The economy and the stock market are painting two very different pictures today...

The economy and the stock market are painting two very different pictures today...

You see, last year, the Federal Reserve raised interest rates by roughly 4% to combat rampant inflation. This crushed the market...

The S&P 500 Index fell 19%, marking its worst year since the Great Recession.

Not a lot has changed for the economy as a whole in 2023... Inflation remains above the Fed's 2% target rate. The credit market continues to tighten. And the central bank just announced that it will be raising interest rates another quarter percent to a 22-year high.

Now, despite continued signs that the economy is under pressure, the S&P 500 is up nearly 20% year to date.

Market sentiment is much better than it was back in January. In fact, investors are fairly bullish.

A look under the hood, though, tells us some industries are being left behind...

The telecom industry, for example, is down more than 8% so far this year – as measured by the SPDR S&P Telecom Fund (XTL).

Telecom companies carry a ton of debt. After all, it is a highly capital-intensive industry... These companies rely on debt to fund their continuous investments in infrastructure.

However, with interest rates so high and the Fed not ruling out further rate hikes, that debt is more expensive today. And investors are worried telecom companies won't be able to keep up.

Their spending budgets might just take a hit. And unfortunately, telecom companies may have to cough up a big chunk of cash soon...

A recent Wall Street Journal investigation found that more than 2,000 telecom cables around the country are covered in toxic lead. These cables are found underwater, in soil, and on utility poles. And they pose a serious health risk to Americans who are exposed.

Environmental groups have urged the Environmental Protection Agency to call for the immediate removal of these cables.

This could cost telecom companies millions – if not billions – of dollars.

Today, we'll look at what yet another obligation means for the sleepy telecom industry. As we'll show you, there's good reason for investors to be steering clear...

Network providers have to spend big just to stay afloat...

Network providers have to spend big just to stay afloat...

It's not easy for telecom companies to keep up with technological advancements.

For instance, when cellphone companies start moving from 4G to 5G, telecom operators have to transform all their infrastructure to be able to provide that next-generation service.

Telecom giants like AT&T (T) and Verizon Communications (VZ) have spent billions of dollars investing in 5G towers and access to the 5G spectrum.

Verizon paid $45.5 billion in a 2021 spectrum auction for the license to use important airwaves fit for deploying 5G. AT&T spent $32.5 billion.

Unfortunately, these big investments didn't even lead to better returns...

That's because cell service is basically a commodity. Telecom companies need to provide the latest product so they don't fall behind, which means they pretty much need to spend billions of dollars every time a new product comes out.

That doesn't mean they can charge more money, though. The telecom industry is highly competitive. And the big network providers compete on price.

As a result, both AT&T and Verizon have struggled to increase their profitability.

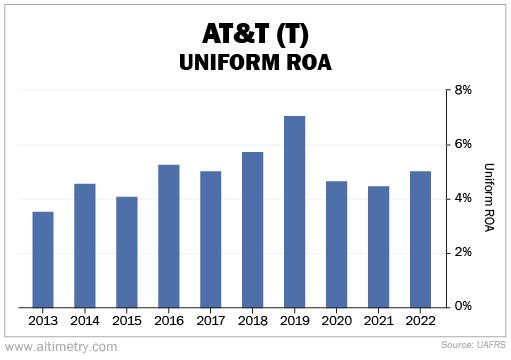

AT&T's Uniform return on assets ("ROA") has averaged about 5% since 2014, which is just enough to cover its costs.

Take a look...

As you can see, its massive spectrum investment in 2021 hasn't helped improve returns at all. They've pretty much remained flat...

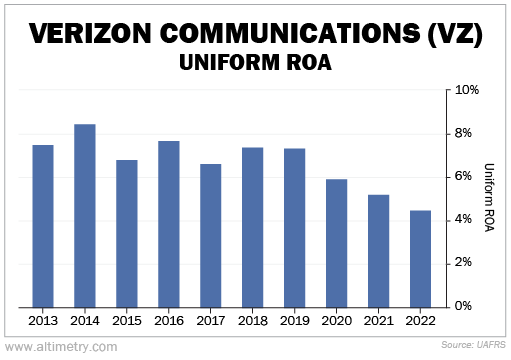

The same is true for Verizon. Its profitability has been slightly higher than AT&T's – closer to an average of 7%. Still, the 5G rollout didn't boost profitability...

In Verizon's case, Uniform ROA is actually down from 2021.

These companies have spent billions upgrading their infrastructure, yet it hasn't translated into improved returns. That's because these investments are the bare minimum needed from telecom just to stay in business.

Telecom companies have barely kept up with their cost of capital over the past decade...

Telecom companies have barely kept up with their cost of capital over the past decade...

And now, they want to reduce 5G spending in 2023 and 2024. Most companies are wrapping up their initial 5G buildouts and are aiming to cool their investments in brand-new infrastructure.

However, that doesn't necessarily mean telecom companies will stop spending...

Even if they don't invest in improving and transforming their infrastructure, they still have to maintain it. Their services are critical, so telecom companies can't exactly get away with letting their infrastructure rot.

On top of that, the telecom industry will have to deal with the thousands of toxic lead cables currently covering the U.S. That will likely be another massive expense.

Even if telecom companies aren't forced to gut their old lead-covered cables, it still highlights a pattern in the industry. Whether they are upgrading cellular networks or restoring old cable lines... these companies have to keep spending. And they are loading up on more and more debt to do so.

That's a big reason why the industry has underperformed so far this year... and why we recommend investors continue to look elsewhere.

Regards,

Joel Litman

July 27, 2023

The economy and the stock market are painting two very different pictures today...

The economy and the stock market are painting two very different pictures today...