AI was one of the strongest drivers for the stock market this year... And not everyone is happy about it.

AI was one of the strongest drivers for the stock market this year... And not everyone is happy about it.

On the one hand, AI-focused companies such as chipmaker Nvidia (NVDA) rallied like crazy. Nvidia owns the platform that everyone needs to develop best-in-class AI software... and its stock has tripled this year.

On the other hand, AI poses an existential threat to businesses like education-technology provider Chegg (CHGG). Students used to use Chegg to help with studying... now, they're using AI chatbot ChatGPT. Chegg fell 65% in the first half of 2023.

Much of the media industry is also at the forefront of the AI battle. AI models like ChatGPT have to train themselves on tons of information. And one of their biggest sources is online media.

This has become a contentious topic... because AI companies access most of this media for free. And if it keeps getting more advanced, AI threatens to replace traditional media companies.

However, that doesn't mean you should pull your money out of all media stocks. As we'll discuss today, the threat of AI is actually creating a huge opportunity for some investors in the media space... as long as you know where to look.

Rather than digging its heels in, digital-media company Ziff Davis (ZD) is taking the AI battle into its own hands...

Rather than digging its heels in, digital-media company Ziff Davis (ZD) is taking the AI battle into its own hands...

Some media mainstays – like IAC (IAC) Chairman Barry Diller, who controls brands like Investopedia and People Magazine – have threatened to sue AI companies for using copyrighted data.

Diller believes they should pay billions of dollars for profiting off his businesses' property without paying a cent.

Others see the writing on the wall. They're trying to partner with AI companies now to prevent more pain... like the New York Times (NYT), which is working with Google parent Alphabet (GOOGL) on tools to distribute its content.

Ziff Davis falls into the second category.

It specializes in the technology and gaming markets through publications like PCMag and gaming-focused website IGN. It also owns medical publication MedPage Today.

The company recently made a $25 million investment in an AI company called Xyla.

Xyla has an AI tool called OpenEvidence that almost instantly pulls the latest medical research from millions of medical journals. Ziff Davis plans on offering MedPage visitors access to this tool to keep people reading.

Tools like this have the potential to keep readers coming back to Ziff Davis' websites. And that could dramatically change the company's earnings potential...

And yet, the market still thinks Ziff Davis' business is melting away...

And yet, the market still thinks Ziff Davis' business is melting away...

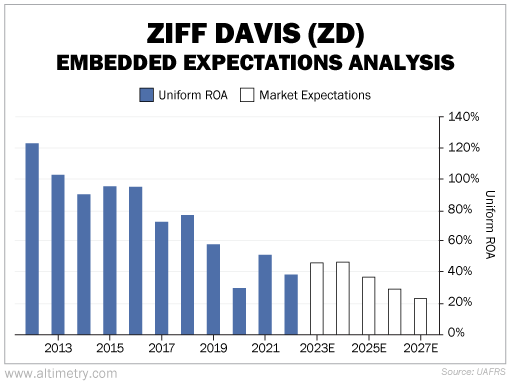

The company's Uniform return on assets ("ROA") has been falling for years now. It was above 120% back in 2012, or 10 times the corporate average.

That number has fallen almost every year since. Today, it sits around 35%.

While we believe AI could give Ziff Davis a much-needed boost, the market doesn't feel the same way. We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA works a lot like a betting line in a sports bet. We use the current share prices of these streaming giants to calculate what investors expect from future performance... and compare those forecasts with our own.

It tells us how well our "team" (the industry) has to perform to justify the market's "bet" (the current price).

The market expects Ziff Davis' Uniform ROA to get cut nearly in half over the next five years. Take a look...

The market's predictions would certainly follow the historical trend. These expectations wouldn't be unreasonable... if it weren't for Ziff Davis' new AI investments.

We've seen how powerful AI can be for businesses and stocks. Just look at how AI transformed Nvidia. Before this year's rally, shares were down 50% in 2022.

In the media industry, companies that are willing to adopt AI are much less likely to be caught unawares down the road.

Ziff Davis has clear potential to turn its business around... and investors still have time to jump in before the market realizes.

Regards,

Joel Litman

September 6, 2023

AI was one of the strongest drivers for the stock market this year... And not everyone is happy about it.

AI was one of the strongest drivers for the stock market this year... And not everyone is happy about it.