of the widespread expectation for 25, adding to the market's excitement.

However, investors overlooked another incredibly important development last month... one that had to do with U.S. banks.

In short, banks secured a victory with regulators over capital requirements.

Regulators have been pushing for big banks to carry a lot more capital. They wanted to safeguard the economy from potential crises. Back in July 2023, regulators demanded a 19% jump in capital.

After a lot of back and forth, though, banks negotiated that number down to 9%... a huge retreat from the initial request.

This isn't only a big win for banks, either. As we'll discuss today, borrowers have a lot to gain from a win that nobody is talking about...

The initial proposal of 19% would have given banks much less room to maneuver...

The initial proposal of 19% would have given banks much less room to maneuver...

It would have tied up more capital, meaning lower returns on equity ("ROE").

Put simply, banks would have been less profitable. And that means fewer people would be investing in banks, since investors would earn lower returns by putting money into less-profitable businesses.

That's why banks launched an aggressive lobbying effort following the proposal's introduction last year. Their victory isn't only a big deal because of ROE, either...

See, for every dollar of capital a bank has to tie up on its balance sheet, that's a dollar it can't deploy as loans into the economy.

With these lower capital requirements, banks can lend more compared with the initial capital-hike suggestion.

And this is crucial for borrowers... because banks can inject more capital into the system and have greater flexibility to lend. That should boost credit availability.

As more banks start to lend more money, the element of competition also kicks in. Borrowers will have more options to choose from. So banks will need to up the ante to attract borrowers... by lowering the interest rates they offer.

This may also change one of the U.S. lending environment's biggest overhangs...

This may also change one of the U.S. lending environment's biggest overhangs...

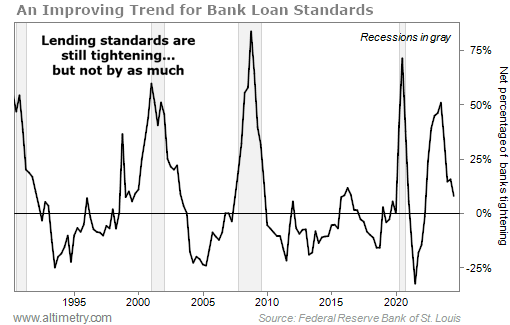

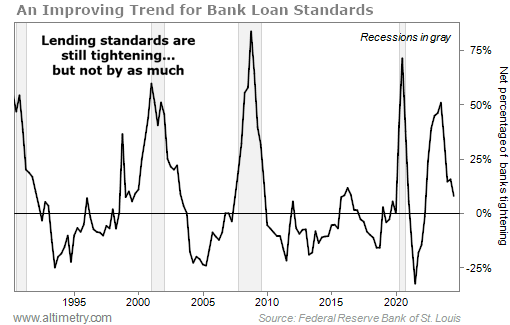

Longtime Altimetry subscribers are familiar with one of our favorite ways to track credit standards, the Senior Loan Officer Opinion Survey ("SLOOS").

The SLOOS is a quarterly survey from the Fed. In short, it gathers information about lending practices in the U.S... by asking loan officers if their lending rules have tightened, eased, or remained unchanged in the past three months.

Lending standards have been tightening for some time. We saw the most aggressive tightening last year... In the first quarter of 2023, 45% of banks tightened lending standards. In the second quarter, 46% made them even stricter. And 51% tightened them again in the third quarter.

They capped off their strict lending year in the fourth quarter, with 34% of banks tightening once again.

This year has been a different story. Only 15% of banks tightened lending standards in the first quarter... 16% in the second quarter... and just 8% in the third quarter.

So while standards were still getting tighter last quarter, it wasn't nearly as aggressive as it has been.

Take a look...

Now that banks know their capital requirements will be lower than expected, it should further improve this trend...

Now that banks know their capital requirements will be lower than expected, it should further improve this trend...

Lending standards will relax, helped by heightened credit competition.

And with debt more accessible, businesses will have room to invest and grow... giving a boost to the market.

While folks haven't paid much attention to the new capital requirements, they should. This could be the exact signal the market needed to start borrowing from banks again.

Regards,

Joel Litman

October 28, 2024

For the past month, interest-rate cuts were all anyone paid attention to...

For the past month, interest-rate cuts were all anyone paid attention to...