Most of the time, sea trade works like clockwork...

Most of the time, sea trade works like clockwork...

And most of the time, it goes largely unnoticed.

Ships are the lifeblood of world transportation. More than 80% of all internationally traded goods are carried by maritime transport. other form of transportation.

And yet, most folks only appreciate its importance when it's disrupted.

Sea trade has faced some challenges in recent years. Starting in early 2022, the Russia-Ukraine war disrupted Black Sea shipping routes... hurting oil and grain.

A severe drought in the Panama Canal restricted transit capacity, creating long waiting lines to pass through the canal for most of the past year.

And this year, pirate attacks have been ramping up in the Red Sea... forcing ships to sail all the way around Africa to get from Asia to Europe (or vice versa).

All of this is putting pressure on much of the industry... and on consumers. However, as we'll explain, one corner of the supply chain is benefiting from the shipping industry's short-term problems.

Recent disruptions mean longer transportation times, higher costs, and fewer available ships...

Recent disruptions mean longer transportation times, higher costs, and fewer available ships...

On top of that, as geopolitical risk increases, insurance premiums also increase.

As recently as last October, shipping containers only had to pay about 0.07% of the value of the ship in "war risk premiums." This year, ships are paying upward of 1%.

That means even higher shipping prices.

None of that is great for the consumer. However, container shipping companies like Maersk (MAERSK-B.CO) are having a banner year...

Maersk and its peers carry cargo all over the world. It's not an exaggeration to say the entire supply chain relies on them. So they see constant strong demand with plenty of staying power.

Sea trade disruptions aren't hurting Maersk's business. If anything, they're helping. The company gets to charge customers more, maintaining or even improving margins.

With operations in more than 130 countries, Maersk is the world's biggest container shipping company. And its massive network is getting a big boost from higher prices.

At the beginning of June, the company raised full-year estimates for earnings before interest, taxes, depreciation, and amortization ("EBITDA")... earnings before interest and taxes ("EBIT")... and free cash flow ("FCF")... all by $3 billion.

That's a huge jump in estimates. And yet, shares are down 8% since the announcement.

Despite the tailwinds behind Maersk, investors are bearish...

Despite the tailwinds behind Maersk, investors are bearish...

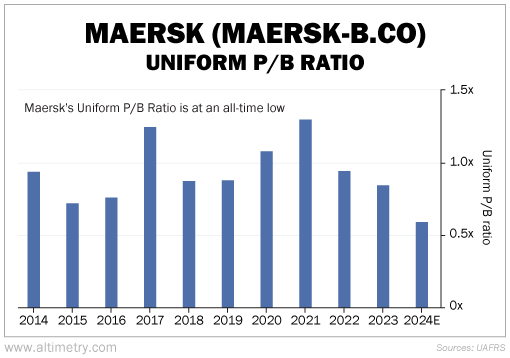

We can see this through the Uniform price-to-book (P/B) ratio.

The P/B ratio compares a company's total value with the value of the assets on its balance sheet (or "book"). The higher the P/B ratio, the more investors are willing to pay for its assets.

A company normally trades below a Uniform P/B ratio of 1 when the market is worried about bankruptcy risk. And yet, Maersk currently trades at a 0.6 times Uniform P/B ratio... its lowest level in 15 years.

Valuations weren't even this low when Maersk reported losses in 2016.

Take a look...

There's no reason for Maersk's Uniform P/B ratio to be this low... unless the company goes bankrupt and is forced to sell off its assets.

Based on recent stellar guidance, we wouldn't hold our breath.

Despite recent challenges, sea trade isn't going anywhere anytime soon...

Despite recent challenges, sea trade isn't going anywhere anytime soon...

And neither is Maersk. It's at the top of its market... and it's trading at a rare discount relative to its assets.

The company should maintain its solid performance at a minimum. Eventually, investors will realize that a few extra short-term costs won't doom the shipping industry.

Maersk's valuation won't stay this low for long.

Regards,

Joel Litman

June 25, 2024

Most of the time, sea trade works like clockwork...

Most of the time, sea trade works like clockwork...